What's Up With Retail?

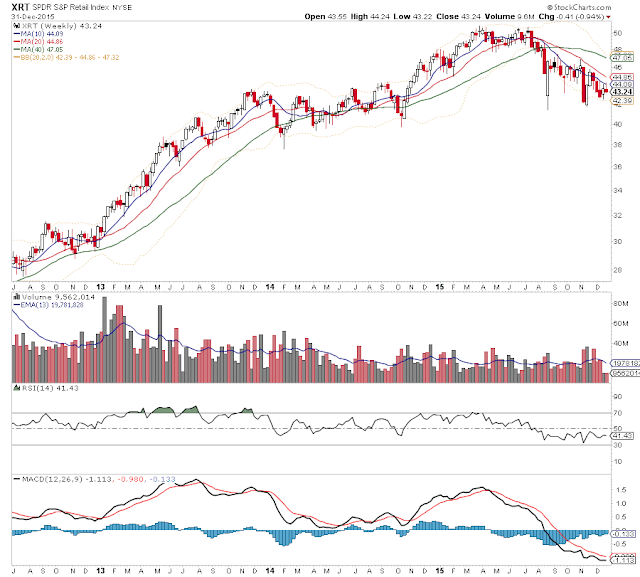

The holdings in the SPDR Retail ETF (XRT) are largely acting horribly. Traditional retail just continues to get wrecked.

With that in mind, I took a look at the best charts and companies in the space.

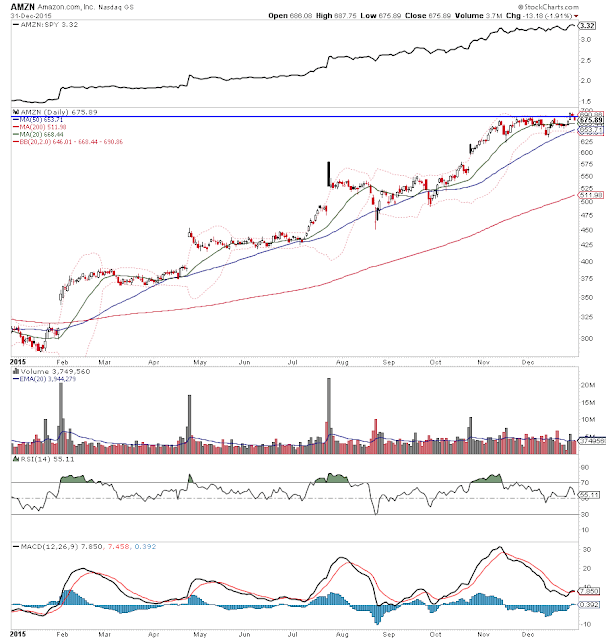

The bullish argument for retail is e-commerce is winning by a landslide. Of course it is. At this point, everyone and their mother knows that bullish argument for Amazon (AMZN). It's mostly if not completely priced in.

Amazon is a must watch chart. The 2015 rally was amazing. Everybody wanted to show a large position in Amazon at the end of the year. Can it continue to lead? The trend is clearly still up on each timeframe for now.

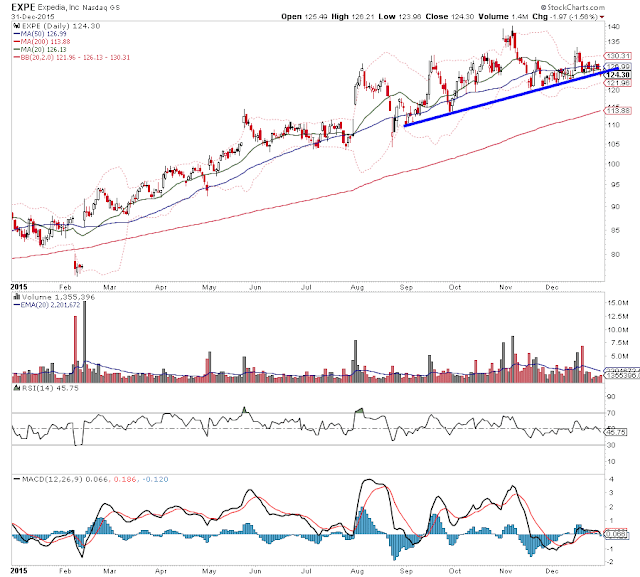

Expedia's (EXPE) chart is really struggling right now. The bear thesis of a slowly eroding global economy (therefore leading to less business travel) certainly is NOT refuted by this price action.

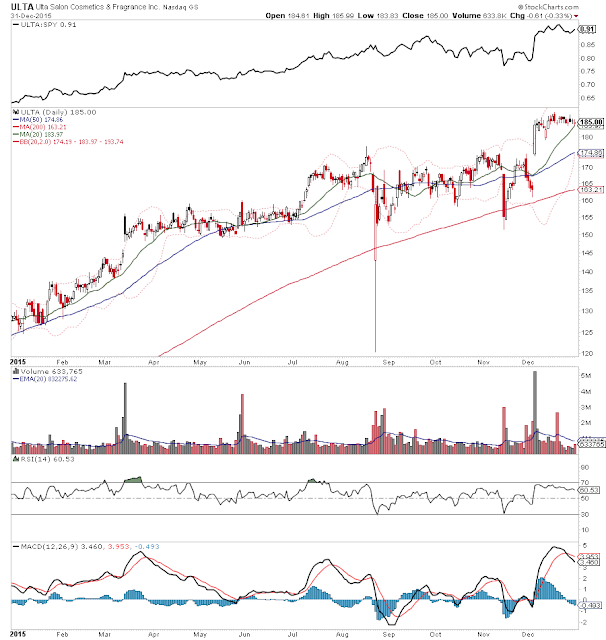

Ulta Salon (ULTA) is an amazing retailer with amazing management. All systems are still go technically. Can it continue to power higher? My question is, what's stopping them outside of a recession?

