Fed: Why They Will Cut Rates (But Probably Should NOT)

Image Source: Pexels

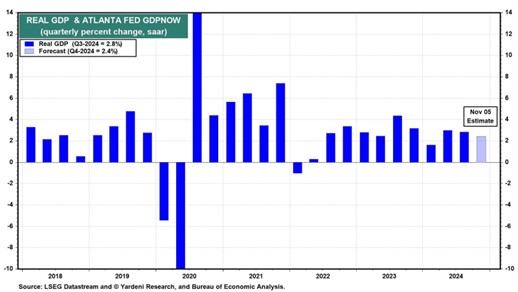

By most measures, including the recent nonmanufacturing PMI report, the economy was roaring even before the Fed's Sept. 18 meeting when the FFR was cut by 50 bps. When the Fed cut by 50 bps rather than 25 bps, we immediately concluded that was too much, too soon.

The Bond Vigilantes have agreed with our assessment, raising their expectations for long-term inflation and taking the 10-year US Treasury yield from 3.65% on September 16 to 4.44% (and that was before the post-election surge).

Only one FOMC member dissented from the September decision, favoring a 25 bps cut. There are likely to be more dissenters at today’s FOMC meeting. They may prefer not to fight the Bond Vigilantes for now given the strength of the economy and vote in favor of no cut. Without commenting on political matters, they might fear that the US elections will result in persistent and large federal budget deficits despite strong economic growth.

More By This Author:

The Good, The Bad, And The Ugly: A Recap Of Post-Vote Winners & LosersRISR: A Unique Bond ETF With Interest Rate Protection

SPY: What Now After The Big Post-Election Rally?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more