European Earnings Estimates - Looking For Double Digit Growth

(Click on image to enlarge)

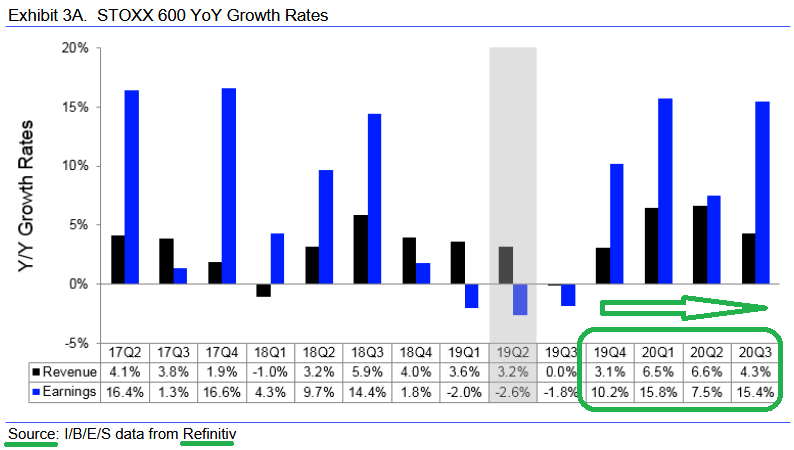

So the bad news is European (Stoxx 600) earnings estimates came in modestly in the past week. The good news is, they are still holding at double-digit growth moving forward: Q4 2019 +10.2%, Q1 2020 +15.8%, Q2 2020 +7.5%, and Q3 2020 +15.4%.

The other factor that changes the game is the lowering of the discount rate this morning (affording potential multiple expansion) and the re-institution of quantitative easing – which will force capital back into risk assets (equities). It all sets up for a situation where extremely pessimistic sentiment sets the stage for a “fear of missing out” rally as the market creeps up and managers have to chase (and ultimately lever up) to catch up to their benchmarks and keep their jobs.

Are these estimates still too high? Perhaps, but the multiple has room for expansion and institutional money is dramatically underweight European Equities. This will change as sentiment changes.

The pessimism is understandable as most managers look to Germany for guidance when they consider investing in Europe. If that is the tact you take (as well as doing so looking exclusively in the rearview mirror), here’s what you see:

(Click on image to enlarge)

Source: I/B/E/S data from Refinitiv

But what you miss is the growth in the rest of the continent… and the impact of new stimulus moving forward.

Disclaimer: Not investment advice. For educational purposes only: https://www.hedgefundtips.com/terms-of-use/