Two New 0DTE ETFs Challenge The Current Leaders

Image Source: Pixabay

I recently learned about two relatively new zero-day-to-expiration (0DTE) covered call ETFs. I want to compare them against our current standards for this type of ETF.

A 0DTE ETF employs an options strategy that involves selling calls that will expire the same day. A benefit of this strategy is that the funds are not exposed to overnight swings in the stock markets. Roundhill Investments launched the first 0DTE ETFs with its SPY and QQQ tracking funds, which hit the market in March 2024.

Currently, only three securities have daily options expirations:

Any 0DTE ETF will have one of these three index ETFs as the underlying asset. Also, since one-day options will trade at similar prices, different 0DTE ETFs with the same underlying ETF will deliver similar returns.

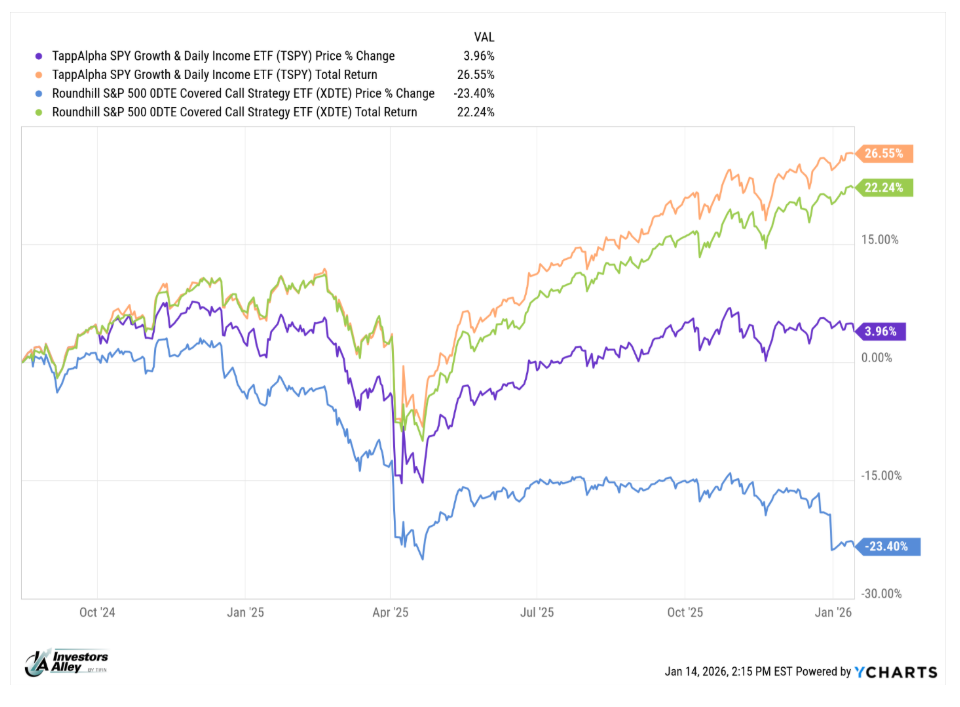

The ETFs I recently discovered are from TappAlpha Funds. These funds launched on August 14, 2024 and on September 4, 2025, so each has a track record ofat least four months. Let’s compare the Roundhill ETFs to the TappAlpha ETFs over the short period since the latter launched.

SPY ETFs:

• TappAlpha SPY Growth & Daily Income ETF (TSPY) (8/14/24 inception date)

• Roundhill S&P 500 0DTE Covered Call Strategy ETF (XDTE)

(Click on image to enlarge)

So far, TSPY has impressed with a higher total return and avoided share price erosion.

The QQQ funds are:

- Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE)

- TappAlpha Innovation 100 Growth & Daily Income ETF (TDAQ) (9/4/25 inception date)

More By This Author:

Two New ETFs Track Hedge Funds, Pay 15%

One Energy Yield Stands Apart From The Rest

How To Separate The Best Income ETFs From The Rest