Ethereum: Goldman's Shapella Upgrade Post-Mortem (& What Happens Next)

It's been just over a week since Ethereum’s latest upgrade (Shapella) activated successfully, enabling ETH withdrawals, with the rate of withdrawals in line with expectations, accompanied by and increase in ETH deposits and renewed institutional interest.

Goldman Sachs' Crypto desk wrote the following post-mortem on the last week:

How did the latest Ethereum upgrade go and what was the immediate aftermath?

Shapella, Ethereum’s latest protocol update went live on April 12, activated at epoch 194048 without any material technical issues. The upgrade, among other implementations, enabled staked ETH withdrawals and heralds the final step in Ethereum’s transition to PoS, as it relates to the broader Ethereum roadmap.

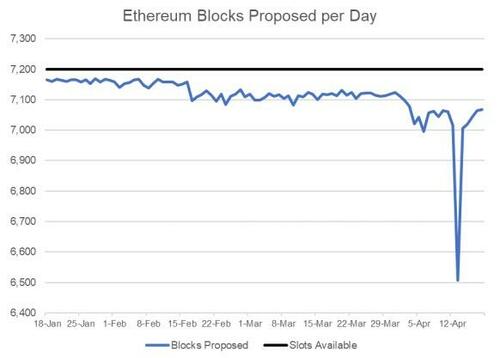

From a technical point of view, Shapella upgrade was a success, apart from minor issues, including the Prysm client software, which caused some validators to fail to propose blocks. The by-effect was a brief increase in missed slots. Coin Metrics data indicates that on April 12, the missed slot rate increased to 10%, but has since recovered to a healthier rate (Figure 1).

Figure 1: Ethereum blocks proposed per day

(Click on image to enlarge)

Source: Coin Metrics as of 19 April 2023. Past performance is not indicative of future results.

Prior to Shapella upgrade, key market concerns were over the impact of ETH withdrawals and broader expectations as to staker behaviour following the withdrawal enablement. What was the outcome?

We noted previously that ETH withdrawals have an in-built mechanism to limit the rate of withdrawals. As such, once the withdrawals were being processed, any market concerns over price impact of withdrawals dissipated. Overall, since Shapella, the network has processed ~818,000 withdrawals, distributing ~1,316,000 ETH (Beaconcha.in).

Partial withdrawals (staking rewards withdrawals): Prior to Shapella, an aggregate of ~1,172,820 ETH earned by validators was ready to be withdrawn to validator’s addresses, as validators do not earn staking rewards on excess balances (Coin Metrics). We estimated that it would take ~4.8 days for partial withdrawals to be withdrawn. Since the upgrade, given the nature of the round the clock automatic withdrawal of eligible partial withdrawals, the number of partial withdrawals has been heightened. This should come down in the future, as staking rewards withdrawal is now automatic.

Full withdrawals (withdrawal of 32 ETH & validator exit): Key market focus was on full withdrawals, given the unpredictability of who and by what volume will opt to withdraw. Currently, 19,048 validators are actively exiting (indicated intention to withdraw, currently in exit queue) at time of writing (Beaconcha.in).

3. What is the net impact on Ethereum staking?

The net impact on staking economics is neutral, as while ETH withdrawals were enabled, ETH deposits increased in volume. On Apr 15, daily ETH withdrawals peaked at ~392k ETH withdrawn, while, since Apr 12, we have seen a steady increase in ETH deposits (Beaconcha.in). The enablement of withdrawals has likely led to holders opting to re-stake their ETH holdings (Beaconcha.in). It is unclear how many of those were re-stakers, as opposed to new validator nodes being spun out. The later effect has commonly not been appreciated enough, with the market over-emphasizing withdrawals enablement.

Additionally, the rate of withdrawals was slowed down on the back of some withdrawals not being eligible. This is due to a fair portion of validators with type 0x00 credentials not having updated to 0x01 credentials (Beaconcha.in).

4. What was the price impact of Shapella on ETH?

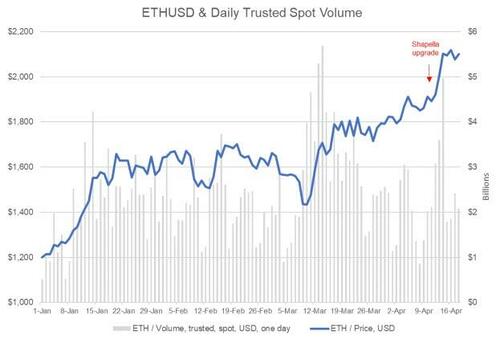

ETH price responded to the post-Shapella de-risking with ETH closing $2,010 on April 13, and is since up +4% (Figure 2).

Figure 2: ETH/USD & Daily spot trusted trading volume

(Click on image to enlarge)

Source: Coin Metrics as of 19 April 2023. Past performance is not indicative of future results.

Aside from the positive outcome of Shapella, the price performance was likely due to ETH’s underperformance to BTC year to date, with ETH catching up to +64% vs BTC +76% price increase ((YTD), Coin Metrics) and a more favourable macro environment.

(Click on image to enlarge)

ETH inflows deposited on exchanges are within the normal range (Coin Metrics).

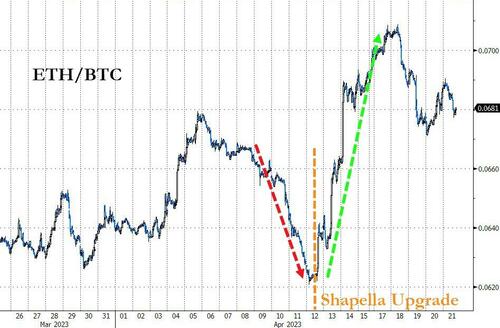

ETH/BTC ratio rose to above 0.07 on April 17 for the first time in over a month (Coin Metrics) and ETH price performance was in stark contrast to the Merge, following which at a weekly, ETH dropped -10% (Coin Metrics).

(Click on image to enlarge)

5. What’s next on Ethereum’s roadmap?

For the rest of year, Ethereum Core developers will be busy focusing on upgrades relating to the protocol's scalability, mainly on EIP-4844, or proto-danksharding, which will be included in the next upgrade termed Cancun/Deneb.

The timing of the next upgrade is not known yet. The scope of the EIPs to be included in the upgrade is currently being discussed.

More By This Author:

US Debt: Visualizing The $31.4 Trillion Owed In 2023Stocks, Bonds, Gold, & Crypto Slide As US Sovereign Risk Roars To Record High

Futures Slide In Risk-Off End To Volatile Week

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more