SPX, Gold, Oil, G6 Targets For The Week Of March 4

The SPX made another swing high and reached the top of the resistance zone. This was accompanied by a subtle change in market breadth, suggesting that the market has adopted a wait and see approach.

The daily SPY chart shows in greater detail how both positive and negative market breadth declined during the last seven trading days. This however, does not necessarily spell weakness but rather, as mentioned above, that market participants are biding their time. It is also worth mentioning that since the end of January, it has taken the SPX two weeks to reach its upper weekly targets, instead of one. Although this points to slowing momentum, we shouldn’t neglect the fact that no downside targets have been challenged during the last nine weeks. Until that happens, and until support levels starting with 2763 get broken, the up- trend should be given the benefit of the doubt.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX remains unchanged at 2650-2850.

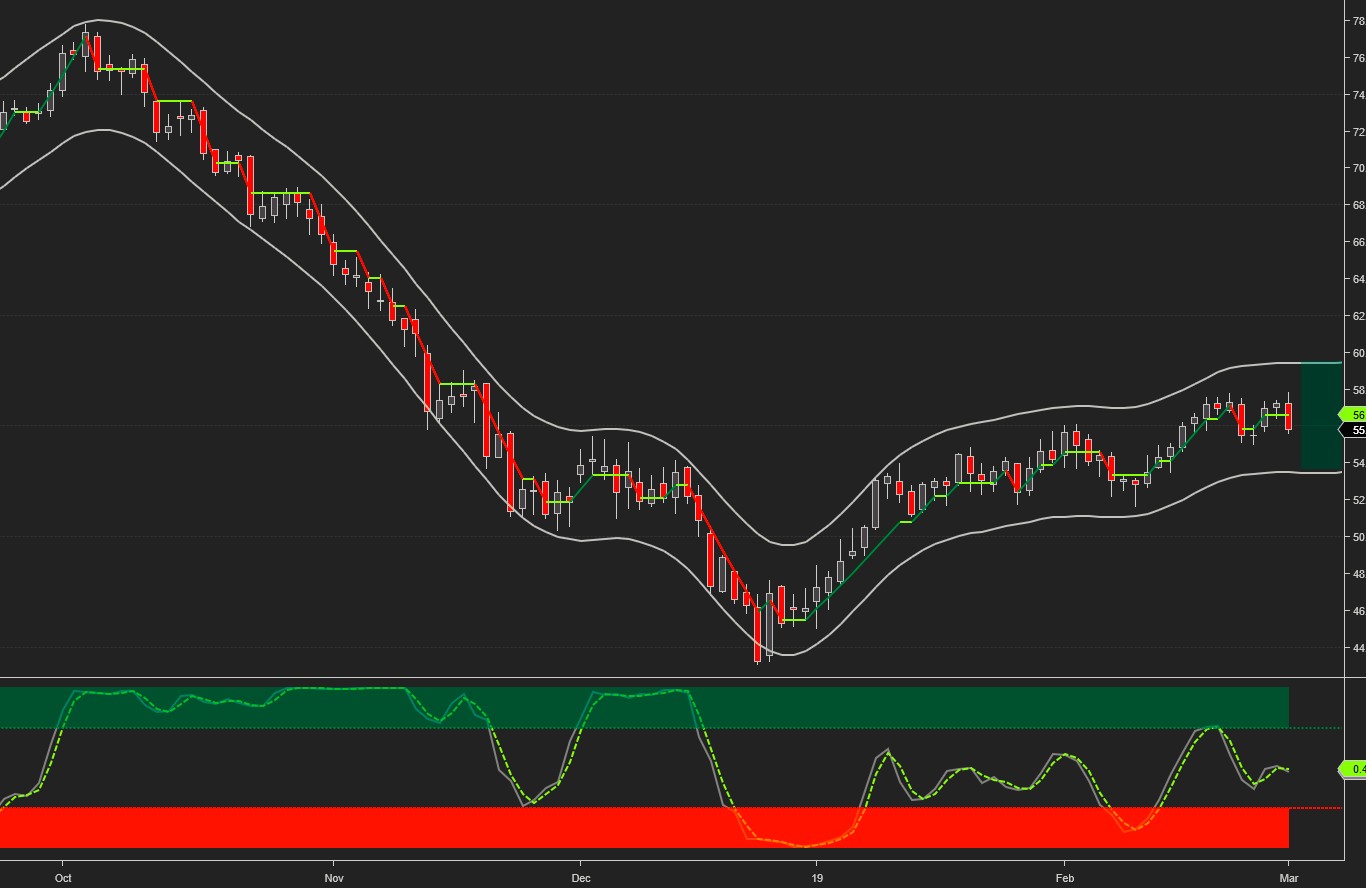

Oil failed again just below the 58 level but remains in an uptrend and continues making higher highs and higher lows.

