Everyone Expecting Rate Cuts; Are They Necessary?

Image Source: Pexels

“Davidson” submits:

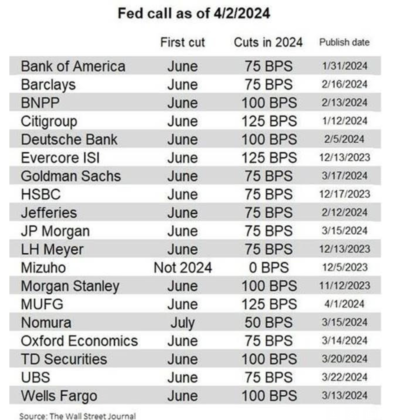

Every firm is expecting rate cuts anticipating a recession but there is no recession in sight. The question is with so many on the same side of the ledger, “What occurs once no recession becomes apparent?” The tables below show only modest adjustments to rate cut expectations with the PMI rising to 50.3. The Wall Street Journal compiled these tables. Employment has been rising with some believing the numbers are manipulated because they believed the PMI was literally screaming recession. Yet, retail sales, personal income, industrial production and especially manufacturer’s new orders and construction spending have supported the employment figures indicating economic expansion. Institutions, however, have piled into the Mag 7 tech expecting recession. In particular, they hold Nvidia and anything AI(Artificial Intelligence) and related while being short oil/gas energy related and industrials. They expect high tech to thrive during recession just like 2020 COVID lockdown while the latter are expected to be good short candidates. These investors expect rates to fall precipitously. What will occur should this scenario not be as expected?

More By This Author:

PMI Ruling SentimentRecession? Not Today, But…

Oil Situation Stable… Despite The Headlines

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more