XLK Is Positioned For Sustained Outperformance

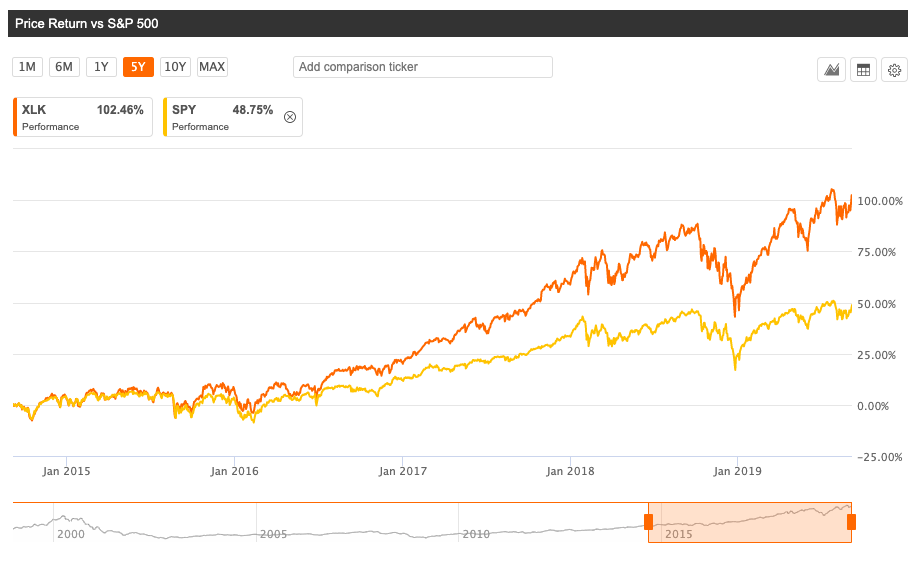

The Technology Select Sector SPDR ETF (XLK) ETF has delivered impressive returns over the past five years. The technology fund gained over 102%, more than doubling the 49% return produced by the SPDR S&P 500 (SPY) ETF in the same period.

(Click on image to enlarge)

Source: Seeking Alpha Essential

Past performance does not guarantee future returns. However, considering both the big picture fundamentals and the bottom-up return drivers, Technology Select Sector SPDR ETF looks well-positioned for sustained outperformance over the years ahead.

Competitive Strength And Profitability

In a sense, every business is a tech business nowadays since staying at the forefront of technological innovation crucial for success and sometimes even for survival across a wide variety of industries.

That said, companies that operate in the tech sector face particularly attractive opportunities since technology is fertile ground for growth and disruptive innovation. Successful companies in technology tend to benefit from rock-solid competitive strengths and superior profitability levels, which has massive implications for investors.

The table below, based on data from Morningstar, shows competitive strength - moats - and return on invested capital - ROIC - for companies in Technology Select Sector SPDR ETF versus SPDR S&P 500.

(Click on image to enlarge)

Data Source: Morningstar

XLK offers a higher percentage of companies with wide and narrow moats and a smaller proportion of companies with no moats in the portfolio. Technology can be a key source of competitive differentiation, especially for big and successful companies in the sector.

Assessing competitive strength is subjective to some degree since factors such as brand power, innovative drive, and scale advantages can be hard to quantify. Nevertheless, it's easy to see that many of the most successful and powerful businesses over the past decades come precisely from the tech sector.

In any case, the numbers don't lie. Superior profitability is a clear sign of superior competitive strength because a company needs to have strong moats in order to protect the business from the competition and sustain higher profitability over the long term.

Companies in the XLK portfolio are clearly stronger than those in the SPY portfolio based on return on invested capital. The average return ROIC level for companies in XLK is 21.2% versus an average ROIC level of 15.43% for companies in SPY. This is a clear sign of underlying fundamental quality.

Reasonable Valuations

The main risk factor to keep in mind when investing in high-quality growth stocks is valuation. Even if the business is performing well, the stock can be a mediocre investment if the entry price is too high. This is a particularly important point to consider now that XLK has substantially outperformed the rest of the market in recent years.

