Turning The Corner

It appears the general theme of the market these days is we have turned the corner in terms of the virus and the self-inflicted damage done to the economy. This is clearly good news. And to be sure, a collective sigh of relief is warranted.

In reviewing the slew of economic data that continue to flow, analysts seem to be concluding that we have seen the nadir in terms of the negative economic impact. After all, since the economy was purposefully stopped on a dime for a couple of months and is now reopening, there is really only one direction the data can head - upward.

So, you can hardly criticize the bulls for celebrating the idea that the worst is behind us. In addition, we continue to receive encouraging news on the vaccine front. In fact, the last two weeks have begun with what can only be described as upbeat news on this front as "Operation Warp Speed" is in full swing. And the idea that a vaccine could be available this year looks to be gaining traction.

It Is Strange To See...

However, given the massive hit the economy has taken - you know, the biggest decline in data since the Great Depression (or worse) - it is still more than a little strange to see the S&P 500 off only -10.1% from its February peak and down just -5.77% on the year.

Stranger still to most is the fact that the Nasdaq 100 is off just -1.7% from its February 19 all-time highs and the ETF that tracks the tech-ladened index (QQQ) is up +8.3% in 2020. All the while, the small caps (IWM) and value stocks (VLUE) are down -15.4% and -18.5% on the year respectively and are off -18.1% and -20.8% from their highs.

Looking Ahead

By now, it is my sincere hope that readers recognize that stocks do not trade based on what is happening now, or what has happened in the past. As I've written a time or two, the stock market looks forward and is effectively a discounting mechanism for future expectations. Therefore, the idea that the economy is starting to turn the corner and that a vaccine that could return things to the "old normal" is definitely the stuff rallies in the stock market are made of.

The Hole is Deep

But... You knew, that was coming, right? As the Wall Street Journal reported last week, investors should keep in mind that the hole the economy needs to climb out of in order to return to normal is "very deep."

From my seat, this may be the most important point the market faces in the coming months. Sure, stocks can continue to celebrate the country's reopening and the idea that there is only one way for the economy to go from here. And I will certainly agree that the cyclical stuff deserves to play a little catch-up if everyone believes that the economy is done declining and now has nowhere to go but up.

Yet at some point, I can't help but think that the market may struggle with the actual economic data versus the hopeful expectations that have already been priced in.

In an article titled, "Spending Plunge Will Keep Weighing on US Growth," the Journal wrote what I feel is an excellent summary of the situation: "With more businesses starting to reopen, consumer spending looks as if it is starting to dig its way out of the hole caused by the coronavirus crisis. But the hole is very deep."

The Heard On The Street column penned by Justin Lahart on Friday argues while consumer spending has improved since April's record drop, we are still looking at an annualized decline close to 40%. Ouch.

Lahart's final point was that unemployment uncertainty is likely to also keep consumer spending from leaping back to the old normal. "Then there is the matter of the labor market. Economists expect that next week's employment report will show that millions more people lost their jobs in May and that the unemployment rate will rise even more. That will make many people reluctant to spend, and that reluctance won't go away until there are sure signs that the job market is improving and unemployment has begun to fall," Mr. Lahart opined.

It's a Matter of Degree

I guess what we're really talking about here is a matter of degree. As in the degree to which the economy is expected to recover in the next three to six months versus the degree to which the stock market indices have already recovered. In other words, will the economy really recover as much as the stock market indices are currently pricing in?

Sure, Microsoft (MSFT), which is up +16.8% YTD and is just -2.9% from all-time highs, looks like it will indeed grow earnings in 2020 and then produce healthy EPS growth in 2021 and 2022. And according to Ned Davis Research, the software maker's current P/E is actually below the five-year average (30.24 vs 31.97). As such, it is fairly easy to justify "Mister Softie's" current pricing. The same likely goes for the other big-cap COVID winners as well.

But the growth story for any industry that involves people congregating isn't nearly as encouraging. In reality, there won't be any growth in restaurants, airlines, movies, concerts, and sporting events. No, the real question is how deep the declines will be.

Some Caution Remains Warranted

Please understand that I love a good romp in the stock market as much as the next guy. And I am happy to jump on the "hope" bandwagon now that we are turning the corner. For a while, at least.

But for me, the bottom line is I remain deeply concerned that the stock market is writing checks that the economy won't be able cover in the appropriate time frame. So, from my seat, some caution remains warranted.

Weekly Market Model Review

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

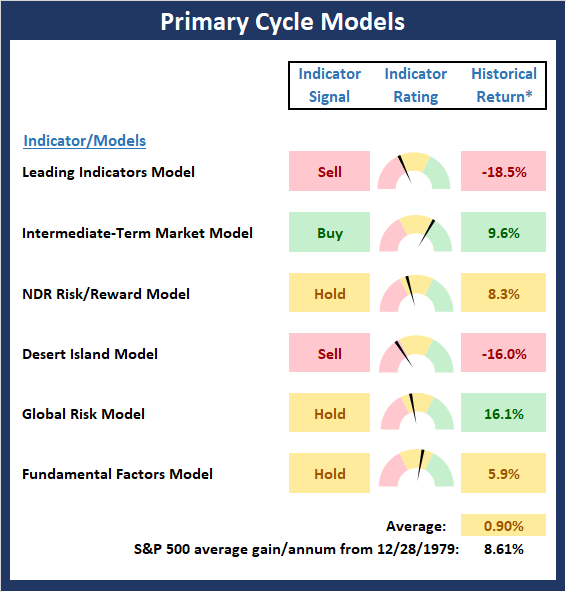

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There is one change to report on the Primary Cycle board this week. Our Intermediate-Term Market Model, which includes 39 technical indicators/models and is designed to be our primary indication of technical health, improved to positive. However, the weight of the evidence from the Primary Cycle board is mixed at best. As such, I believe that some caution remains warranted. In short, as the country moves into the re-opening stage, there is likely to be some uncertainty.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Fundamental Backdrop

