Fed Inflation Target Nears As US CPI Tumbles More Than Expected In November

'A grain of salt' is how many have described their position on this morning's government shutdown-delayed release of October and November Consumer Price Inflation data.

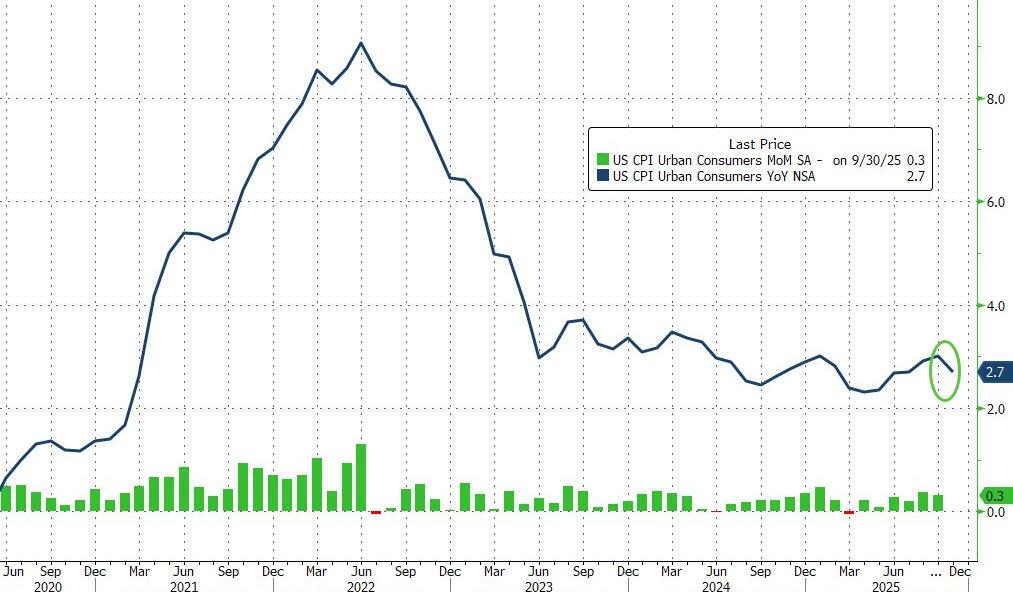

Headline CPI slowed to 2.7% YoY in November (dramatically below the 3.1% YoY expected).

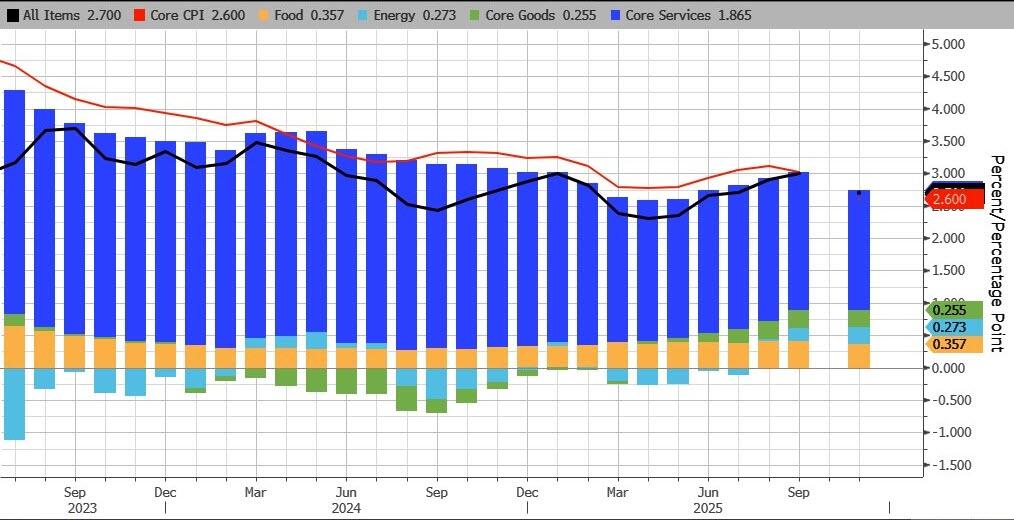

Core CPI fell to 2.6% YoY in November (well below the 3.0% YoY expected) and the lowest since March 2021...