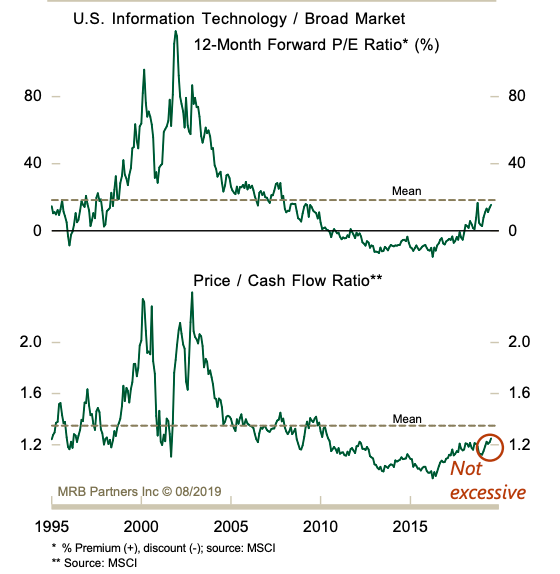

However, valuation is not much of a problem when it comes to the technology sector as a whole right now. It can be easy to find specific cases in which some individual tech stocks are overpriced. However, the technology sector as a whole is not overvalued.

Comparing forward price to earnings and price to free cash flow ratios for the technology sector versus the broad market, valuations have been getting more expensive lately, but they are still in line with historical standards.

XLK has appreciated more than SPY in the past years, but this appreciation was driven by stronger growth in earnings and cash flows, so valuations have remained reasonable. At current levels, the technology sector looks moderately priced overall, even if there can be some particular cases in which individual stocks in the sector are overvalued.

(Click on image to enlarge)

Source: MRBPartners.

Strength Under The Surface

When analyzing an ETF, we can get some valuable insights by looking not only at the ETF itself but also at the main stocks in the portfolio. At the end of the day, the ETF is as good or bad as the stocks that it owns.

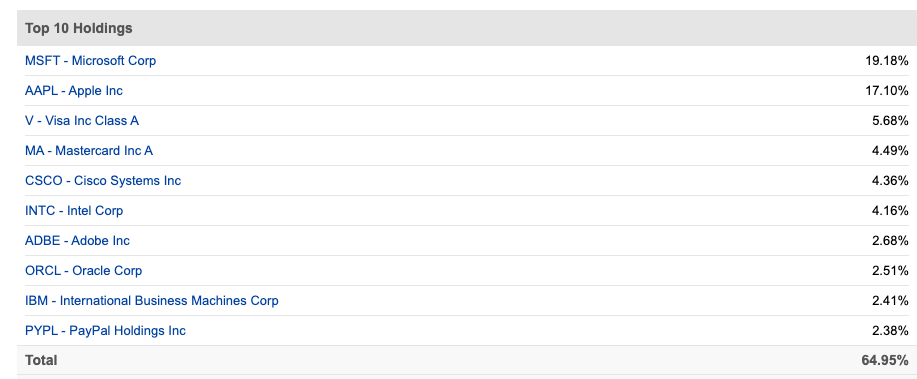

In this particular case, XLK has a highly concentrated portfolio, with 10 names accounting for almost 65% of its holdings. These companies are Microsoft (MSFT), Apple (AAPL), Visa (V), Mastercard (MA), Cisco (CSCO), Intel (INTC), Adobe (ADBE), Oracle (ORCL), IBM (IBM), and PayPal (PYPL).

(Click on image to enlarge)

Source: Seeking Alpha Essential

In order to evaluate these companies from a quantitative multi-factor perspective, we can run them through the PowerFactors algorithm. This is a quantitative system that ranks stocks based on 4 factors: financial quality, value, fundamental momentum, and relative strength.

Here is a quick explanation of the factors considered in the algorithm:

- Financial quality includes profitability metrics such as return on assets, return on investment, return on equity, gross profit margin, operating profit margin, and free cash flow margin. The more profitable the business, the higher its ability to create profits for shareholders over the long term.

- Valuation covers typical valuation ratios such as price to earnings, price to earnings growth, price to free cash flow, and enterprise value to EBITDA. The cheaper the better, so stocks with lower valuation levels receive a higher ranking in the algorithm.

- Fundamental Momentum: This factor looks for companies that are performing better than expected and producing rising expectations, so it measures the change in earnings and sales forecasts. The bigger the increase in forecasts, the higher the score for the company in fundamental momentum.

- Relative Strength: Winners tend to keep on winning when a stock is outperforming the market, it tends to continue doing so more often than not over the middle term. For this reason, the PowerFactors system looks for stocks delivering above-average returns over different time frames.

