Will Bullish Sentiment Return To Alternative Energy ETFs?

In a year of upheaval, including worries about conventional energy supplies, the prospects for alternative energy sources should be front and center for investors. Or so one might think. But using a set of ETFs to gauge sentiment suggests the crowd is still lukewarm at best in embracing industries in the alternatives space vs. old-school fossil-fuels stocks.

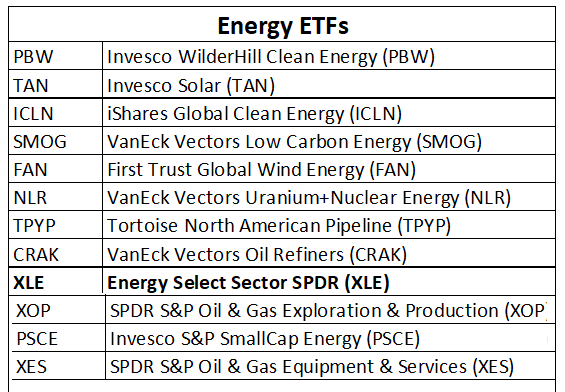

For proxies, consider 12 ETFs that cover a broad measure of energy stocks:

Notably, the top performers this year are conventional energy ETFs, led by SPDR S&P Oil & Gas Exploration & Production (XOP), which is up more than 92% year to date through yesterday’s close (Aug. 24). A close second-place performer in 2022: the benchmark for conventional energy behemoths (think ExxonMobil and Chevron, for example) via Energy Select Sector SPDR (XLE), which is ahead by nearly 80%.

In fact, the top performers on our list are dominated by conventional energy firms. There are hints that alternative/clean energy stocks are gaining some traction after a rough couple of years. The strongest year-to-date performer in the table above: Invesco Solar ETF (TAN), which has earned a modest 4.0% so far in 2022. The weakest return this year: VanEck Low Carbon Energy ETF (SMOG), which has lost nearly 16%.

For comparison, the US stock market overall is off 6.3% year to date, based on SPDR S&P 500 (SPY).

Despite the weak performances of clean/alternative energy stocks, the future remains bright, or so various studies suggest. The think tank RMI, for example, advises in a new report:

“The next decade will be transformative for the technologies needed to confront the climate challenge and capitalize on the opportunities inherent in the clean energy transition. And for once, Congress is leading the way. Annual real federal spending on climate and clean energy over the next decade will likely be at least 3.5 times its level in the period from 2009 to 2017, and 15 times its levels in the 90s and early 00s.”

In theory, the wave of spending ahead suggests a golden era is brewing for the clean/alternative energy space. Judging by this year’s results for the ETFs listed above, however, investors are on the fence about assuming that a regime shift is here.

More By This Author:

Rebound Expected For US Q3 GDP, Based On Median Outlook

Monitoring Investment Trends With ETF Pairs - Tuesday, Aug. 23

The Major Asset Classes Lost Ground Last Week

Disclosures: None.