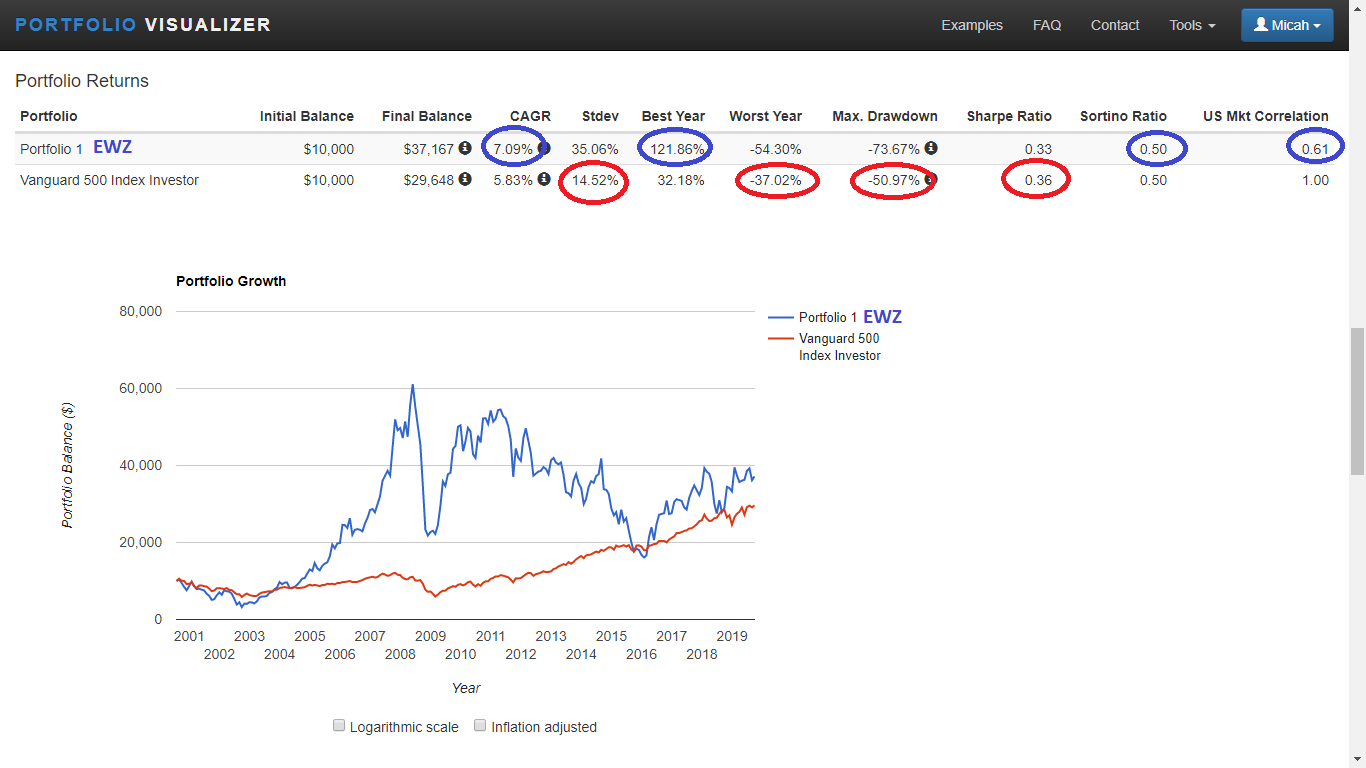

Weighing The Risks & Rewards Of The Brazil ETF (EWZ)

- The iShares MSCI Brazil ETF (EWZ) has outperformed an S&P 500 index fund by 1.26% CAGR over the last 19 years

- This is a single-country emerging market ETF which means it carries more risk than a diversified emerging market fund

- This article will explore some of the risks and rewards of holding this ETF in an equity portfolio