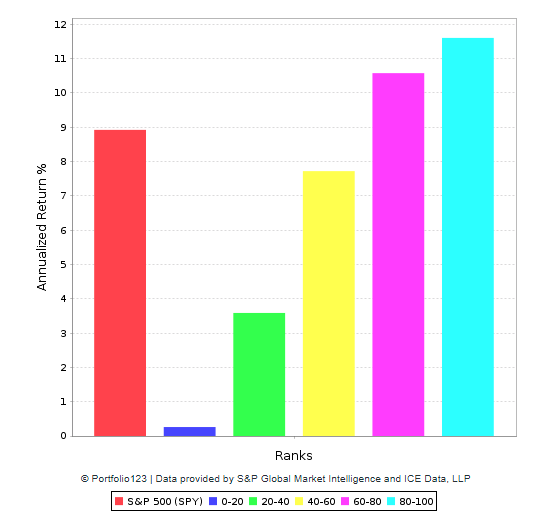

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns in the long term. The higher the PowerFactors ranking, the higher the expected returns, indicating that the system is consistent and robust.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The table below shows the PowerFactors ranking for the top 10 positions in the XLK portfolio. All of those 10 stocks have PowerFactors rankings above 80, meaning that they are in the top 20% of the US stock market according to the PowerFactors algorithm. The average PowerFactors ranking is also quite elevated at 94.

(Click on image to enlarge)

Looking at the top positions in Technology Select Sector SPDR ETF, the fundamentals look clearly strong from a quantitative bottom-up perspective.

Moving Forward

Technology is a high-growth sector with above-average volatility. The sector tends to outperform when market conditions are favorable, and it can also underperform in times of declining risk appetite among investors. Due to their cyclicality, technology stocks can be more vulnerable than the rest of the market to economic uncertainty and the trade war disruptions.

Those risks being acknowledged, Technology Select Sector SPDR ETF offers a diversified collection of high-quality business with solid competitive strengths and superior profitability. The top companies in the portfolio also look remarkably attractive from a bottom-up perspective too.

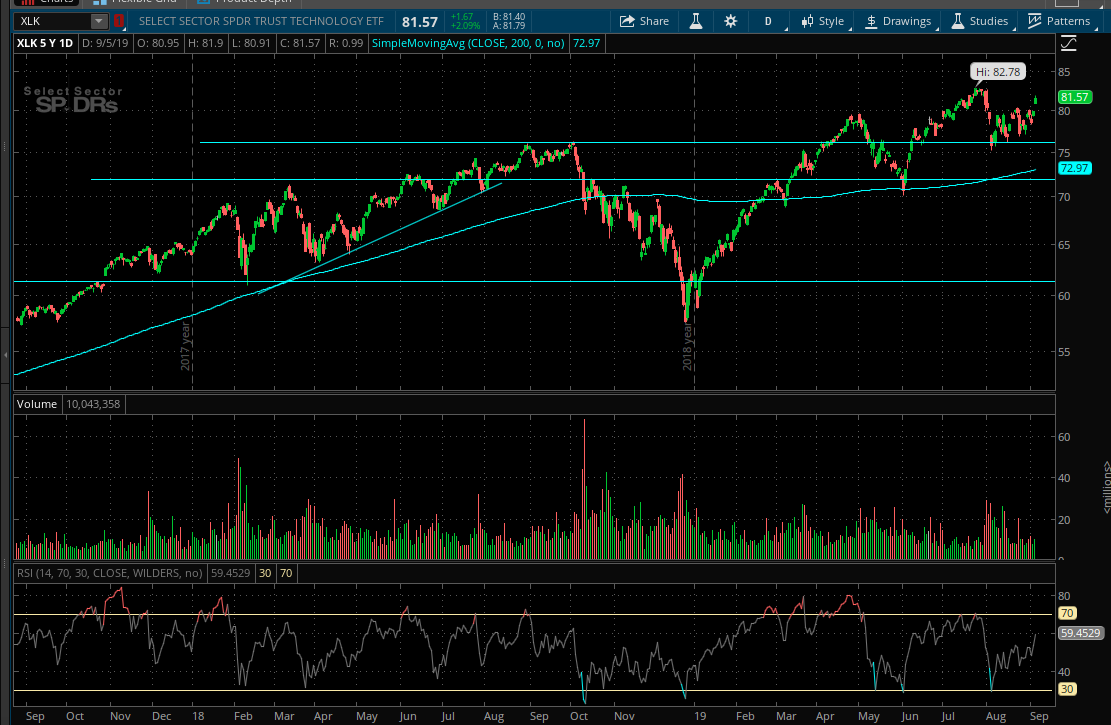

(Click on image to enlarge)

Source: Think or Swim

The ETF is in a vigorous uptrend, and it's not too overbought at current prices. As long as it remains above $75 per share, it makes sense to expect more gains from Technology Select Sector SPDR ETF over the middle term.

Disclosure: I am/we are long PYPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more