Uranium Miners ETF Looking To End Impulsive Rally

Image Source: Pexels

The Global X Uranium ETF (URA) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components. It includes those miners involved in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries. $URA offers a convenient way for investors to gain diversified exposure to uranium without directly owning physical assets or individual stocks. Below we will update the Elliott Wave outlook for this ETF.

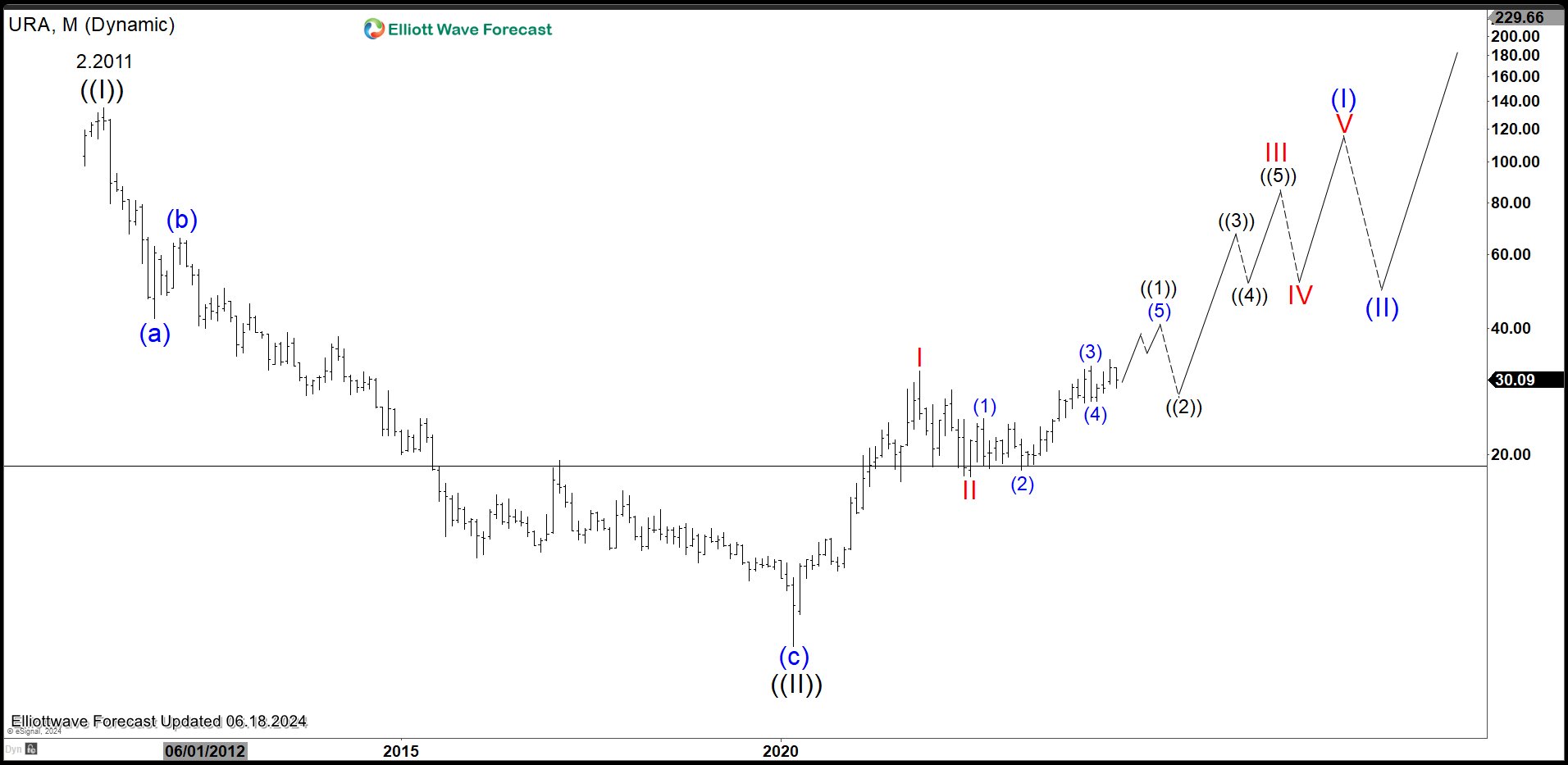

$URA Elliott Wave Chart Monthly Chart

Monthly Elliott Wave Chart of Uranium ETF (ETF) shows that wave ((II)) Grand Super Cycle correction ended at 6.95. Wave ((III)) higher is currently in progress with internal subdivision as an impulse. Up from wave ((II)), wave I ended at 31.6 and wave II dips ended at 17.65. The ETF has broken above wave I, creating a bullish sequence from wave ((II)) low. Near term, the ETF is looking to extend higher to end wave (5) before ending wave ((1)) of III in higher degree. Afterwards, it should pullback in larger degree wave ((2)) before it resumes higher again. Further upside should be seen in years ahead against wave II low at 17.65 and pullback should find support in 3, 7, or 11 swing.