EWZ vs S&P 500 index fund: August 2000 - September 2019

Source: Portfolio Visualizer

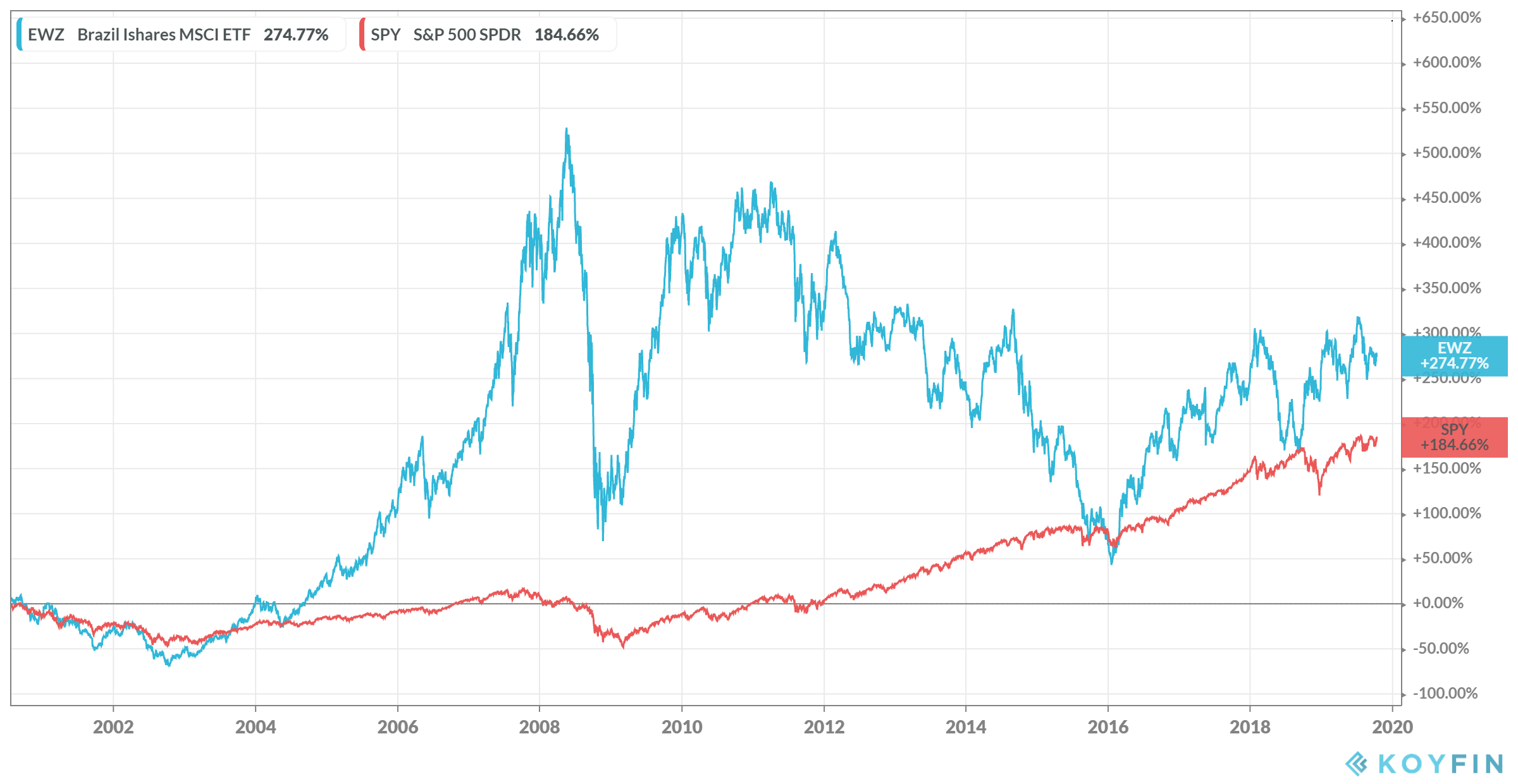

EWZ vs SPY: July 14, 2000 - October 15, 2019

Source: Koyfin

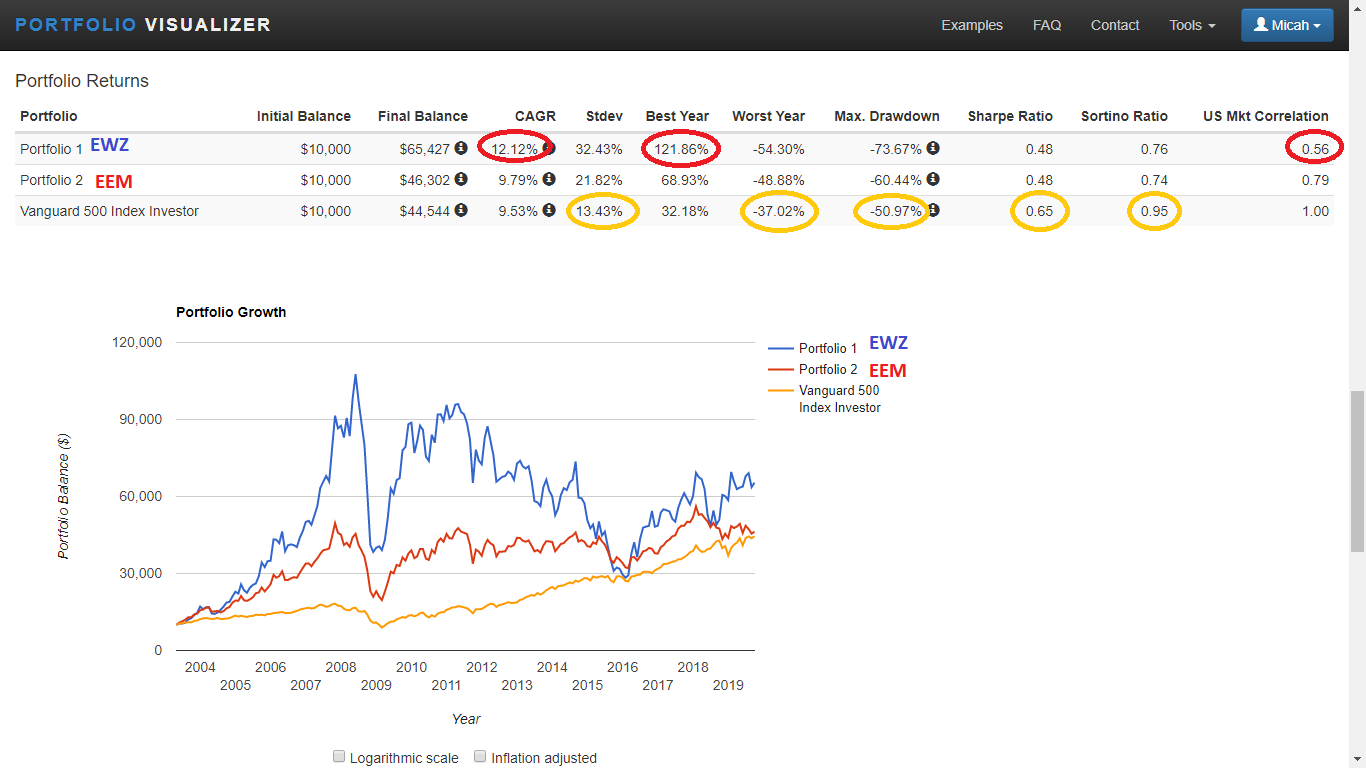

EWZ vs EEM vs S&P 500 index fund: May 2003- September 2019

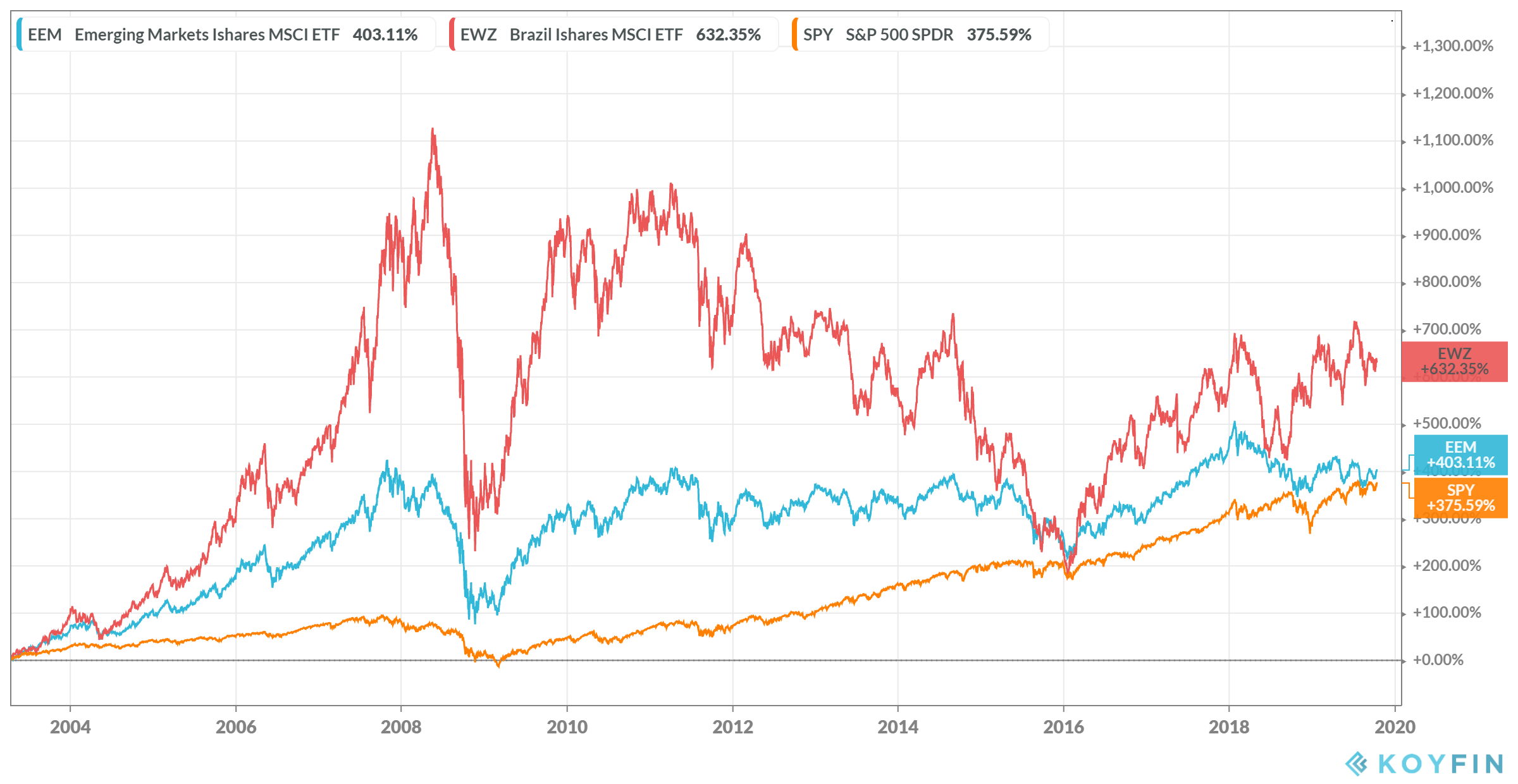

EWZ vs EEM vs SPY: April 11, 2003 - October 15, 2019

The iShares MSCI Brazil ETF (EWZ) inception date was July 10, 2000. Since inception, this ETF has outperformed an S&P 500 index fund by 1.26% CAGR. EWZ has also outperformed the iShares MSCI Emerging Markets ETF (EEM) by 2.33% CAGR since May 2003. But this outperformance was not achieved without a lot of risk in the process. If you measure risk by volatility or standard deviation, you can see in the charts above that EWZ is more than twice as volatile as an S&P 500 fund and more than 60% more volatile than EEM. With so much risk involved, investors should ask themselves if the potential rewards of this single-country emerging market fund is actually worth the risks.

So, what are the potential risks involved with owning the iShares MSCI Brazil ETF (EWZ)?

- Equity risk: Investing cash in a company's stock is usually more risky than investing in so-called 'risk-free' investments, such as government bonds.

