XLK: A Familiar Tech Fund That Offers Benefits In This Volatile Market

Image Source: Pexels

Between fluctuating signals, geopolitical conflicts, and all the reality-TV-worthy drama in the White House, it feels like we’re entering a strange new world...without a clear map to guide us through it. Personally, I’m not a fan of all this market turmoil, but I do know that in times of uncertainty, we often cling to what’s familiar.

Familiarity can offer security, especially in the market. Founded in 1998, XLK was the first-ever exchange-traded fund to launch in the technology space. As a consequence of this milestone, its focus on the US technology segment is narrower than its contemporaries. XLK excludes small - and mid-cap stocks, entirely consisting of stocks in the S&P 500.

XLK’s heavily concentrated nature also leads to a few “misfit” stocks, including financial payment processors and telecom firms. But this strict adherence to large-caps helps the ETF avoid smaller, less-stable firms, resulting in lower volatility and a tilt toward value. In fact, XLK long held the title as the cheapest and largest fund in its segment.

XLK has $73.7 billion in assets under management and an expense ratio of 0.09%, which is incredibly low. Its primary sector is, of course, technology, with electronic technology taking up the largest share at 52.7% of its holdings.

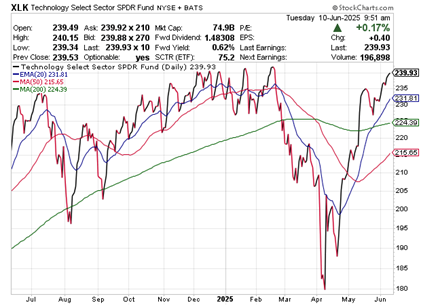

The fund is up about 10% over the last month, 9.7% over three months, and 3.1% year to date. In seeking security from the familiar choices, it’s important to make sure that it offers the shelter you really need. Investors should always do their due diligence before adding any stock or ETF to their portfolio.

More By This Author:

Nasdaq 100: As Market Fate Hangs In The Balance, Watch These LevelsKBR: A Value Play With Construction, Defense, And Energy Exposure

AAPL: Investors Asking "Is That It?" After WWDC Event

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more