Current signals: Daily Flat, Weekly Long.

The projected trading range for Oil for next week is 54 – 59:

GOLD traded around the weekly pivot line during the first half of the week but then dropped to and broke below the lower weekly target on Friday. There are signs (gray zone) that the current sell-off is getting overextended.

Current signals: Daily Short, Weekly flat

The projected trading range for Gold for next week is: 1285 – 1325:

USDCHF keeps trading around parity for the fourth week in a row. $1.000 remains the bullish/bearish pivot going forward.

The projected trading range for USDCHF for next week is 0.992 – 1.0125:

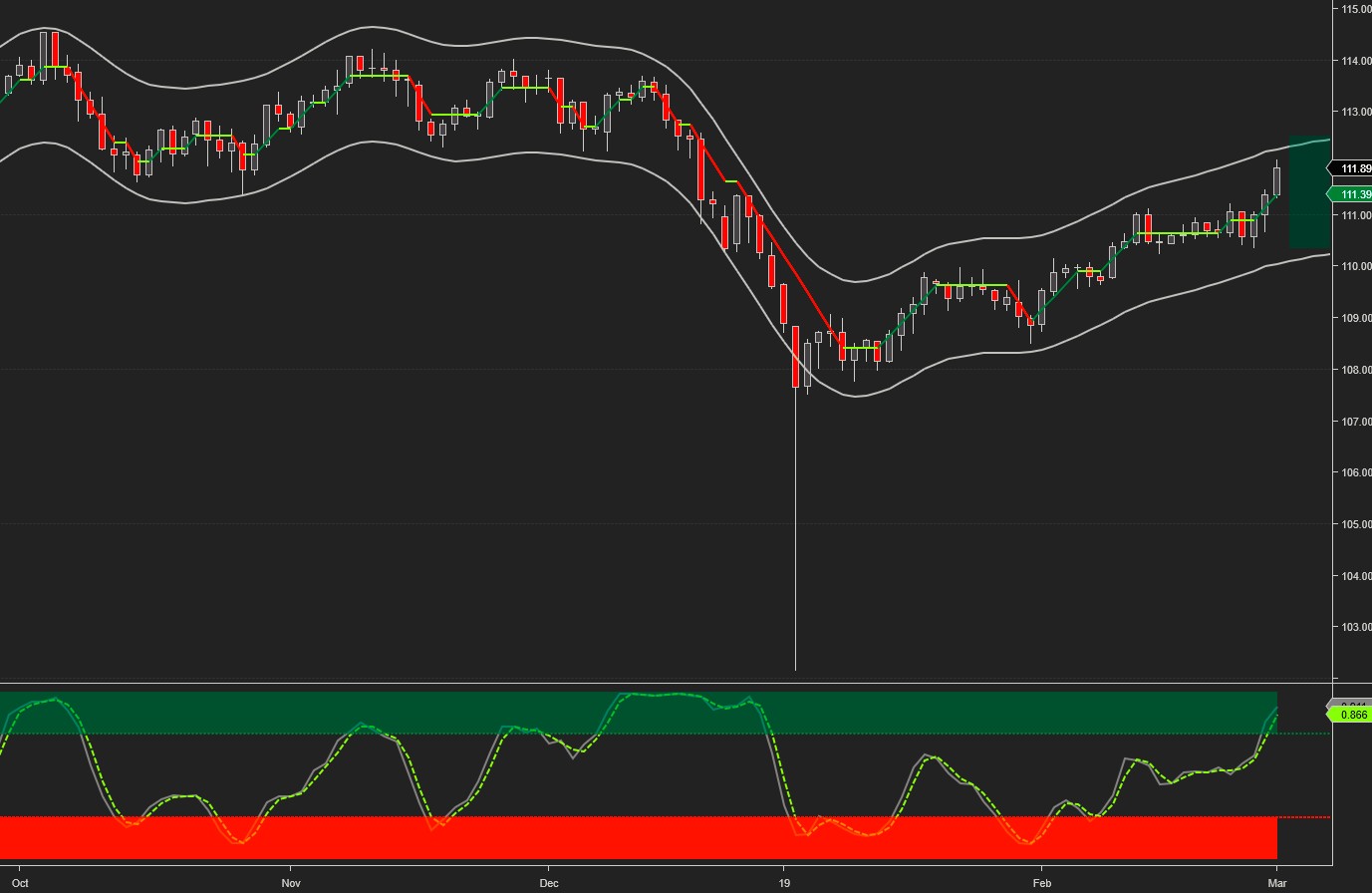

USDJPY reached the upper weekly target and remains in an uptrend.