- Emerging Market risk: Foreign Exchange Rate Risk, Non-Normal Distributions, Lax Insider Trading Restrictions, Lack of Liquidity, Difficulty Raising Capital, Poor Corporate Governance, Increased Chances of Bankruptcy, Political Risk

- Country-Specific fund risk: currency risk, changing economy risk, sovereign risk, economic risk, political risk, and single-country funds are less diversified than multi-country funds

Some potential rewards of owning the iShares MSCI Brazil ETF (EWZ)

- 19-year history of good returns

- 12-month trailing yield: 2.64%

- High volatility improves opportunities to scale into this fund when it is out-of-favor with other market participants

- Brazil is the 9th largest economy in the world

- Brazil is the 5th largest population in the world

- Brazil is the 6th largest country by land area

- Brazil aims to forge more trade accords as Bolsonaro heads to Asia

- American Airlines says it is negotiating partnership with Brazil’s Gol

- Iberdrola CEO sees improving business environment in Brazil, looks to expand

- Santander Brasil predicts loan book growth above 10% through 2022

- Brazil pension reform to clear Congress by October 22: senator

- Why US-China trade war’s latest escalation could be good news for Brazil, Mexico, and Vietnam

If the iShares MSCI Brazil ETF (EWZ) interests you as an investor, you should get to know some the key facts and characteristics of this fund:

- INVESTMENT OBJECTIVE: The iShares MSCI Brazil ETF seeks to track the investment results of an index composed of Brazilian equities. Exposure to large and mid-sized companies in Brazil. Targeted access to the Brazilian stock market. Use to express a single country view.

- Inception date: July 10, 2000

- Expense ratio: 0.59%

- 12-month trailing yield: 2.64%

- Net assets: $8.4B

- Benchmark index: MSCI Brazil 25/50 Index

- 20-day avg. volume: 22M shares/day

- P/E ratio: 14.68

- P/B ratio: 2.06

- Number of holdings: 56

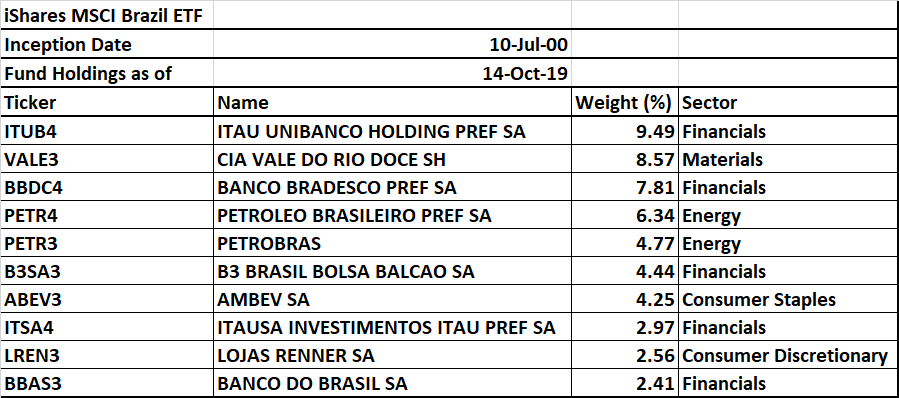

Top 10 Holdings:

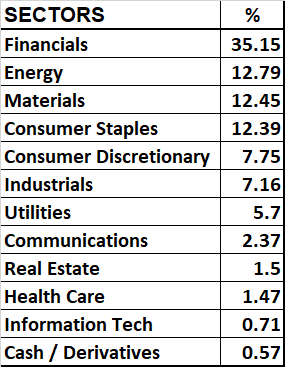

Sector Weights

The iShares MSCI Brazil ETF (EWZ) is a single-country emerging market fund. As with most emerging market funds, this ETF carries with it considerable risks. But, to the long-term investor the potential rewards can outweigh these risks. It was my goal to help investors, who are considering investing in Brazil, gain a better grasp of the potential risks and rewards of owning EWZ. As with any investment decision, please consider all your options and perform your own diligence prior to investing in EWZ.

Disclosure:

We currently own shares of EWZ and we intend to buy more shares in the future. I am not a professional investment advisor. Please perform you own due diligence or seek the ...

more