United Rentals: How To Trade This Rental Equipment Stock After Its Recent Pullback

Image Source: Unsplash

Technical momentum has been building at United Rentals Inc. (URI). The company is the largest rental equipment provider in the world, with a store network nearly three times the size of any other provider, and locations in 49 states and all Canadian provinces, notes John Eade, president of Argus Research.

The company has over 27,000 employees and approximately 1,600 rental locations in the US and Canada. Shares of United Rentals have outperformed the market over the past five years, gaining 245% while the S&P 500 Index (SPX) has risen 80%. The shares substantially outperformed the market and the iShares US Industrials ETF (IYJ) over the long-term as well.

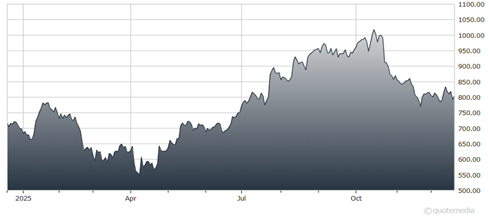

United Rentals Inc. (URI) Stock Chart

Though the shares are in a long-term bullish pattern of higher highs and higher lows, they have pulled back significantly from all-time highs at $1,020 in mid-October. Indeed, United Rentals has recently been approaching 100-day moving average support at $750, and we would set a stop-loss just under that mark.

Resistance may come into play at $975 as the stock moves back towards that all-time high, and that is where we would consider taking some near-term profits.

About the Author

John Eade is CEO and President of Argus Research Corporation. He has been with Argus since 1989 and has worked as an analyst, director of research, market strategist, and director of portfolio strategies at the firm. Mr. Eade has an MBA in finance from New York University's Stern School of Business and a Bachelor's degree in journalism from Northwestern University's Medill School of Journalism. He has been involved with Argus's new product development team, which has kept the company at the forefront of the independent research industry.

Mr. Eade is a founder and board member of the Investorside Research Association, an industry trade organization. He is also a member of the New York Society of Security Analysts and the CFA Institute.

Mr. Eade has been interviewed and quoted extensively in The New York Times, The Wall Street Journal, Forbes, Time, Fortune and Money magazines, and has been a frequent guest on Fox Business News, CNBC, CNN, CBS News, ABC News and the Bloomberg Radio and Television networks.

More By This Author:

Chevron: A Supermajor To Own For Energy's Next Powerful PhaseAPD: An Industrial Gas Giant Offering Compelling Value

SPX: Why 2026 Could Be Much Better Than Investors Think