VanEck Rare Earth & Strategic Metals ETF Elliott Wave Technical Analysis

VanEck Rare Earth & Strategic Metals ETF (REMX)

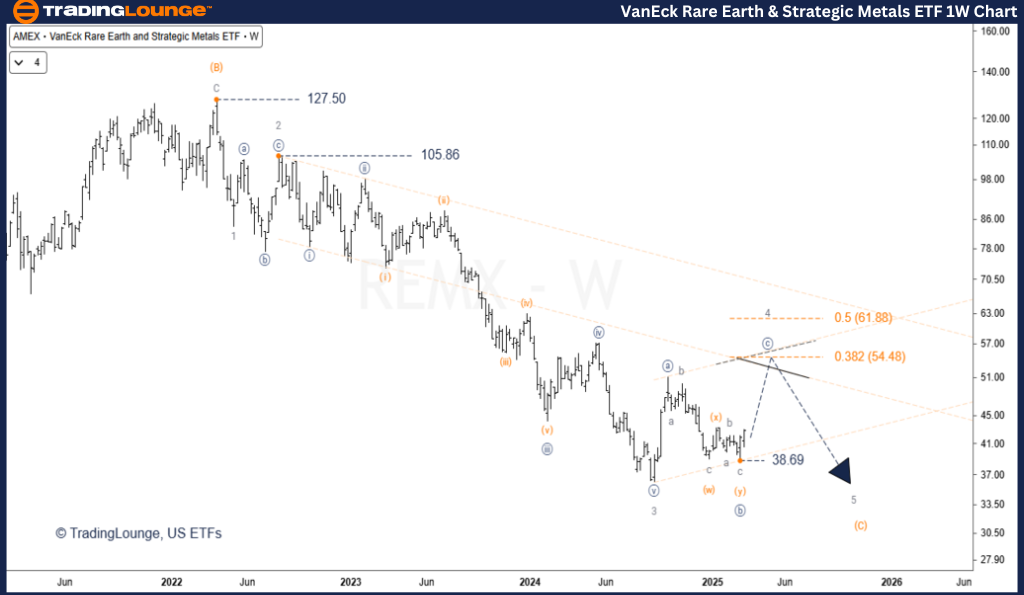

Weekly Elliott Wave Technical Analysis (1W Chart)

- Function: Countertrend

- Mode: Corrective

- Structure: Zigzag

- Position: Wave 4 (Grey)

- Direction: Bear Market Rally

- Invalidation Level: $38.69

Key Analysis Details:

- Wave 4 is nearing its final subwave, signaling the end of the correction.

- The current rally is projected to retrace 38.2% to 50% of Wave 3's decline.

- A zigzag confirmation occurs when the Wave [a] high is broken.

- The end of Wave 4 should be supported by the Kennedy Base Channel, using Wave 3’s subwaves.

- The upper boundary of the corrective channel will likely act as resistance for Wave [c].

- After Wave 4 peaks, the 5th wave decline is expected to break below Wave 4’s origin.

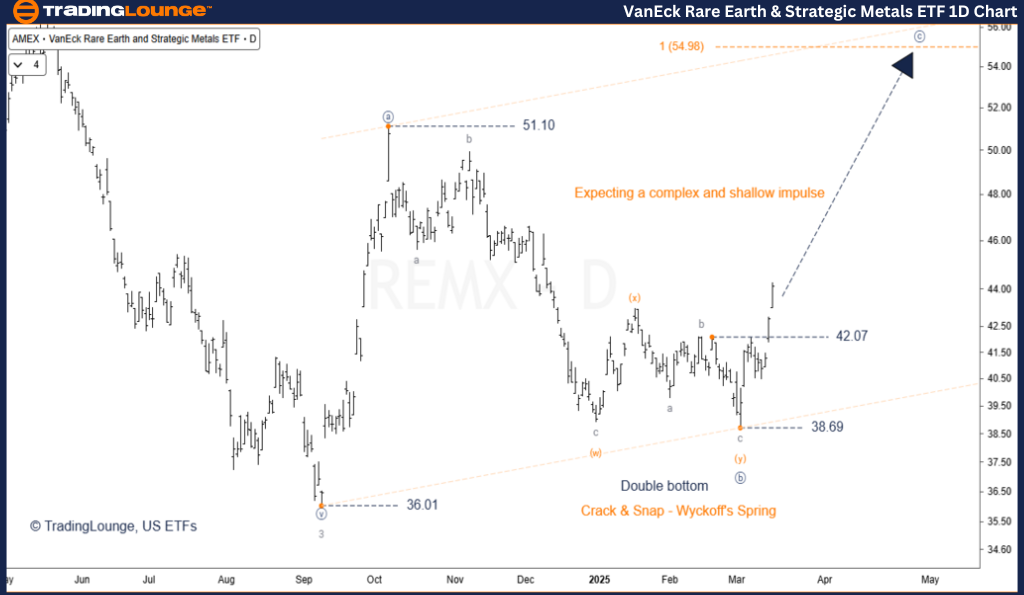

Daily Elliott Wave Technical Analysis (1D Chart)

- Function: Major Trend (Minor Degree, Grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave [c] (Navy) of 4 (Grey)

- Direction: Rally

- Invalidation Level: $38.69

Key Analysis Details:

- The rally should continue, surpassing the $51.10 high in an impulsive move.

- Wave [c] is expected to be shallow and complex, compared to Wave [a].

- The break of the $47.02 high confirms the ongoing rally.

- At $54.98, Wave [c] will equal Wave [a], following the common Fibonacci relationship in a zigzag pattern.

Conclusion & Market Outlook

- REMX is projected to climb in the coming days and weeks.

- The market should rally above the end of Wave [a].

- Major target: $54.98, where Wave [c] equals Wave [a].

- This presents a strong long opportunity for ETF traders.

- Traders should monitor Elliott Wave rules and invalidation levels to minimize risk.

Technical Analyst: Siinom

More By This Author:

Elliott Wave Technical Analysis: ASX Limited - Tuesday, March 18

Elliott Wave Technical Analysis: British Pound/Australian Dollar - Tuesday, March 18

VeChain Crypto Price Today

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!