Sunday, April 7, 2019 7:18 AM EST

- ETH at risk of falling into trap of rising wedge.

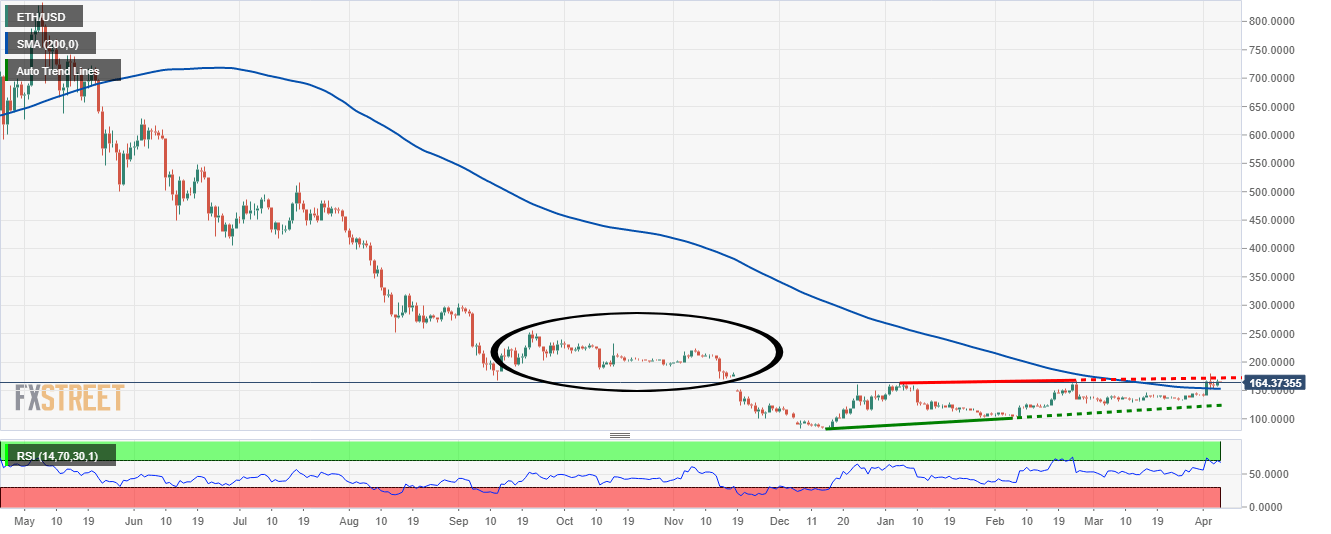

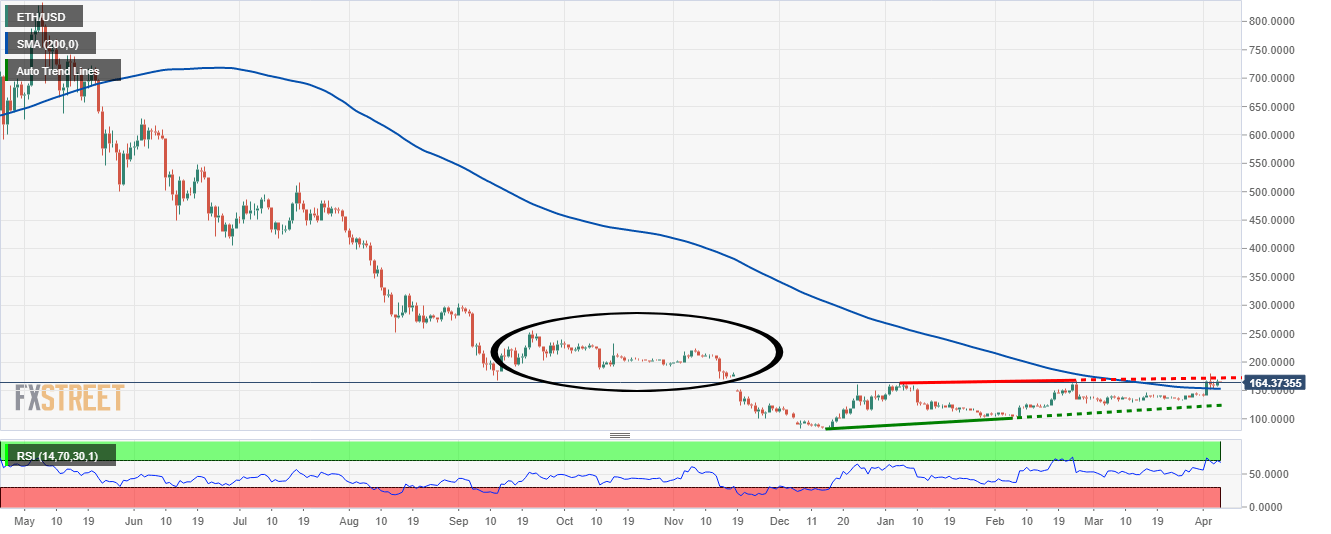

- Long term stability only after $200-250 range decisively crossed.

Ethereum, the second largest cryptocurreny by market capitalisation has doubled from its December 2018 lows and is technically way past the definition of a bull run. But given the set up it is in, there is every likelihood it may fall trap to a rising wedge on the long term chart, unless it decisively crosses and sustains above a specific range.

