Which Sector ETFs Should You Be Overweight Right Now?

Volatility is back. After a relatively quiet April, the market got a jolt earlier this month with the sudden escalation in trade war negotiations between the Trump administration and China.

The added volatility has been a welcome sign for traders, but another thorn in the side of investors wondering how to best position their portfolios. For ETF investors, the best idea going forward—at least, for the time being—could be to go overweight utilities, real estate, and consumer staples, according to investment research platform Quantamize.

According to the platform, which rebalances a model sector ETF portfolio monthly based on its Q-Factor scoring system and thousands of signals from neural networks, this is the ideal sector weighting at this moment:

Utilities Select Sector SPDR Fund XLU 0.18%: 18.41 percent

Real Estate Select Sector SPDR Fund XLRE 0.16%: 16.95 percent

Consumer Staples Select Sector SPDR Fund XLP 0.35%: 16.77 percent

Industrial Select Sector SPDR Fund (NYSE: XLI: 9.13 percent

Materials Select Sector SPDR Fund XLB 0.5%: 9.01 percent

Health Care Select Sector SPDR Fund XLV 0.21%: 8.44 percent

Energy Select Sector SPDR Fund XLE 0.17%: 7.28 percent

Consumer Discretionary Select Sector SPDR Fund XLY 0.13%: 6.17 percent

Technology Select Sector SPDR Fund XLK 0.03%: 5.86 percent

Financial Select Sector SPDR Fund XLF 0.83%: 2 percent

According to the platform, “The Quantamize SPDR S&P Sectors Stocks ETFs Q-Folio is a portfolio of US-listed SPDR S&P sector ETFs that uses an advanced form of AI to create a robust diversified portfolio of the SPDR S&P sector ETFs.” A portfolio of these holdings and weightings would have delivered an annualized return of 17.93 percent.

Image courtesy of Quantamize

Interestingly enough, on an individual basis, the platform has sell recommendations nearly all of the Select SPDR ETFs right now. Only the consumer staples, materials, and healthcare ETFs have a buy signal.

Image courtesy of Quantamize

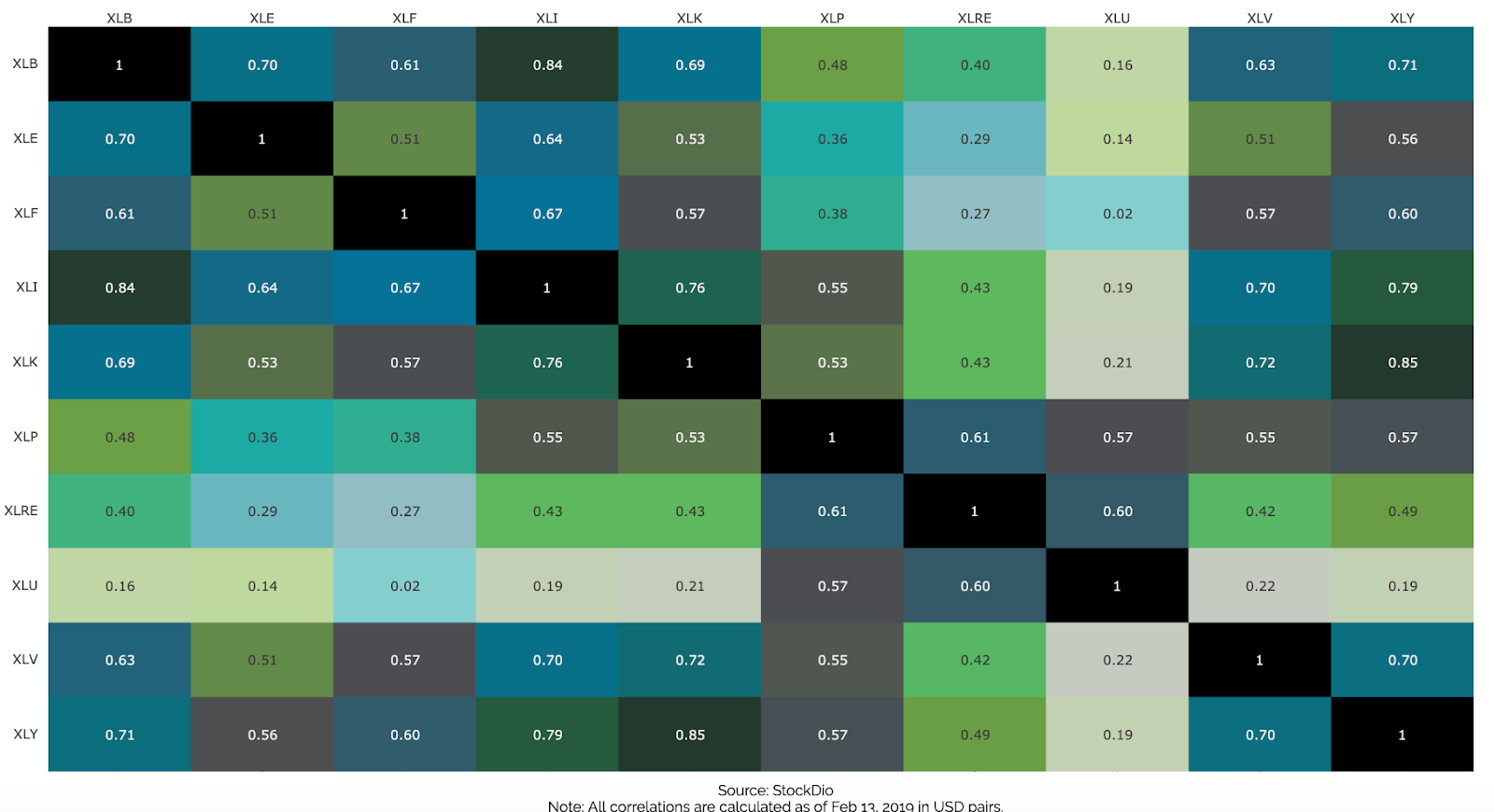

But this isn’t about individual ETFs—it’s about how to weight them in a portfolio given the current market dynamics. Of course, a broad-based US sector ETF portfolio wouldn’t want to be overexposed to any one correlation. The challenge in adjusting your exposure is figuring out how the sectors are related to one another.

The chart below shows the correlation between each of these sector ETFs:

Image courtesy of Quantamize

As you can see, there’s a strong relationship among the “defensive” sectors of consumer staples (XLP), real estate (XLRE), and healthcare (XLV). Likewise, the “cyclical” sectors of technology (XLK) and consumer discretionary (XLY) have a strong correlation.

Interestingly, the XLK appears to have a strong correlation with industrials (XLI), a pair that most investors would not commonly associate together.

The upshot here is that sector outperformance is always changing, and a portfolio optimized to take advantage of these changing relationships will have to be rebalanced on a consistent basis.

Nice article,

Keep up the good work!