Fed Forecasts: Financial Sport Or Costly Distraction?

Image source: Wikipedia

For some reason, the Fed continues to publish the Summary of Economic Projections (SEP), in which Federal Open Market Committee (FOMC) members guess the trajectory of macroeconomic indicators like gross domestic product, the unemployment rate, and price inflation. They also take a stab at forecasting their own policy decisions over the next few years in what is known as the “dot plot” (figure 1).

Figure 1: FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate

Source: Summary of Economic Projections (Board of Governors of the Federal Reserve System, September 20, 2023), fig. 2.

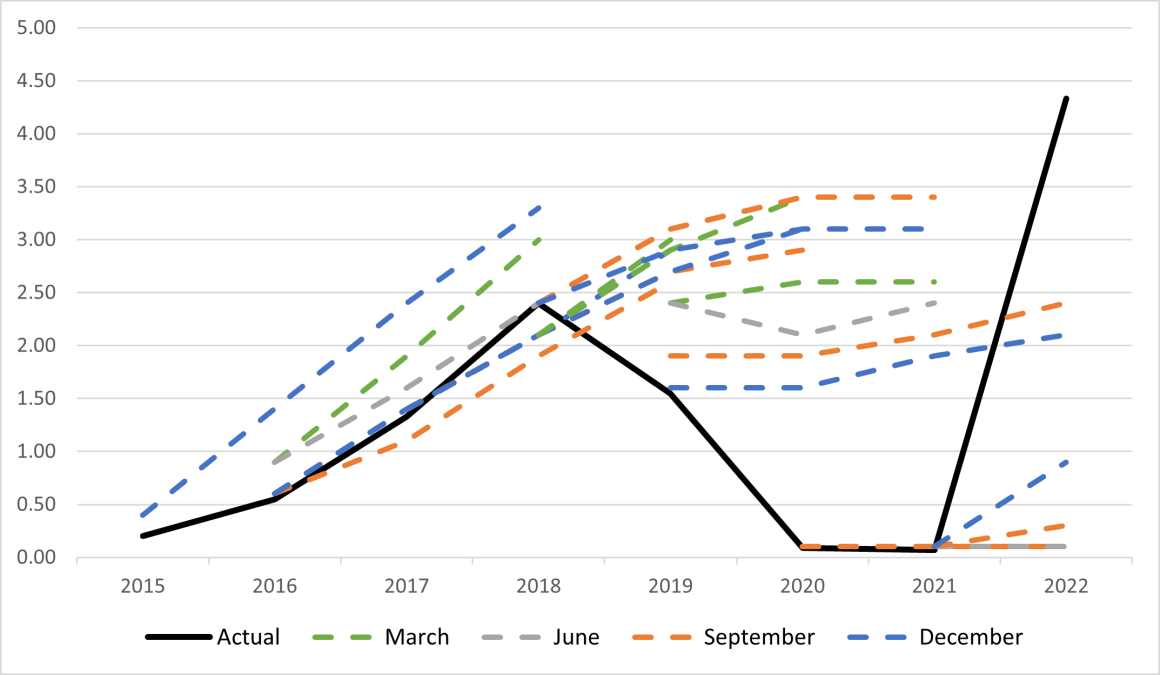

One issue with these projections is that they are usually very wrong. You would expect the FOMC members’ projections for their own policy rate to be the most accurate since they have complete control over it. I’ve compiled their projections and the actual course of the federal funds rate (FFR) in the graph below.

Figure 2: Federal funds rate, actual (black) and quarterly projections, 2015–22

(Click on image to enlarge)

This graph might be a little difficult to take in, so let me explain it. The black line shows the actual FFR at the end of each year. The dashed lines show the median projection for the FFR in each of the quarterly meetings. The projections and the actual values are lined up in time, so in each year you can see how close (or how far off) the FOMC members were in their guesses. We should expect the beginning of each blue dashed line to touch the black line or at least be very close to it because the blue dashed line represents a December projection for the end of the year FFR, which by that point is about two weeks away.

