Even The Stock Market Enjoys Spring Weather

The weather plays a major role in April and is one of the best-known seasonal drivers. Sunny weather and mild April temperatures seem to have a noticeable impact on market performance by enhancing the confidence of bullish traders, which then pushes stock prices up. Can investors also participate in this market shift and profit from any market anomalies on the horizon?

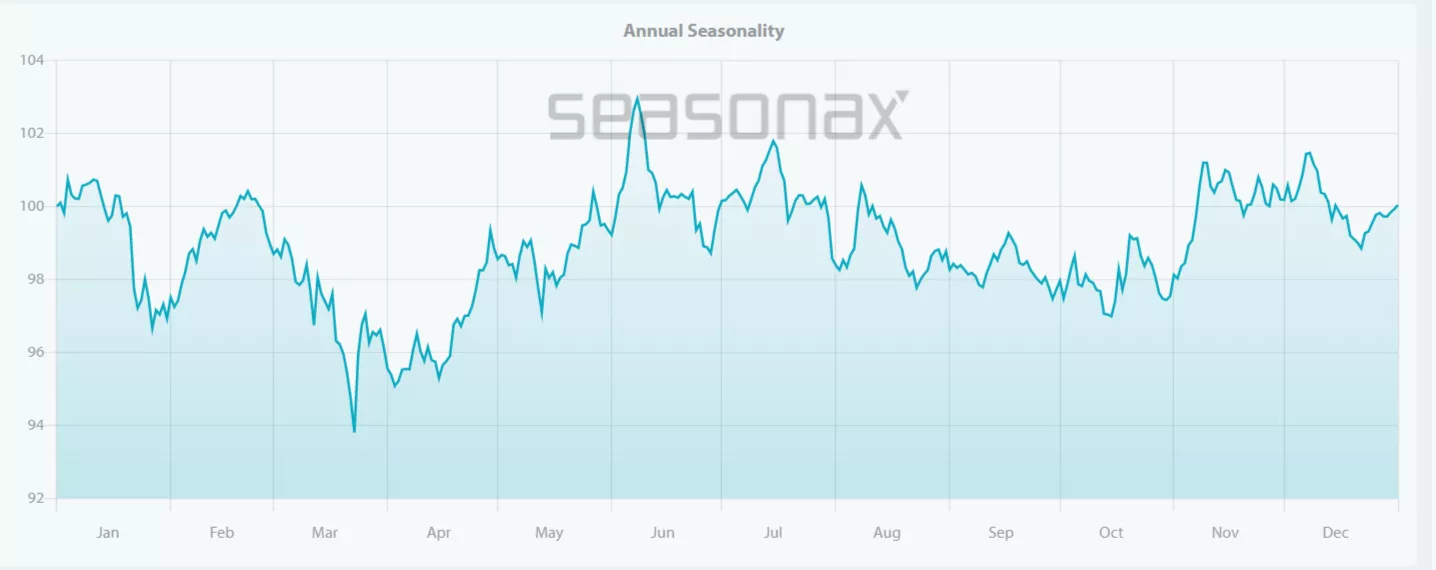

The analysis below measures the performance of the S&P 500 index in every month of the year, averaged over a 25-year period.

Average monthly return of the S&P 500 Index since 1997

Source: Seasonax http://tiny.cc/SPX500monthly

From the chart above it is clear that for decades April has been one of the best performing months. It is hard to say whether this pattern will be repeated again this year, but trading psychology is often influenced by so-called self-fulfilling prophecies.

It is not only the weather that influences traders behaviour during this month. Tax refunds are starting to reach Americans’ bank accounts, and contribute to increased retail spending.

As every holiday is a good excuse for buying, 1-800Flowers.com Inc (FLWS) is one of the stocks that bloom ahead of Easter. The company also owns other e-commerce operations, including Harry & David, Personalization Mall, Shari’s Berries, Fruit Bouquets and The Popcorn Factory, which all rise to the occasion, so to speak.

Seasonal Chart of 1-800Flowers.com over the past 15 years

(Click on image to enlarge)

Source: http://tiny.cc/1-800Flowers-Seasonax, highlight the area in the chart to receive further analysis

Keep in mind that, unlike a standard price chart that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100).

As can be seen on the chart above, the strong seasonal phase is quite pronounced during April. Indeed, it can be stated that April was the best performing month over the last 15 years for 1-800Flowers.com.

Don’t put all your Eggs into one Basket

When looking at different trading ideas, I can’t stress enough how important it is to diversify, diversify, and again diversify.

It might not be hard to guess that one of the retail stock that benefits from an “Easter rally” (and beyond) is Amazon (AMZN). It is often seen in investors’ portfolios across the world.

Seasonal Chart of Amazon over the past 10 years

Source: Seasonax http://tiny.cc/Amazon_Seasonax

Another stock that caught my attention is American Express (AXP)

Source: Seasonax http://tiny.cc/AmericanExpress_Seasonax

Will American Express rise again this year? Or will the interest rate hikes slow US growth and harm the stock’s outlook? We will have to wait and see. But remember eventually someone always has to pay for the “party”.

Before you kick start your trading activities don’t forget to seasonax the stocks on your radar.

Disclaimer: Past results and past seasonal patterns are no indication of future ...

more