XLE: This Is NO Replay Of 2015 In The Oil Patch

Photo by Timothy Newman on Unsplash

The sector then was at the end of a multi-year investment boom. Awash in debt and over-capacity, it was already ripe for a reckoning. Long-time Energy and Income Advisor readers will recall our forecast for North American benchmark oil prices to bottom out near $20 a barrel, down from $100-plus.

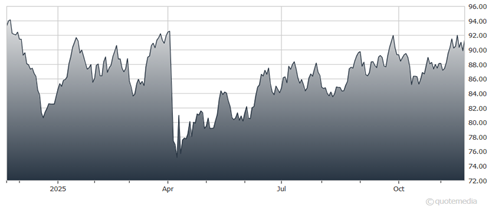

Energy Select Sector SPDR Fund (XLE)

Why bring this up now? Because there’s a growing narrative on Wall Street that 2025-2026 will be a repeat of the bloodbath of a decade ago. That stems from what we see as the exceptionally bearish oil price forecasts now circulating among some of the larger investment banks, which also extend to natural gas.

Bearish opinion has made laggards out of many energy stocks this year. The super major-dominated Select Sector Energy SDPR ETF (XLE) is in the black this year with a total return of a little less than 10%, but underperforming the S&P 500 Index (SPX).

But the idea this is 2015 all over again is pure bearish fantasy. And you don’t have to look any further than freshly reported Q3 results and guidance to see best-in-class energy companies are not just still growing and raising dividends now. They’re arguably the best prepared they’ve ever been for a downturn, thanks to conservative investment strategies focused as much on controlling costs and cutting debt as expanding revenue.

Bottom line: The North American oil and gas industry was ripe for collapse in 2015. But here in late 2025, it’s just not. In fact, the real question is if it will be able to meet the emerging demand growth of the next few years.

More By This Author:

Constellation Energy: An AI Trade With The Right Balance Of Risk And RewardIXC: A Fund To Profit From A Resurgence In Energy Prices

AI Stocks: Does Burry's Hyperscaler Depreciation Thesis Hold Water?