The notable feature of this graph is that the FOMC was caught off guard by the pandemic and by recent price inflation. But notwithstanding the size of those surprises, the graph shows that the prepandemic guesses were no good either. For example, the December 2015 projection was off by roughly 100 basis points for the years 2016–18.

Forward Guidance

The Fed’s rationale for publishing these forecasts is to provide “forward guidance”—the Fed’s way of not surprising financial markets. The problem with forward guidance is that to the extent that market participants rely on the FOMC projections, the projections themselves become an element of surprise. Financial markets get spooked if the projections are revised unexpectedly from one meeting to the next, in the same way, that they would react to a plain adjustment of the target range for the FFR. This was evident after the most recent FOMC meeting: the stable target rate was expected, but the revised projections were not.

One of the journalists at the most recent FOMC press conference brought up the usefulness of these projections. After noting some of the abrupt changes in the forecasts, Michael McKee of Bloomberg asked, “How much confidence do you have, can investors have, or the American people have in your forecasts?”

“Well,” Powell recited, “forecasts are highly uncertain. Forecasting is very difficult. Forecasters are a humble lot with much to be humble about.”

In 2016, the Brookings Institution surveyed academics and “private-sector Fed watchers” on their view of Fed projections. Only a third of respondents considered the SEP’s dot plots as “useful” or “extremely useful.” About half of the respondents evaluated the SEP overall as useful.

The view of the Fed from an ivory tower seems to be much nicer than the view from a trading floor or business office:

There was strong disagreement about whether Fed communications helps the real economy and/or the financial markets: 35% said it helps both the markets and the economy while 42% said it helps neither. The divide fell sharply on academic/private-sector lines: 55% of academics thought Fed communications was good for both the real economy and markets while only 21% of private-sector Fed watchers thought so. About half (52%) of private-sector Fed watchers thought it helped neither.

Strikingly, academics thought the Fed’s current approach to communications was far more helpful to the markets than those in the markets said. Some 73 percent of academics said Fed communications helps the markets; only 44 percent of private-sector Fed watchers agreed.

“Fed Watching” as a Sport

Despite what these survey results imply, it seems like the entire financial sector is enthralled by FOMC meetings when they occur. All eyes are on the Fed chair as he simply reads the transcript of an announcement that has already been posted online. Financial news media post-moment-by-moment commentary on minutiae like small textual changes from one announcement to the next and the tone of Powell’s voice.

Fed watching has become a veritable sport, with cheerleaders, teams (bulls versus bears), live commentary, and an unhealthy amount of gambling. And unlike the NFL, the Fed has grown more popular in the past few years.

But Fed watching isn’t just a game. There are real stakes and broad repercussions for correctly guessing whether Jay Powell will see his shadow when he emerges from the FOMC den on announcement days.

Discussing how the Fed has become a “Big Player” in financial markets, Roger Koppl noted that there has been a “reallocation of resources toward ‘Fed watching’” due to the potential rewards for guessing the Fed’s next move.

So, the costs of a gargantuan central bank are even bigger than the inflation and business cycles they generate.

Every Econ 101 student learns that we incur opportunity costs when we use scarce resources. One of those scarce resources is our own attention. The nature of the Fed’s rigged game encourages entrepreneurs to pay attention to how much Jay Powell’s brow glistens when he announces a quarter-percentage-point revision to core Personal Consumption Expenditures Price Index inflation projections.

And this attention comes at the expense of what entrepreneurs would be focused on—namely, satisfying consumers—if there weren’t a big money-printing circus coming into town on a regular basis.

Unfortunately, the Fed has much influence on retirement savings, mortgage rates, the cost of living, stock market ups and downs, production, consumption, and international trade. Can we afford to ignore it?

More By This Author:

True Money Supply Is The Correct Measure Of Inflation, Not Consumer Price IndexAssessing The BRICS Expansion: Debunking Expectations

The State Vs. Entrepreneurs: Prosperity Always Loses