VIX Trading: Even The Pros Get It Wrong

It can sometimes be a little confusing to the average investor when the media and financial market communities throw around the phrase “the VIX is dead”. But when we review the chart of the VIX itself, we come to acknowledge how docile the market and the VIX really are over time.

As depicted in the VIX chart, it becomes quite clear that volatility, measured by the VIX/fear index, can remain quite complacent for extended periods. In fact, volatilities very nature is to remain complacent far longer than expressing outsized volatility. Regardless of the factual representations offered in the VIX chart, which goes all the way back to 1991 and encompasses major market events, for some reason many traders and investors look to go long volatility in any of its form factors. The VIX or volatility doesn’t die nor does it have the ability to die, but rather it expresses an ability for a market or markets to mature past the point of greatest fears and from the events that cause fear to have taken place. In other words, the fearfulness surrounding the “what’s the worst case scenario” curtails as the perceived worst-case scenario actually occurs. The Savings & Loan crisis, Dot Com bubble bursting, 9-11 and the Financial Crisis have all given birth to a more resilient market and more fearless traders/investors.

It has come to be that even with markets around the globe expressing all-time highs, record sovereign debt levels, political uncertainty and currency “manipulation”, fear or volatility is near record low levels in the United States equity markets. Really short and really sweet; the VIX is not for those betting against the market, is not a viable hedge against a potential market pullback and is not an instrument for those with long, long-term intentions. Moreover, to succeed with profits by going long volatility with the VIX or any direct VIX-leveraged instrument, the timing must be impeccable and cheaply acquired, which is a rarity in and of itself. Nonetheless, even with the apparent pitfalls and seemingly narrow path to profits from positioning long the VIX, many people do so…even those supposed professional traders and media participants on CNBC’s Fast Money.

It was a little over a month ago that the markets were going up against several political and global events. These votes included an Italian Referendum vote, the eventual Inauguration of Donald Trump, U.S. equity indices hitting all-time highs and much more. It was around this time that Fast Money’s Pete Nejarian expressed on air that he had hedged against a market pullback by going long the VIX against his long positions. This wasn’t the first time Mr. Nejarian outlined the strategy and it wasn’t the first time I had followed (not positionally, but in event chronology) his thought to see how the strategy would pan out. Of the many times the Fast Money contributor outlined this strategy to viewers, Mr. Nejarian lost money on this “hedge”.

The definition of a hedge is to find the hedge profitable with respect to a possible event that goes against the underlying asset being hedged, like a market pullback. So by Pete using an instrument, like volatility to theoretically move higher in case of a market pullback of sorts doesn’t make a lot of sense. Again, I refer to the VIX chart above for a brief point of evidence. If one is fortunate, going long the VIX may work out profitably, as a hedge, 10% of the time utilized as a hedge. That's not a hedge! In a sense that is an expression of ignorance and willing negation of what the VIX is, does and likely will do over time. And it is for this reason of possible confusion as to why Mr. Nejarian uses the VIX as a hedge that I personally reached out to the Fast Money contributor via Twitter.

Knowing that this trade implemented by Mr. Nejarian had run its course with a loss to capital invested I offered the following to him on Twitter.

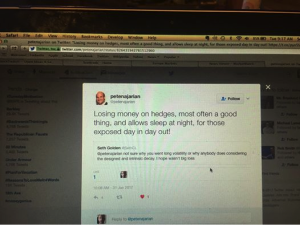

I took a screen shot of Mr. Nejarian’s reply to my direct Tweet because I often find myself in a position where others fail to legitimize an argument contrary to my position, for whatever the subject matter might be.

“Losing money on hedges, most often a good thing, and allows sleep at night, for those exposed day in day out”. That was Mr. Nejarian’s response to my tweet displayed, but again, negates that volatility is almost always a losing hedge from the long side. Having witnessed Mr. Nejarian failing to achieve his objective with such a hedge in the past I was hoping for a better response or at least the recognition, through further dialogue, of why going long volatility is not a hedge at all. What I found though after the short response and my followed retort was that Mr. Nejarian couldn’t retort with logic as to why anybody would hedge underlying positions with the VIX/volatility. Knowing the Fast Money contributor was found wanting for logic and as he is such a public figure and proposed market trading expert I believed his tweet would be erased. As such I took the screen shot as not just proof of the engagement, but also to show that even experts have trading and understanding errors regarding the VIX. Unfortunately, I was accurate in my assessment of the forecasted actions by Mr. Nejarian who has blocked me from viewing his Twitter feed. In no way was I attempting to pull a “ha ha ha” on Mr. Nejarian, but more so to seek out where my misunderstanding may be with regards to his VIX participation and mine to boot. Sometimes, one can validate their market participation through the participation of others.

