Why The Inflation Crowd Is Missing The Real Money

Everyone keeps talking about inflation. I get it - the Fed's cutting rates, printing money again, and at some point inflation will probably return.

But if you're using that as your trading thesis right now, you're missing where the actual money is being made.

Here's the thing: you need to trade the market in front of you, not the market you think ought to be.

The Inflation Crew Is Grasping At Straws

Last week's energy surge has the inflation crowd pumping their fists. "See! Energy's leading! Inflation's coming back!"

Look, I get why they're excited. Energy was the top performer last week, and historically, energy outperformance signals late-cycle inflationary pressure.

But they're celebrating one week of performance like it's a victory lap. That's chump change analysis.

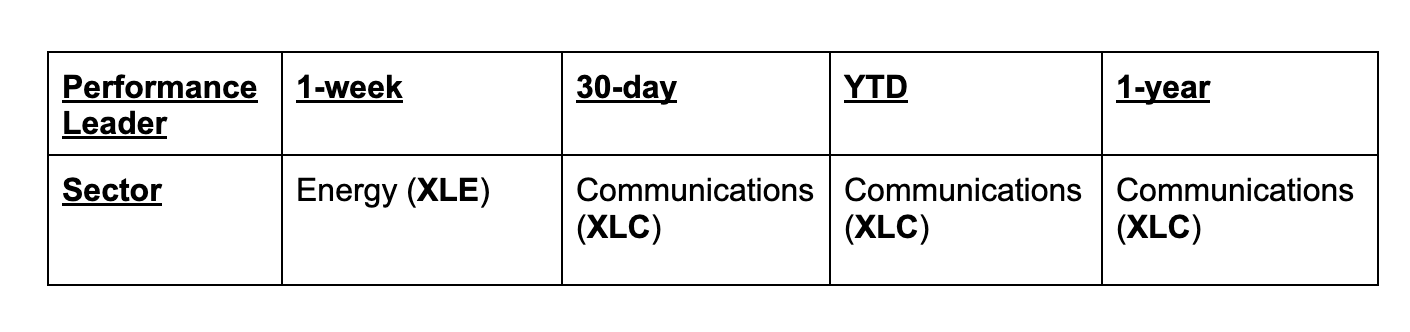

Here's what the data actually shows:

You see the problem? Energy had one good week. Communications has dominated everything else.

Why I'm Not Buying The Energy Story

I'll be straight with you - in my quarterly forecast last week, I called for another reversal back lower in oil prices. I fully expect the broader energy sector to follow it down.

Energy outperformance means something when it sustains over 30+ days or year-to-date. One week? That's noise, not signal.

Meanwhile, communications - tech's sibling sector - is crushing it at every meaningful timeframe. That's where the smart money is flowing.

The Real Story Nobody's Talking About

This communications dominance is screaming one thing: we're still in a growth-driven market, not an inflation-driven one.

Tech and communications thrive when investors are betting on innovation, productivity, and future earnings growth. They get crushed when inflation becomes the dominant narrative.

The market is telling you exactly what it wants. Are you listening?

What This Means For Your Portfolio

Don't fight the tape. Your portfolio isn't the place to be a hero.

The inflation crowd can have their theories. I'll take the sectors that are actually making money.

Keep buying those dips in communications and tech. The data doesn't lie - this is where wealth is being created right now.

Trade what you see, not what you think should happen.

More By This Author:

The Warning Signal Most Traders Miss

Sell The Rips Or Buy The Dips?

The Mining Stock Gravy Train Just Left The Station