Current signals: Daily Long, Weekly Long.

The projected trading range for USDJPY for next week is 110.35 – 112.55:

EURUSD got rejected several times at the upper weekly target and, as mentioned before, will remain in a weak position as long as it trades below 1.15. A break below 1.12 can lead to an 8% drop.

The projected trading range for EURUSD for next week is 1.128 – 1.145:

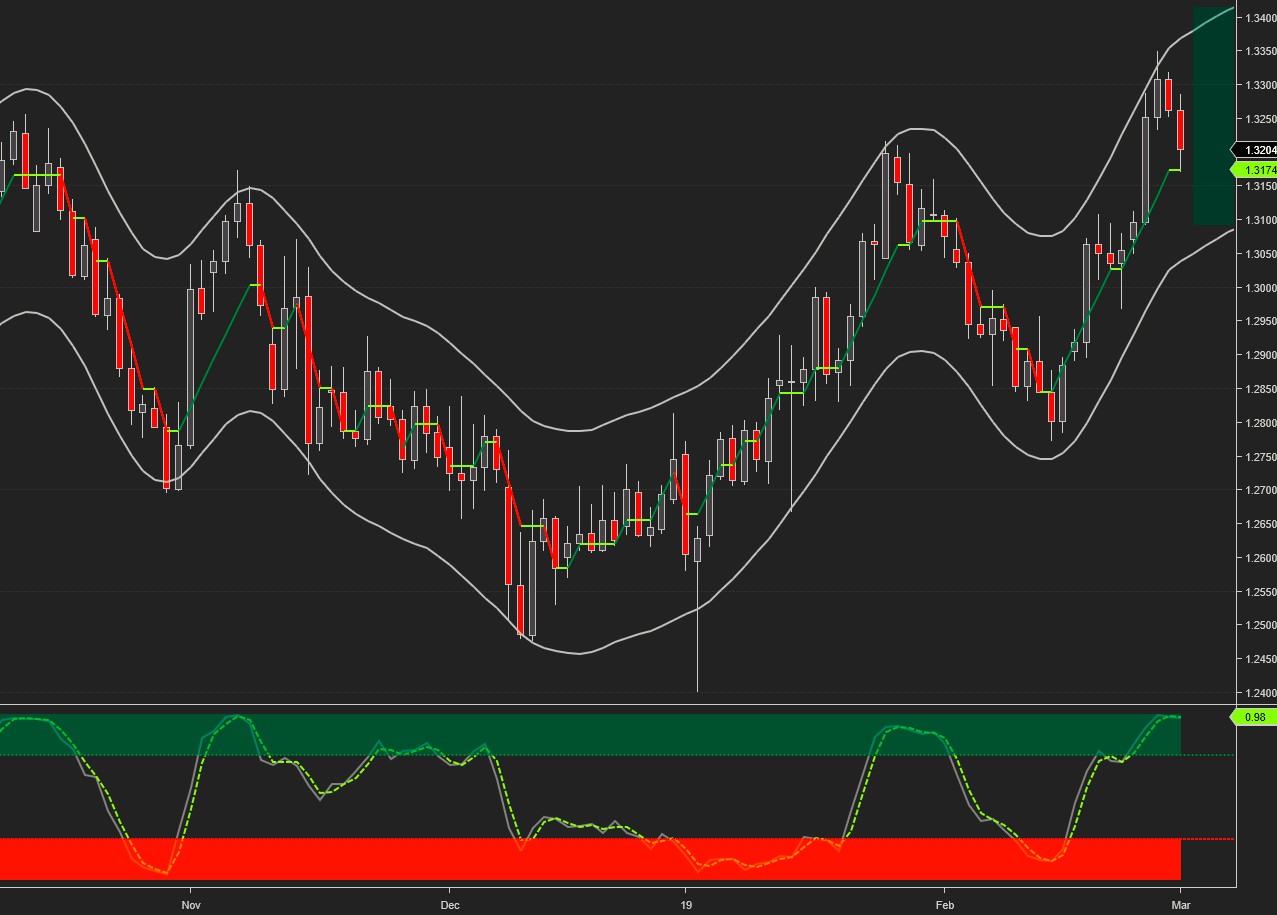

GBPUSD broke above the upper weekly target on Tuesday but started selling off on Thursday and finished the week on target. It still remains hostage to the Brexit news flow.

