Fed Decision, Inflation Data, EPS, And Most Importantly...

We are on the road heading back home to Colorado this morning, so I'm going to keep this brief. The key focus in the markets has returned to the spread of COVID as new lockdowns have been announced in places like Austria and Germany. With cases on the rise again here in the U.S., investors can't be blamed for rethinking those reopening plays, fretting about future economic growth, and/or revisiting the dependable growth names that seem to be able to prosper in a socially distant environment.

Beyond the outlook for the state of the economy, the key news this week will be the Administration's announcement on the next Fed Chairman. President Biden has promised he will decide "before Thanksgiving" on whether Jay Powell will continue to chair the FOMC or hand the keys to current Fed Governor Lael Brainard. The thinking is that Brainard would represent a more dovish choice going forward, meaning that the phrase "lower for longer" could come back in vogue. However, some analysts also worry that Brainard would be beholden to her liberal supporters such as Senator Warren.

This just in... President Biden has renominated Jerome Powell as Fed Chair for a second term and Lael Brainard will become Vice Chair. Stocks seem to be fine with the announcement in the early going. In a prepared statement, Biden praised the Powell Fed for its “decisive” action during the early phase of the pandemic.

While on the topic of the Federal Reserve, the central bank's favorite measure of inflation - the PCE (Personal Consumption Expenditures) Index - will be released on Wednesday. And with inflation on the tip of just about everyone's tongue these days, this could easily move markets on what is usually one of the sleepiest trading sessions of the year.

Speaking of seasonality, it is worth mentioning that history shows this to be a favorable for the stock market. CFRA's Sam Stovall reports that stocks have traditionally risen during Thanksgiving weeks since 1950. And with stocks now in the most favorable six month period of the year, it is easy to argue that the bulls should be favored into year end.

From a big picture standpoint, my feeling is that beyond COVID, earnings expectations will continue to be the key going forward. Cutting to the chase, if expected EPS can continue to climb then the indices could easily have additional room to run.

Finally, I would like to take this opportunity to wish everyone a Happy Thanksgiving. Here's hoping you and yours have much to be thankful for and can safely enjoy the holiday.

Photo by Pro Church Media on Unsplash

Now let's get the week started with a review of the "state of the market" from a model perspective...

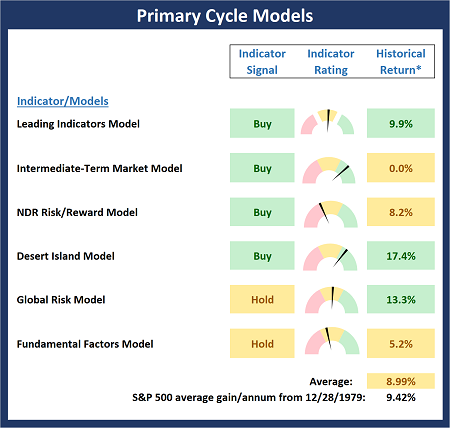

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Big Picture Models

There is no change to the Primary Cycle Board this week. My takeaway from the big-picture market models is the bulls should continue to receive the benefit of any/all doubt.

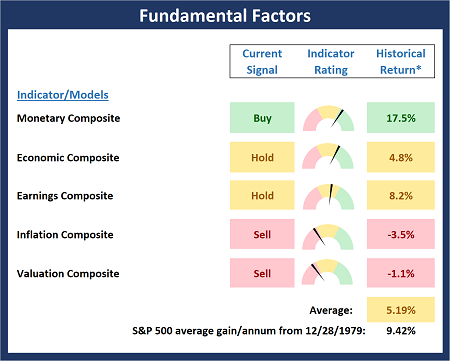

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Fundamental Models

There are also no changes to the Fundamental Board to report this week. However, as I've been saying, the board suggests this is NOT a low-risk environment.

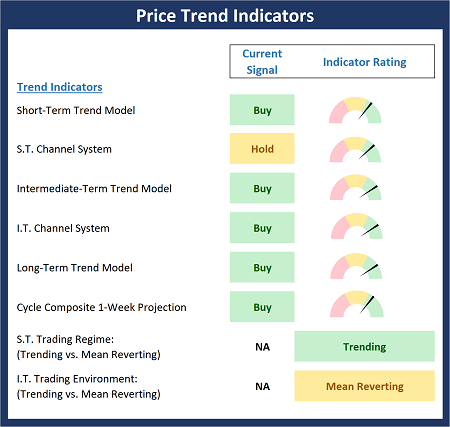

The State Of The Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Trend Models

The Trend Board improved a bit last week as the Short-Term Trend model upticked and the Cycle Composite is green here. While the action has gotten a little sloppy of late, the bottom line is the bulls remain in control.

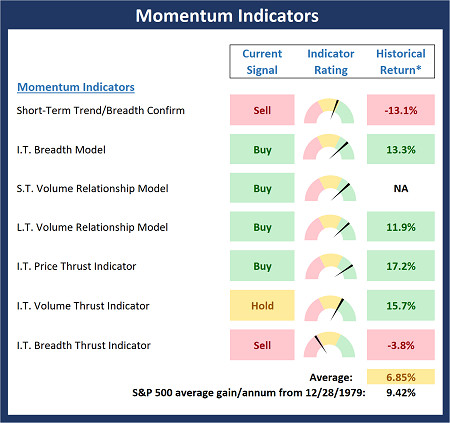

The State Of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Momentum Models

The Momentum Board weakened last week as the Short-Term Trend/Breadth and Intermediate-Term Thrust indicators both issued sell signals. Any further weakness here would be a warning that the current bull move could be ending.

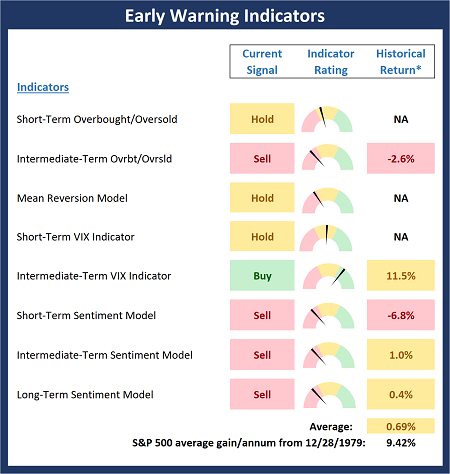

Early Warning Indicators

Finally, we look at our early warning indicators to gauge the potential for countertrend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Current Take: Early Warning Models

Despite favorable seasonality, the Early Warning Board remains in "warning" mode and suggests that some downside action remains possible.

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more