For those readers/investors whom have read my publications over the last few years, you know by now that I don’t pull any punches and I outline things that are the way they are. It’s also no secret that I’ve been short VIX-leveraged instruments since I happened upon them in 2012. My favorite VIX-leveraged instrument is also not a well kept secret as I maintain a core short position in ProShares Ultra VIX Short-Term Futures ETF (UVXY). I generally maintain 20% of the Golden Capital Portfolio with UVXY short shares. Only a couple of weeks ago I reduced that exposure, as I have typically done at the onset of a reverse split. The last reverse split for shares of UVXY found the share price reversing in value from $6 range to $30.60 a share. As the VIX remained complacent through and post the reverse split, shares trended lower whereby I covered a block of shares just below $27 a share. Since that time I’ve made several trades that have still allowed me to profit from shorting UVXY as the share price moved even lower. At the end of the most recent trading week, UVXY shares closed at roughly $23.50 a share, emphasizing or echoing my warnings to those holding UVXY long through a reverse split. In the article titled UVXY: Pre-Split Caution Being Raised, I expressed the greatest of warnings regarding how a long shareholder would be further impacted by a reverse split. Unfortunately, that warning or prescient analysis has come to fruition and would essentially find long UVXY participants with even greater losses since the reverse split.

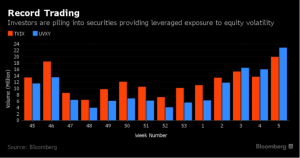

I’ve been asked, over the last two years, about my UVXY participation being as public as it has found itself to be; “Do you worry about more people using it and not being to benefit to the degree you had in the past”. It’s a great question and something I have greatly considered. Utilizing UVXY profitably and in the manner, which I do, takes a dedication to core best practices and an even greater ability to withstand the feared backwardation. Not many can withstand backwardation to the degree of 100% or greater. So even as I ascertain UVXY and like products have a degree of certain profitability from the short side and long-term, many will not participate with these instruments for fear of backwardation of 100% or greater. And I get that! But having said that, more and more people are trading these instruments day in and day out. Bloomberg recently offered a brief titled Trump Leads to Record Trading of Leveraged VIX Securities: Chart

It’s obvious that more and more people are trading these VIX-leveraged products. Hopefully they are trading them according to their construct as opposed to how Mr. Nejarian has used them in the past.

The increasingly, present consideration as it pertains to the media and financial market pundits is whether or not the VIX will trade into the single-digits level. This would express an amazing feat of strength for the fear index and befitting the overall market that has expressed record levels for many market metrics. Having said that, with the Golden Capital Portfolio holding only 17.2% of its assets in UVXY now, I’d also equally welcome a return of volatility for which to recapture short shares of UVXY from higher prices. So bring on the fear and higher levels of volatility oh mighty markets, I’ll be awaiting it with a cash heavy portfolio! And for the increasing number of volatility traders and investors out there, be sure to surround yourself with good resources and sound information on the subject matter.

Disclosure: I am short UVXY

I like your system of shorting $UVXY using layering techniques and routinely taking profits. We just have to keep in mind that it did go up about 1,100% using simulated back-testing late in 2008. If you had relentlessly kept on trying to meet your margin calls, you would be hurt pretty bad. And yeah, the Twitter thing is a lesson to everyone: "Don't tweet strangers unless you are fine with them blocking you."

Thank you for your comment. No it did not go up about "....." any percent. There is no viable back-testing for 2008 or any other event. This is a common misnomer perpetrated through the forbearance of fear. Just as many expected these instruments to perform extremely poorly during the 3% decline on Brexit and the following day's 1.5% decline, that did not come to fruition. The fact is that the first day on how the VIX trades on such a VIX-EVENT will determine how these instruments perform the following day. There is no back testing for the unknown, just simulations from a constant base and the VIX has no constant base.

thanks for sharing