VIX: Does It Make Sense To "Buy Volatility?"

Image Source: Pixabay

The rally that began in early April continues to drive stocks into new, all-time high territory. There hasn't been much of a correction, and so far, the internals have held up very well. However, we know volatility is low, and we also know that it generally begins to rise in August, observes Lawrence McMillan, editor at Option Strategist.

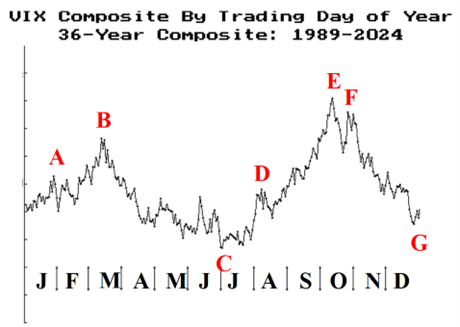

There are overbought conditions, but no confirmed sell signals (yet). To bolster that last statement, the chart of the Composite CBOE Volatility Index (VIX) is reprinted below. We had written an article about this a few issues ago. The most notable thing is point “C” on the chart. That is, VIX typically makes its yearly lows in July and then begins to rise after that.

Recently, VIX has been approaching the 2025 lows, which were set in January at 14.59. So, for all practical purposes, VIX made lows in July, as it normally does.

Even without confirmed broad market sell signals, I believe we can at least analyze this information to see if it makes any sense to “buy volatility” now, based strictly on its seasonal pattern.

To summarize, we remain bullish but vigilant. In particular, it is important to keep rolling deeply in-the-money calls to higher strikes -- or at least to tighten trailing stops.

Eventually, sell signals will be confirmed, and we will act on them. But overbought conditions can persist for far longer than one envisions, and thus we prefer to wait for the confirmed sell signals before taking bearish action.

About the Author

Lawrence McMillan speaks on option strategies at many seminars and colloquia in the US, Canada, and Europe. Prior to founding his own firm, he was a proprietary trader at two major brokerage firms—primarily Thomson McKinnon Securities, where he ran the equity arbitrage department for nine years. Mr. McMillan is perhaps best known as the author of Options as a Strategic Investment, the bestselling work on stock and index options strategies, which has sold over 200,000 copies.

More By This Author:

GEHC: A Healthcare Equipment Stock That Will Benefit From Trade DealsCCI: A Wireless Tower Titan That Just Reported Stellar Results

Are America’s Markets Still Exceptional? Or Is It Time To Bail?

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more