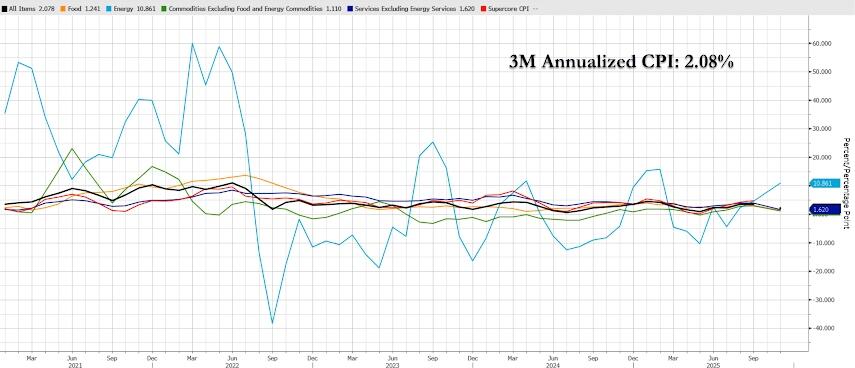

There is very little additional data for now with Core Goods and Services down modestly while Energy prices were higher...

...but will drop notably as oil prices have plunged...

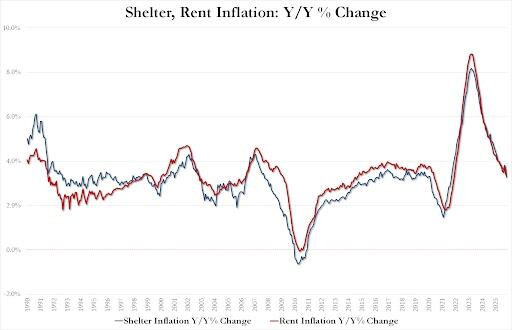

Shelter and Rent inflation also continues to slow dramatically...

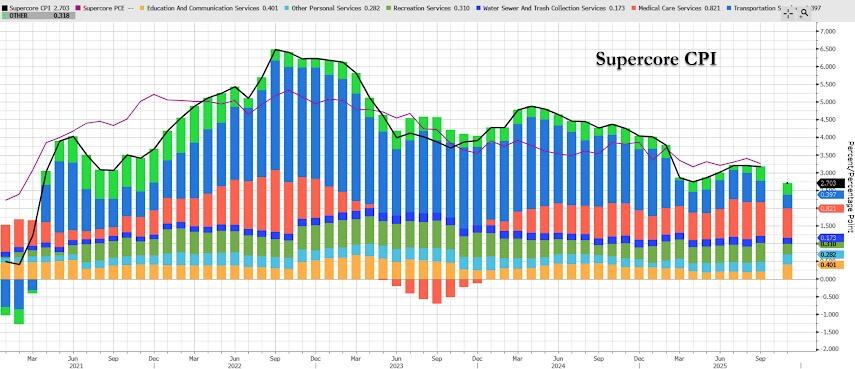

SuperCore CPI also plunged...

3m annualized CPI tumbled to 2.08% YoY... very close to The Fed's target...

Finally, we end with three words from Goldman's Delta-One desk-head with regard this morning's data: 'beware the noise'.

Disinflation remains a key pillar of the equity bull case, and these levels still imply inflation hovering closer to 3% so not quite there yet (but heading in the right direction... a lot faster than many expected).

More By This Author:

Meta Chose Revenue Over Policing Chinese Scam Ads, Documents ShowFord To Lay Off 1,600 Workers As Kentucky EV Battery Plant Pivots To Data Center Storage

WTI Holds 'Venezuela Blockade' Gains After Small Crude Draw, Record US Production

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more