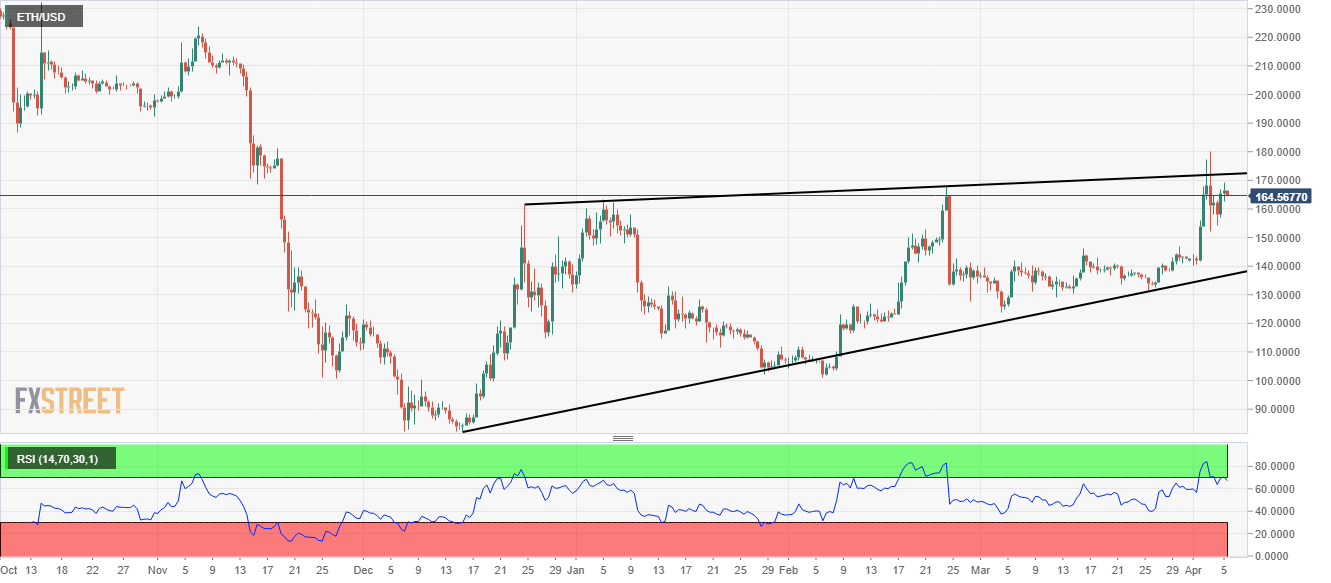

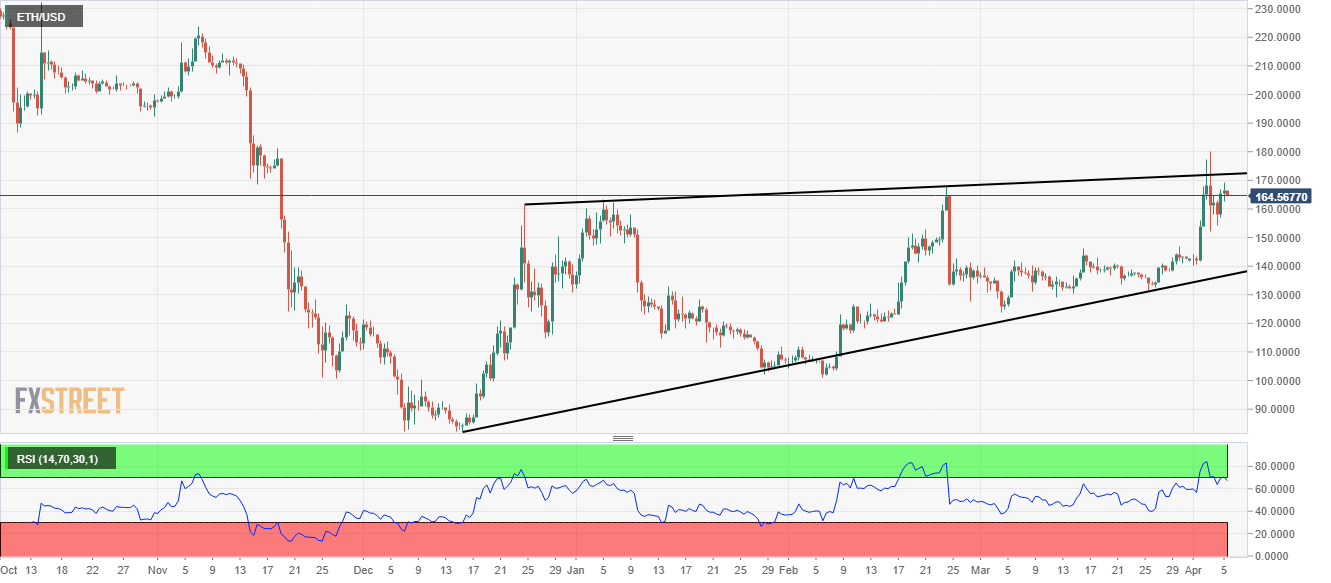

ETH/USD is down more than one percent on day at $64.53, near low point of the day. On the 12-hour chart of ETH, it seems to be falling into the trap of a rising wedge, which is potentially bearish for the prices. If the pattern completes and holds true to itself, it can easily halve the prices from the top of the wedge.

While that is a key worry, for the bulls to disregard the pattern, prices first need to sustain above $180. That would be temporarily sufficient, although for long term bull market stability, ETH still needs to cross past the range of $200-250.

ETH/USD 720-minute chart:

ETH/USD daily chart:

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and ...

more

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk appetite and the trader's level of experience should be carefully weighed before entering the Forex market. There is always a possibility of losing some or all of your initial investment / deposit, so you should not invest money which you cannot afford to lose. The high risk that is involved with currency trading must be known to you. Please ask for advice from an independent financial advisor before entering this market. Any comments made on Forex Crunch or on other sites that have received permission to republish the content originating on Forex Crunch reflect the opinions of the individual authors and do not necessarily represent the opinions of any of Forex Crunch's authorized authors. Forex Crunch has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: Omissions and errors may occur. Any news, analysis, opinion, price quote or any other information contained on Forex Crunch and permitted re-published content should be taken as general market commentary. This is by no means investment advice. Forex Crunch will not accept liability for any damage, loss, including without limitation to, any profit or loss, which may either arise directly or indirectly from use of such information.

less

How did you like this article? Let us know so we can better customize your reading experience.

@[Yohay Elam](user:18095), if you could only invest in one crypto, which would it be?

Why invest only one? Hedge your bets and diverisfy your risk by investing in several.