Ethereum, Is The Pullback Over?

Ethereum bulls are trying hard to stay above the $3500 round number, catalyzing the Fed’s dovish commentary.

Yesterday Fed decided to leave the interest rates intact at 5.25%-5.5% while maintaining their plan for three interest rates cuts in 2024 (four cuts were planned in December 2023, based on the median forecast).

Fed’s Chairman Jerome Powell indicated that the first-rate cut may be expected sometime this year but has refrained from specifying the exact date.

Lowering interest rates may benefit Crypto as more funds could be allocated towards riskier assets

Despite the recent uptick in inflation, the highly anticipated rate cuts are likely to happen once Fed gets enough evidence that the inflation is moving towards its 2% target.

Fed has also hinted on the possibility to slow down the reduction of its balance sheet (selling off their assets), meaning that they may not be taking as much money out of the economy as quickly as they were before.

This could help to avoid stress in the financial markets and potentially extend support to the cryptocurrencies

Ether ETF optimism?

One of the key drivers for ether’s growth was an anticipation for the ETH spot ETFs to be approved by the US’ Securities and Exchange Commission (SEC).

The next approval window is scheduled for May 2024. So far, no commentary was given by the SEC’s official regarding these applications.

If ETH spot ETFs get a green light from the SEC, it could potentially lead to an increased investment into Ethereum, similar to the market impact observed after the approval of the spot BTC ETFs.

However, another delay or a denial by the SEC could lead to ETH moving lower.

From the technical perspective …

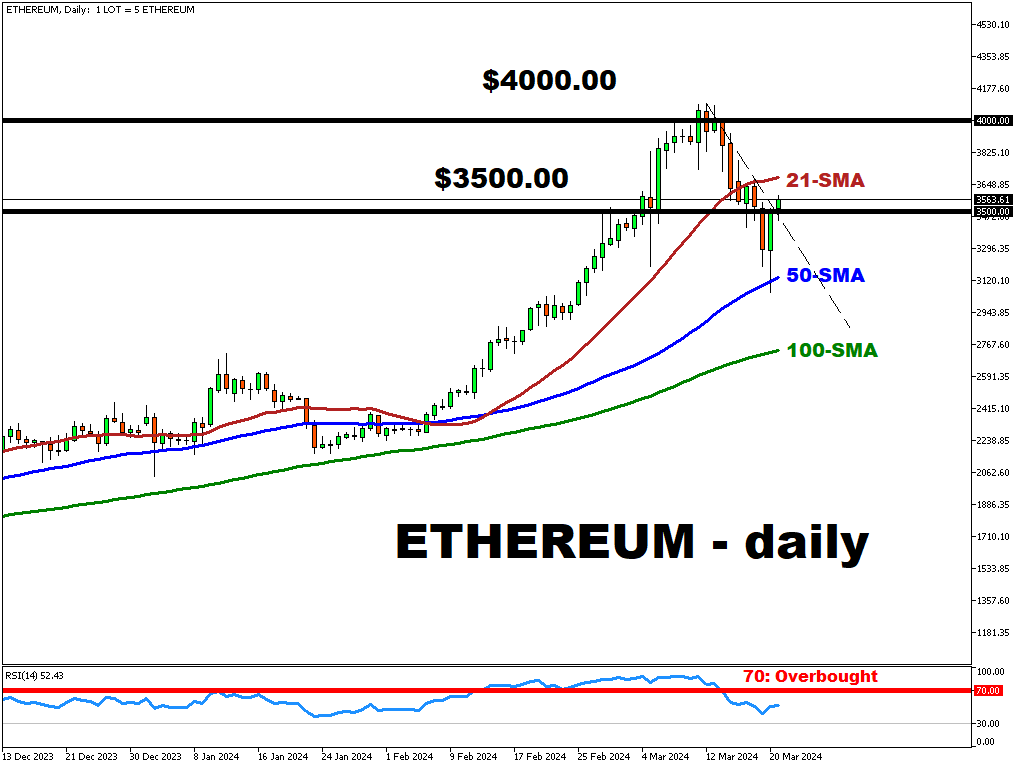

- Ethereum has managed breakout from the steep downward trendline, hinting on a potential trend reversal

- Overall sentiment is mixed. While price is trading above 50 and 100-period SMAs, it is currently below the short-term (21) period SMA

- The key resistance and support levels are located at 21-period SMA and $3500 round number

- Breaking above the key resistance level may indicate a continuation of the uptrend

- Conversely, a drop below the support level at $3500 could indicate a prevailing downward momentum

- The current position of the RSI (52.43) displays the current state of uncertainty as investors await for more catalysts (e.g. spot ETH ETF approvals)

More By This Author:

USDJPY Jumps Above 150 Following The BoJ’s Interest Rate DecisionJP225 On The Way Back To 40000?

Gold Holds Around Record High

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more