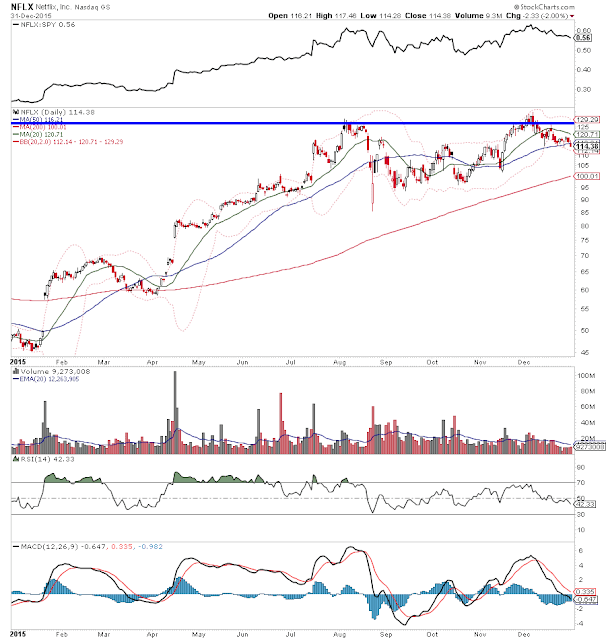

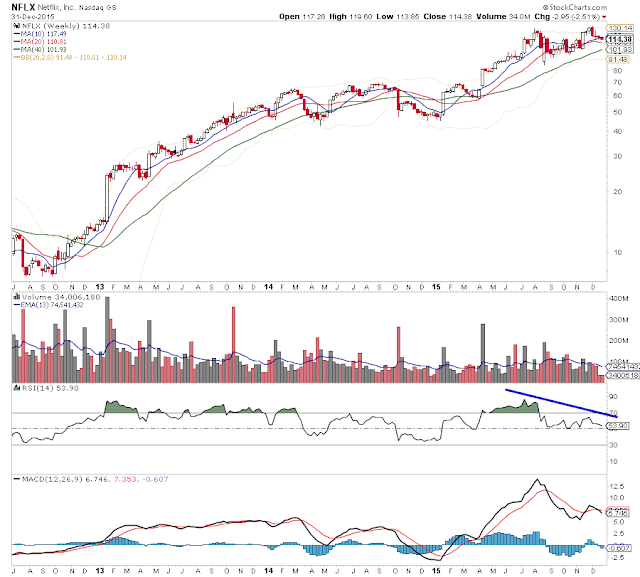

Netflix (NFLX) has really lacked buyers in December. It's really struggling to find a bid. With severely waning momentum on the weekly, it's very risky to own these days.

NFLX weekly

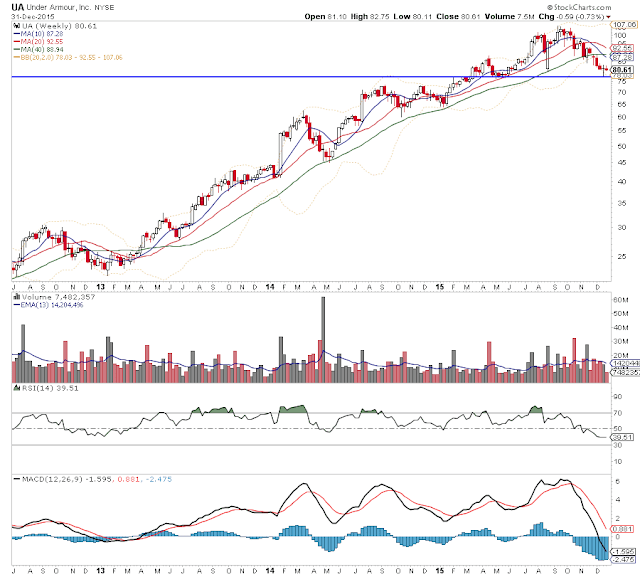

Under Armour (UA) started discounting aggressively last spring. Their management is WAY ahead of the competition. 80 has proven to be a solid support level and the stock's momentum has reset. That's a big level to watch as a tell for the group moving forward.

Remember, even the best companies throughout history have dropped 50%+ from their highs in meaningful corrections.

Finally, the SPDR Retail Index chart is stuck between the fall bottom and downtrends of numerous timeframes. Resolution will be a major tell.

Perhaps the most concerning fact about consumer discretionary stocks is the fact oil and gas prices have cratered in the last 18 months. They haven't helped consumers at all. That seems like a silent alarm going off. It makes me wary of the sector until further notice.

Trade 'em well

Disclosure: None.