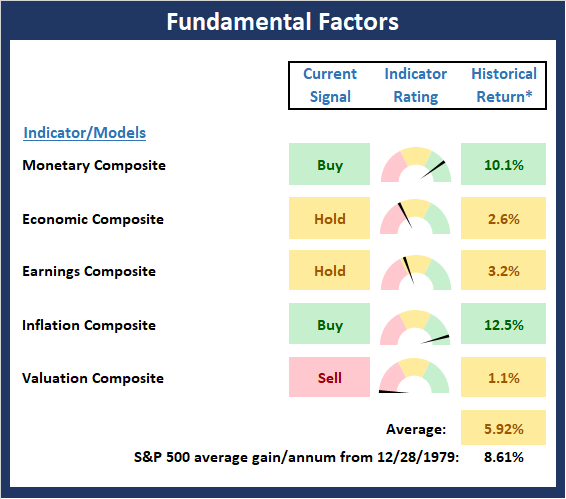

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

Once again, there are also no changes to the Fundamental Factors board this week. From my seat, it appears that the battle between a damaged economy and the monetary stimulus is likely to rage. While the Federal Reserve and Congress are pulling out all the stops and may have taken the worst-case scenario off the table, it is still unclear what the economic recovery will look like going forward.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Trend

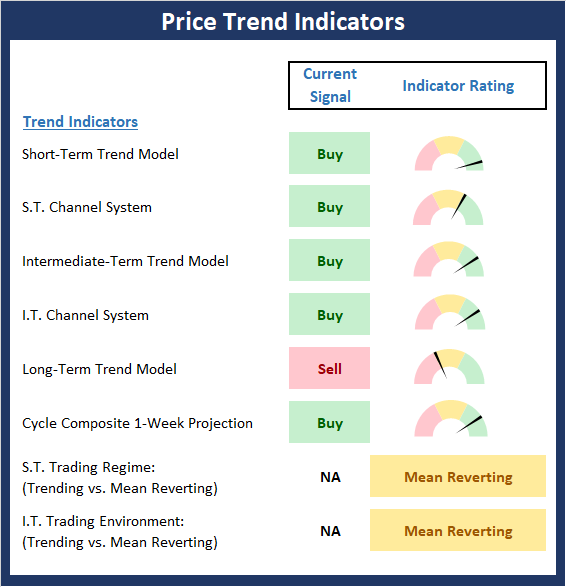

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

The Price Trend board continues to show improvement as another indicator flipped to green last week. In addition, I would expect the short-term trading regime indicator to uptick in the coming days. And while many, including yours truly, argue that stocks have become dislocated from future economic reality, the trend appears to be a friend to stock market investors.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of Internal Momentum

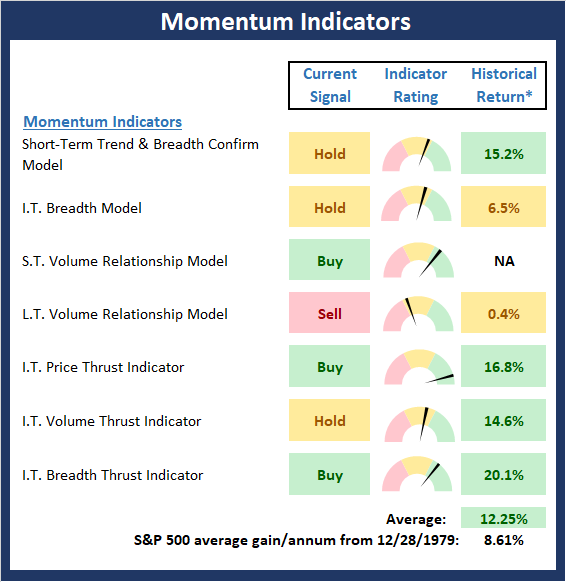

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

The Momentum Board continues to experienced some flip-flopping among the indicators. However, the overall state of the board would appear to support the bulls at this point in time.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

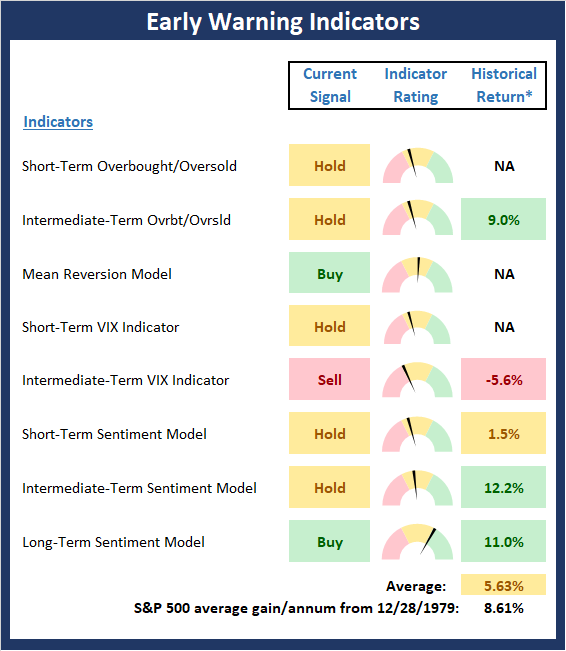

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

The Early Warning board looks to remain stuck in no-man's land. However, it is hard to disagree with the idea that stocks are overbought from a shorter-term perspective (and are quickly becoming overbought from an intermediate-term view) and that the overall mood of the market may be reaching positive extremes. So, while the board is clearly neutral here, I will argue that the edge goes to the bears here for the coming week.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more

Good read.