XAR: A Fund For Capitalizing On The Defense Drone Revolution

Image Source: Pixabay

The drone revolution may add some healthy buzz to your portfolio. While commercial drones are delivering on their promised potential, global defense budgets are surging and Washington is shoveling billions into unmanned systems. Buying the SPDR S&P Aerospace & Defense ETF (XAR) is one way to capitalize, observes Sean Brodrick, editor at Weiss Ratings Daily.

While the commercial drone market is growing at about 7.3% per year, the defense-sector drone market is growing at 11% per year. Recently, we saw the White House’s FY 2026 discretionary budget request allocate $1.01 trillion for defense spending, a 13% increase over 2025 levels.

Washington is pouring billions into the technologies that will define the next decade of warfighting, including drones. That is what is helping the military drone market take wing. The US is 39% of the military drone market — for now — and the race is on as various powers vie to be “top gun” when it comes to military drones.

So, what’s driving the surge?

- AI autonomy: Next-gen drones are taking off, navigating and executing missions with minimal human oversight.

- Swarm tactics: Networked drones that fly in formation to overwhelm defenses have proved terrifyingly effective, and they are moving from lab demos into procurement pipelines.

- New thinking on designs: The Pentagon wants cheap, expendable drones by the thousands. This is a direct lesson pulled from Ukraine’s battlefield.

- Counter-unmanned aircraft systems: In other words, these technologies and programs are designed to detect and neutralize hostile drones.

- Domestic production: Tariffs and procurement rules now box out foreign suppliers. If it’s not American-made, it doesn't make the cut.

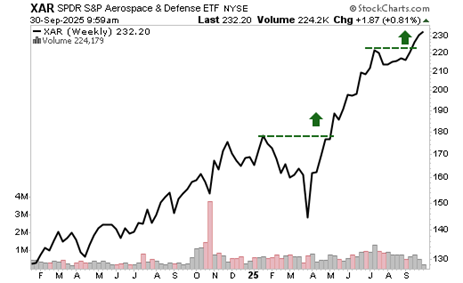

The XAR ETF is a way to potentially play this trend. After breaking out in April, the fund rose 25% before taking a breather. It’s recently been breaking out again — and who knows how high it will go? The fund holds a basket of defense and aerospace stocks.

My recommended action would be to consider buying the SPDR S&P Aerospace & Defense ETF.

About the Author

Sean Brodrick is best known as the "Indiana Jones of Natural Resources." With his boots-on-the-ground experience, he has visited mines, met executives in person, discovered hidden opportunities, and revealed hidden dangers. Mr. Brodrick was also among the first to write about the commodity supercycle and recognize major resource and tech megatrends that transformed our world. He currently edits five publications.

More By This Author:

USD/JPY: Broken Down Amid Broad Dollar PressureCTBI: A Regional Bank With Solid Dividend Growth

AIQ And CHAT: Are These ETFs Vulnerable Amid AI Bubble Talk?

MoneyShow Editor’s Note: Sean is speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. more