We're Living Through The Next Dot Com Bubble

Image Source: Pixabay

We're living through a Great Tech Reset right now.

And here's the kicker - the Fed is cutting rates into a period where tech earnings estimates aren't decreasing. They're expanding.

The last time we saw this setup was the dot com bubble.

Look, I know everyone's tired of dot com comparisons. But the data doesn't lie. Check out this week's

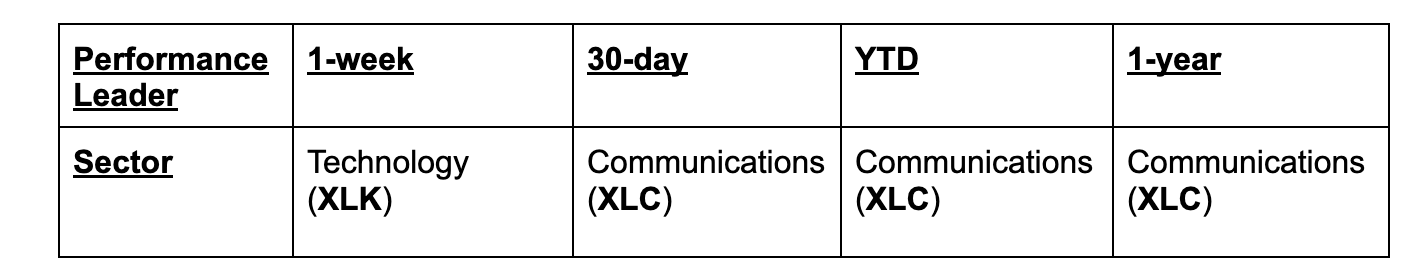

For the second straight week, tech (XLK) is leading on the 1-week timeframe. Communications (XLC) is dominating everything else - 30-day, YTD, and 1-year performance.

This isn't something you see in bear markets.

Tech makes up around 30% of the S&P 500. When it's leading across multiple timeframes like this, with the Fed cutting rates behind it, you're looking at a very specific setup.

The trend is undeniable. We've got two parallel tech resets happening:

1) The Great American Tech Reset - Fed easing into expanding earnings estimates

2) The Great Chinese Tech Reset - Global tech cycle turning

Here's what's encouraging me as a bull: So many traders are still fighting this tape. At the end of the day, I can't just trade against the market makers. When everyone's looking for the crash and the internals keep screaming bullish, that's when you lean in.

It's tech's world right now. We're just living and trading in it.

The market gave us new all-time highs after the Fed cut. If you've been following the internals over the past few months, this was no surprise.

But if you're still waiting for the other shoe to drop while tech resets around the globe, you might be waiting a very long time.

More By This Author:

The Fly Trap Can Catch More Than FliesThe Win Rate Question That Makes Me See Red

We May Be Seeing A Perfect Setup To End Q3