Ethereum's Turn To Outshine Bitcoin Is Coming, UBS Says

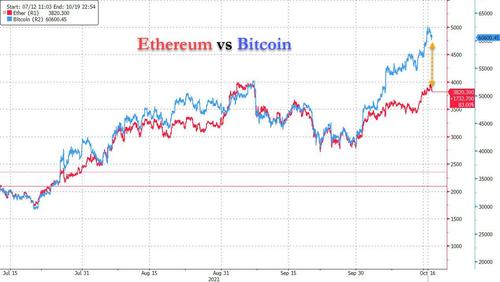

After a stellar start to the year, which saw its price soar to an all time high above $4,100, trouncing virtually all of its crypto peers, Ethereum has stagnated in recent weeks, with its place in the spotlight taken by bitcoin which whose impressive outperformance has been the result of now confirmed speculation that a bitcoin futures ETF is coming. It also meant that what has traditionally been a close correlation between the two larges cryptos has broken in favor of the larger peer; it would also suggest that ethereum is trading about $1000 cheap vs bitcoin.

It wasn't just bitcoin's long-overdue ETF success: ETH was also put in the shade by DeFi- and NFT-driven demand for faster and cheaper blockchains since the late summer, according to UBS strategist James Malcolm. But in the bank's latest Crypto Compass publication, Malcolm writes that this could soon change thanks to the progress with one of Ethereum's prior Layer 2 solutions, Optimism.

As UBS explains, "having been all but forgotten, it suddenly seems set to give leading competitor Arbitrum a run for its money. OVM 2.0 promises faster processing, cheaper gas prices and fewer code constraints, which should encourage smart contract deployment." Furthermore, it has just been implemented on Ethereum's testnet and is now scheduled to go mainnet-live in two weeks, on October 28.

Of course, all of this pales in comparison to the ETH uplift that will take place once Ethereum 2.0 is ready for rollout. Some have speculated that the event will quickly trigger a quick doubling in the cryptocurrency which Goldman dubbed the "Amazon for information" (and is why Goldman also sees ETH eventually overtaking BTC).

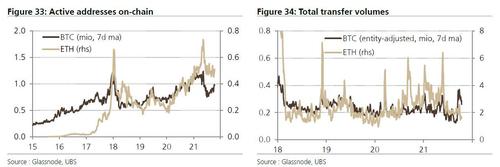

Data also show the recent rebound in active addresses on chain, offset by the small decline in total transfer volumes, which however can be attributed to the surge in whale trading in recent weeks (more below).

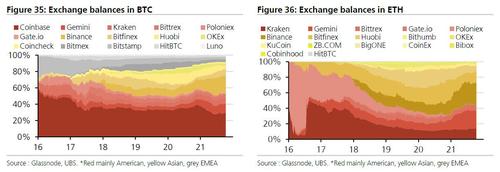

A curious divergence also emerges when looking at exchange balances between BTC and ETH.

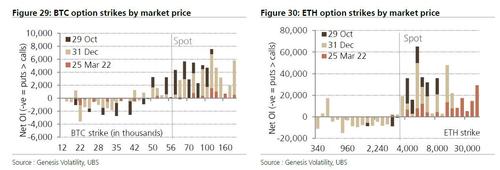

But what appears most remarkable is the distribution of crypto strikes for bitcoin and ethereum, both of which are far above spot, suggesting that a major gamma squeeze may be on deck for both.

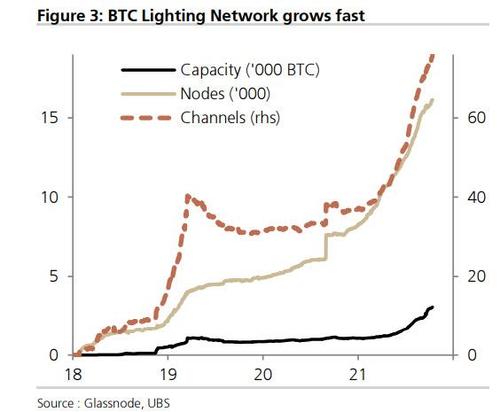

Incidentally, speaking of ETH level 2, Bitcoin's Lightning Network for smaller transactions has also been growing in anticipation of next month's Taproot upgrade: year-to-date, the number of LN nodes and channels has doubled, and capacity nearly tripled.