The projected trading range for GBPUSD for next week is 1.31 – 1.341:

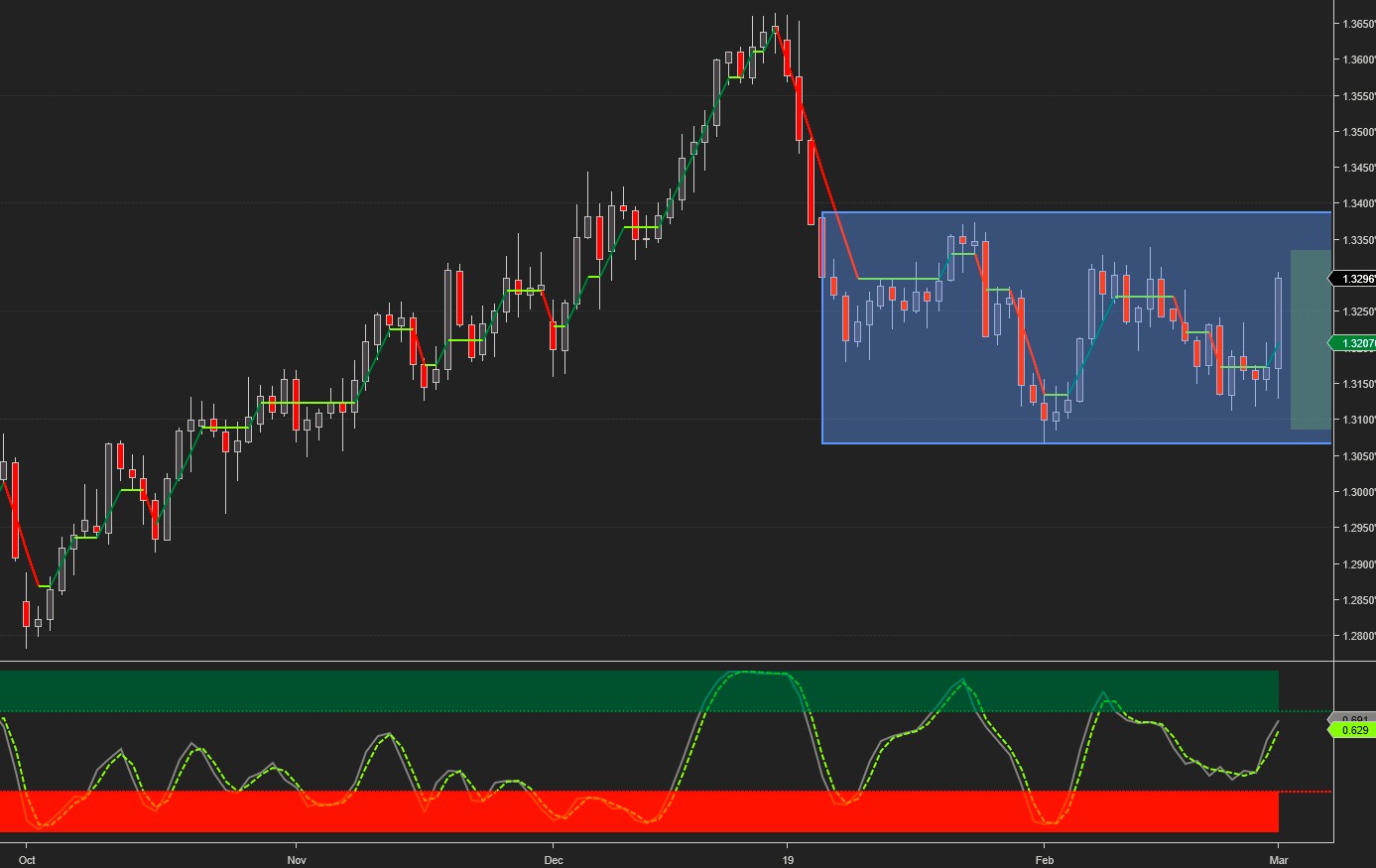

USDCAD found double support at 1.311 and managed to break above the weekly upper target on Friday. USDCAD has been trading in a tight 1.3068 - 1.3388 range since January.

Current signals: Daily Long, Weekly Flat.

The projected trading range for USDCAD for next week is 1.31 – 1.334:

AUDUSD continued zig-zagging within a broader congestion zone that goes back to 2016. After reaching the upper weekly target on Wednesday, it sold off towards the downward target on Friday

The projected trading range for AUDUSD for next week is 0.702 – 0.718:

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8