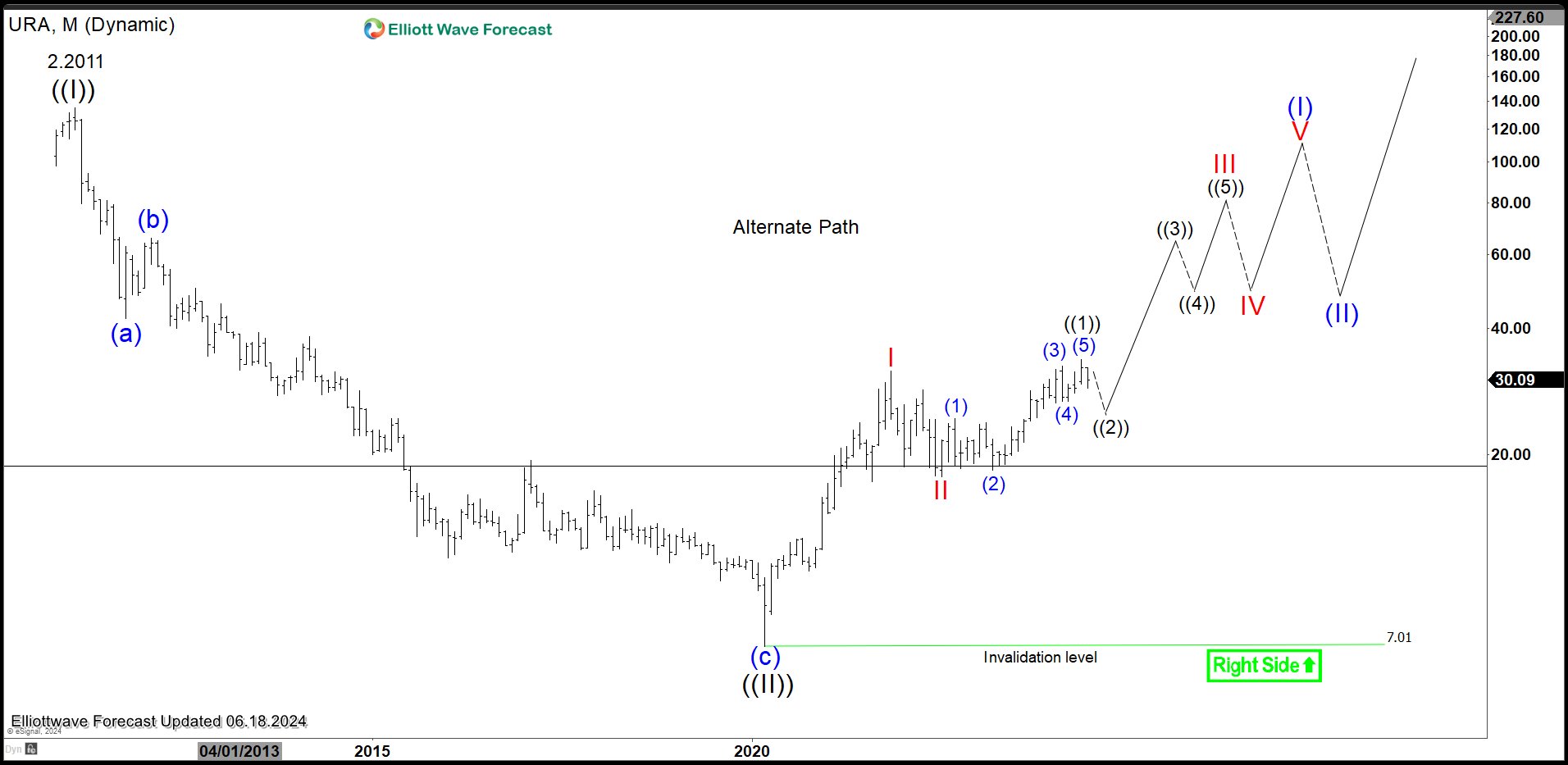

$URA Elliott Wave Chart Alternate Monthly Chart

In the alternate monthly chart above, wave the ETF is also within wave III higher. However, near term it has ended wave ((1)) and already starting the larger degree wave ((2)) pullback to correct the rally from wave II low. In this alternate view, we can expect a prolonged and larger pullback in wave ((2)) before the ETF resumes higher again.

$URA Daily Elliott Wave Chart

Daily Elliott Wave Chart of $URA above shows the primary view where the ETF is looking to rally to end wave (5) of ((1)). Up from wave (4), wave 1 ended at $33.66 and pullback in wave 2 ended at $28.78. Expect the ETF to extend higher as far as pullback stays above wave (4) at $26.77. If the ETF breaks below 26.77, then the alternate view explained above plays out. The alternate view suggests wave ((1)) has ended at the recent peak $33.66. Currently, it’s doing a larger degree wave ((2)) pullback already to correct cycle from 7.6.2022 low.

More By This Author:

Exxon Mobil Corp Found Sellers at the Blue Box AreaElliott Wave Expects Nasdaq 100 To Continue Higher

CROX Should Continue Further Upside

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more