Incidentally, this does not mean that Bitcoin is set to drop, on the contrary.

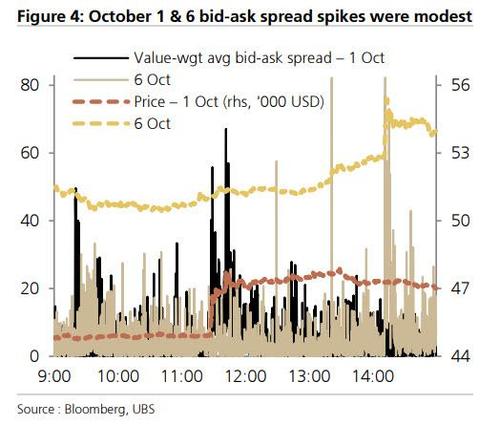

As UBS also writes, Bitcoin - which is now on the right side of $60k - is within striking distance of its April all time highs. Its latest rally came in two steps: October 1, which was put down to a Powell comment about having no intention to follow China in banning crypto, and October 6 when nearly $1.6bn of buy orders were reportedly executed within five minutes. Both occurred against a backdrop of big-name presenters at digital summits, rising speculation about imminent US ETF approval (which we now know has taken place), and pushback from the Senate Banking Committee's ranking Republican against the Biden administration and Fed's crystallizing plans to impose bank-like regulation on stablecoins. Pat Toomey's point was this is something for Congress to decide and enact clarifying legislation, which would take more time. They helped trigger liquidations of short futures positions but left no footprint on bid-ask spreads, which barely budged in contrast to what we saw a month earlier.

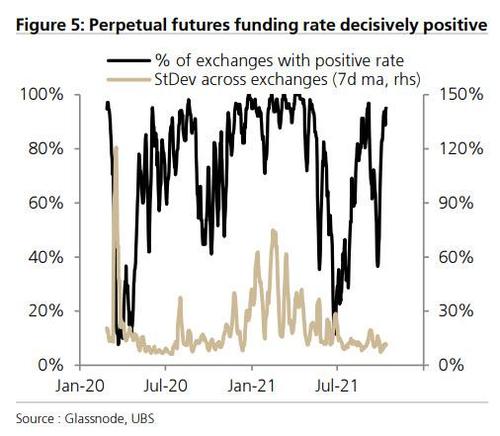

Not surprisingly, with Bitcoin steamrolling above $60K, bullish sentiment has become even more pronounced, attracting growing spot-futures basis arbitrage on the CME and pushing perpetual futures funding rates uniformly higher

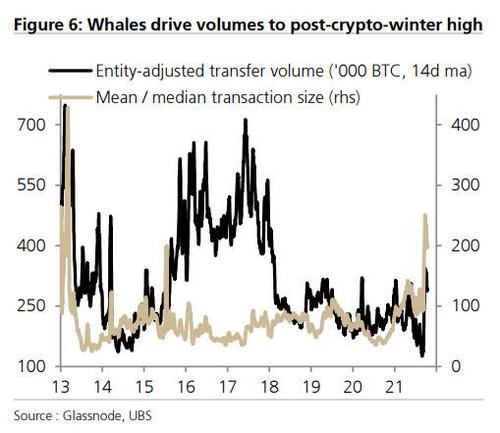

On-chain activity has also seen a major revival as BTC entity-adjusted transaction volumes overshot their early-2021 highs.

What is most remarkable is that this is not at all small-time and retail investors setting the price: as the next chart from UBS shows, whales are in the driving seat to an almost unprecedented degree with the mean-to-median transaction size ratio is at its highest level since 2013.

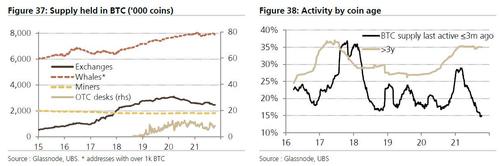

And speaking of whales, the bitcoin supply held by whales is now at the highest it has ever been at around 8mm coins (out of a total 21mm), while both exchanges and OTC desks have seen their holdings decline. Also notable, the collapse in bitcoin supply that was last active less than 3 months ago as increasingly more are truly HODLing.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

It is still speculative and still an effort at undermining the present currency. And I still do not trust it.