Ethereum Price Prediction: Will ETH Retest $4K Amid Rising Sell Pressure?

Image Source: Pixabay

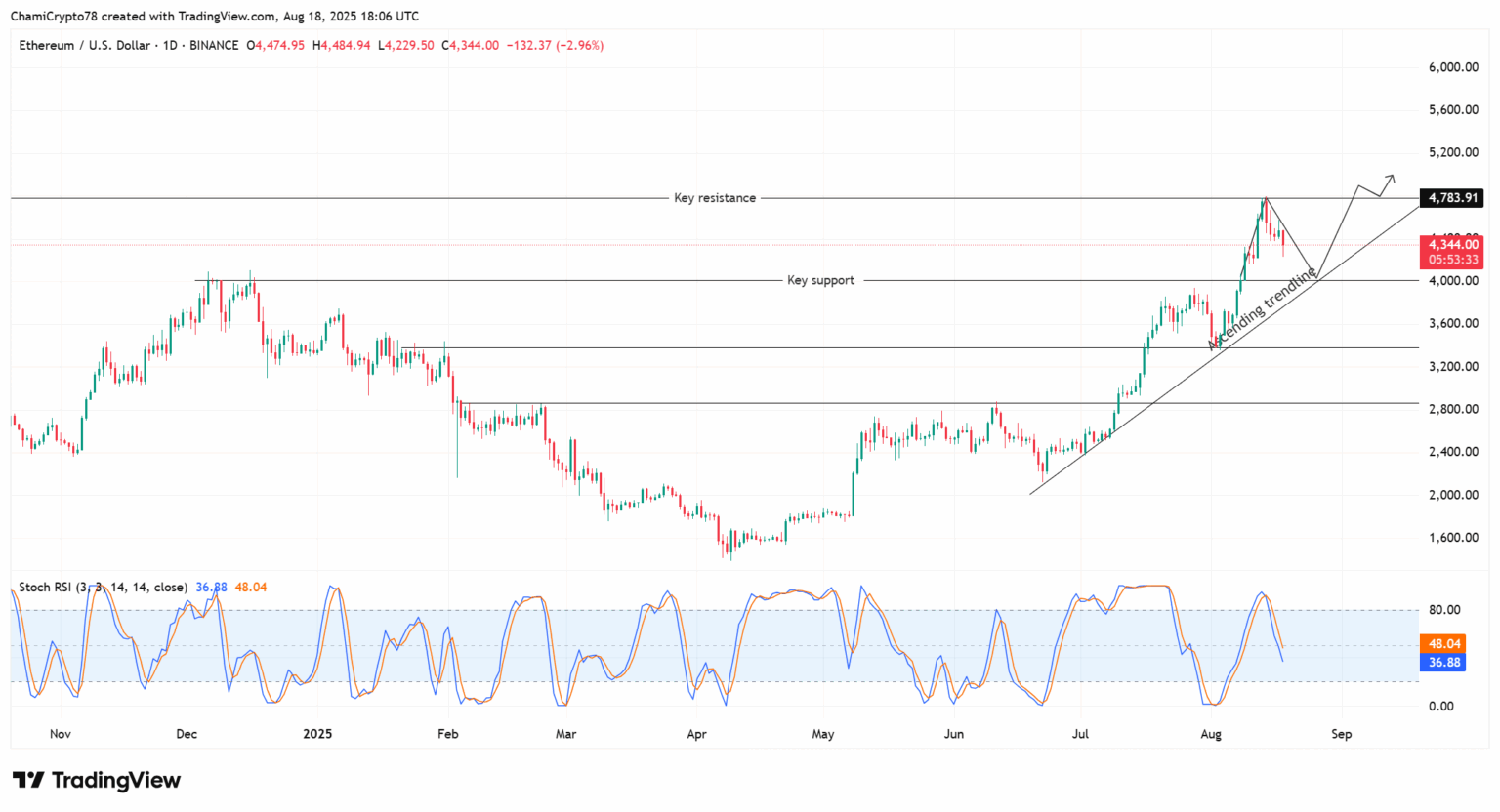

Ethereum’s price has faced a sharp correction after failing to hold above $4,700. The digital asset slipped to $4,335, marking a 4.35% daily decline. The shift in sentiment signals rising bearish outlook, as profit-taking among whales accelerates. Traders are now questioning whether Ethereum will retest the key $4,000 support level before any potential recovery.

Ethereum Price Struggles to Maintain Bullish Momentum

Ethereum’s price has lost ground since its highs above $4,700. Currently, it sits around the $4,300 level, with a key trendline still offering some support. However, pressure is mounting near the critical $4,000 zone, with technical indicators pointing to further downside risk.

The Stochastic RSI is currently at 36, suggesting a reduction in buying strength. With this momentum shift, Ethereum price prediction leans toward a possible dip before any rebound. The $4,000 level remains a significant support area, which could act as a major test for buyers.

(Click on image to enlarge)

ETH:USD 1-Day Chart (Source- TradingView)

Resistance lies near $4,800, with any breach above this price likely to attract renewed bullish interest. However, given the current sell pressure, Ethereum may need to revisit lower levels before it can challenge these higher price points. A strong test of the $4,000 support may dictate Ethereum’s short-term direction.

Whale Activity and Profit-Taking Influence Ethereum’s Price Direction

Recent data from Lookonchain reveals notable whale activity, which has added to the selling pressure on Ethereum. One trader recently closed all 66,749 ETH long positions, realizing a profit of $6.86 million. Such large-scale profit-taking is intensifying market fears, as traders exit their positions.

More By This Author:

China’s AI Cloud Sector Surges 55% As Demand For LLMs Grows

Bitcoin Price Prediction: Why Fed Chair Drama Could Determine Next Major Move

Lyft, Inc. Stock: Co-Founders Exit Sparks Rally as Europe Expansion Lifts Outlook