Watch Out For High Fund Fees

It's hard to believe that a year has gone by since Vanguard founder Jack Bogle died. It is also hard to overstate Vanguard's impact on the investing landscape in the U.S. You probably have benefited from Vanguard's pioneering ways, though you may not be aware of it. If you own a passive (index) mutual fund or exchange-traded fund (ETF) with extremely low fees, thank Vanguard, which popularized the ideas that fees are the enemy of investment performance, and the best way to mitigate high fees is to invest in indexes.

As happens in nearly any industry, competition has led to lower costs. Over the past decade, investors in index funds have seen their fees drop by almost 40%. Vanguard got the ball rolling on this issue, but most fund companies have followed suit at least to some extent. BlackRock, which owns the iShares ETF brand, has become the other dominant player in the index fund market. The two are a bit like the Verizon and AT&T of funds.

Two Great Tastes That Taste Great Together

The combination of index funds and low fees, meanwhile, is like chocolate and peanut butter. Each is great on its own but put the two together and you really have something special.

That's because the two are complementary. Fees, as we mentioned earlier, can really chip away at investment performance. This is a fairly easy concept to grasp, and yet it's an easy thing to miss as well. Fund companies don't send you a bill, after all. You don't "feel" the expense the way you might when you see, say, an automatic payment come out of your checking account. But fees will get you, year in and year out, whether your fund is doing well or doing poorly.

So you want low fees. And the best way to get them is via index funds.

Index funds are generally cheap because their whole point is to mimic an index. Technologically speaking, this isn't that hard: If a stock is added to or dropped from an index, the fund adds or drops it; if the index rebalances, the fund rebalances. This is known as passive investing.

Active investing, on the other hand, means choosing investments to buy and sell instead of simply doing what an index does. A manager--or, often, a team of managers, backed by analysts--decides what to buy and sell. There are endless flavors to active management. Managers might buy because a stock looks cheap, or because it has momentum behind it, or because it pays a dividend. But the main point here is that they're choosing--they're making decisions about when to buy and when to sell.

And they all need to get paid, those managers and analysts. And that leads to higher fees than index funds have. You don't need to pay a computer to make trades for you.

Furthermore, you just can't pick consistent winners over time. And by "you" we mean, first, the managers picking their investments, and also you, the reader, picking the best fund managers. Studies have shown that, while you and your fund managers might be fortunate for a while, the chances of outperforming the market over the long haul are nigh to impossible.

When you combine underperformance with high fees (the latter often very much part of the reason for the former), it becomes pretty clear which way you want to go.

So Now What Do I Do?

Your first move should be to review what you own what you're paying for it.

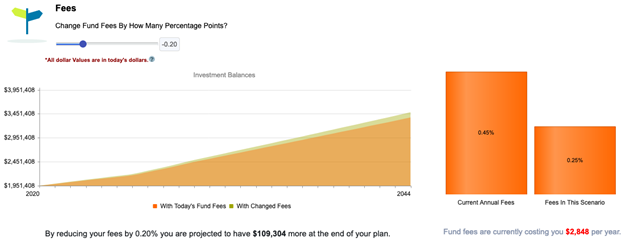

(Click on image to enlarge)

Take a look at the image above, from WealthTrace. The program calculates that annual fees in this hypothetical portfolio of funds are in the 0.45% range currently. That's actually not a bad place to start from; many funds charge a lot more than that. But the graph on the left gives you the bottom line: Reducing those fees from 0.45% to 0.25% could lead to a six-figure increase in value in this investment portfolio over time.

That should be motivation enough to start doing some comparison shopping. You do so for shoes; you do so for groceries. And while it's easier to shop around for those items, the payoff for finding cheaper investments could be much more lucrative.

There's no great single source to find alternative but similar funds to what you own, at least not that we know of. You have a few options, though.

If you're an ETF investor, Morningstar's ETF analyses will list alternative investments to the ETFs under coverage. The analyst will describe the differences between the funds and highlight the fee differences as well. That's a premium (as in, not free) service, though you can sign up for a free trial and see how it works. Same for Morningstar's Find Similar Funds tool. Using this tool you will find fantastic ETFs that do not charge high fees, such as the Vanguard Total Stock Index ETF (VTI) and the Vanguard Dividend Appreciation ETF (VIG).

There's another way if you're a mutual fund investor, an ETF investor, or some combination.

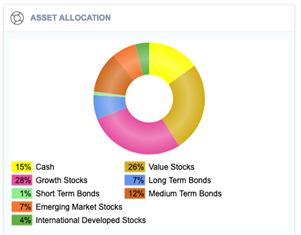

(Click on image to enlarge)

You'll need a way to find out what you own in terms of asset classes. WealthTrace (where the image above is from) is one option for this, though there are many others.

Once you know what you own (and are comfortable with the asset allocation), it's a matter of plugging and playing. That is, you just do the work to find index funds that put you in these same asset classes. Google is your friend here. If you search for "Emerging Market Stocks index," for example, or "Growth Stock index," you'll start to see what some of the standard indexes are, as well as funds and ETFs that try to mimic those indexes' performance.

One Size Does Not Fit All

Is it really worth going through all this work and making these changes? There is more to consider in making the decision than just fees, of course. You might have to realize capital gains that you don't want to realize, for example. Or you might find funds that look great but would require you to change brokerages to purchase them.

It's up to you. Just make sure you're factoring in what paying big fees every year could do to your returns over time. Looking at a six-figure difference in a portfolio's value should at least spur some investigation.

Interesting article..i think fees will decline in the future when funds incorporate Artificial Intelligence and block chain technologies in their trading..some funds today are relying on quantum algorithms to spot arbitrage opportunities in active investment..in the asset allocation graph, I perceive a 28% allocation to growth stocks to be an interesting finding..may be this represent a shift in investment sentiment that favoured value stock for a long time..