XMMO: A Momentum ETF To Buy On The Market's Rate-Related Pullback

Image Source: Pixabay

A steady march higher by US Treasury yields recently pushed the S&P 500 and Dow Jones Industrials into a three-day losing streak. But for domestic stock funds, there are still two potential “Buys” this week, including the Invesco S&P MidCap Momentum ETF (XMMO), notes Brian Kelly, editor of MoneyLetter.

The much-watched 10-year Treasury yield hit its highest level since July, topping 4.25% during Wednesday’s trading session. The Dow dropped 410 points in response.

Higher Treasury yields are somewhat surprising given the Fed’s new policy regime. But a stronger-than-expected economy and the recent firm inflation report (September CPI) have stock traders wondering if 50- or 75-basis-points in rate cuts – once a given before year-end -- are still on the table. Election uncertainty and deficit/debt worries are also factors to consider.

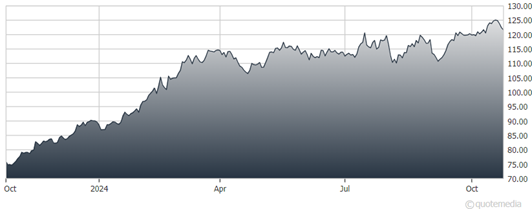

Invesco S&P MidCap Momentum ETF (XMMO) Chart

Returns were mixed for our global indices over the last week. For the Hotline reporting period (Oct. 17-23), the S&P 500 declined by 0.8%; the Euro Stoxx 50 inched up by 0.3%; the Nikkei 225 declined by 2.7%; and the Shanghai Composite gained 3.1%.

Last week, we reminded subscribers that stock valuations are stretched and that a pullback would not be a surprise. Higher interest rates are the catalyst for the decline. However, over the intermediate-term, the path of least resistance is higher. Maintain your asset allocations.

As for XMMO, the ETF seeks to track the investment results (before fees and expenses) of the S&P MidCap 400 Momentum Index. The fund generally will invest at least 90% of its total assets in securities that comprise the underlying index.

Strictly in accordance with its guidelines and mandated procedures, the index provider compiles, maintains, and calculates the underlying index, which is composed of constituents of the S&P MidCap 400 Index that have the highest “momentum score.”

My recommended action would be to consider buying the Invesco S&P MidCap Momentum ETF.

About the Author

Brian Kelly has enjoyed a long career in newsletter publishing and has maintained involvement with MoneyLetter continuously since 1984. He has been a member of the MoneyLetter Investment Committee for over 30 years.

As vice president and product manager for IBC/Donoghue Inc., and IBC USA (Publications) Inc., Mr. Kelly was responsible for all aspects of the MoneyLetter group of products including planning, marketing, fulfillment, customer service, and public relations.

More By This Author:

Alamos Gold: A Mining Stock To Target As Central Banks Pile Into GoldEnerflex: An International Energy Infrastructure Play That's On The Right Track

Markets Showing Strong Momentum. Can It Last?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more