Triumvirate Follow-Up

I normally do just one or two premium posts a week, but yesterday alone I did three. I wanted to briefly touch on all three and do at least a tiny victory lap.

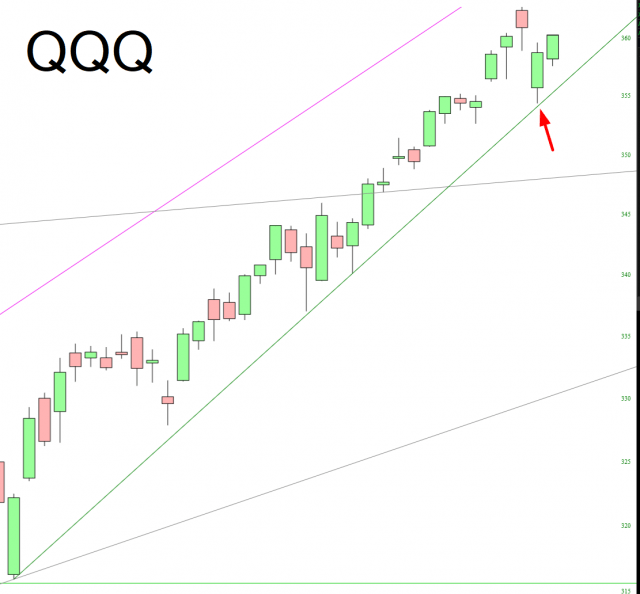

The first one, Backing Off, stated I was closing out some positions, including a big QQQ August put position, in light of the trendline. Looks like that was the right choice!

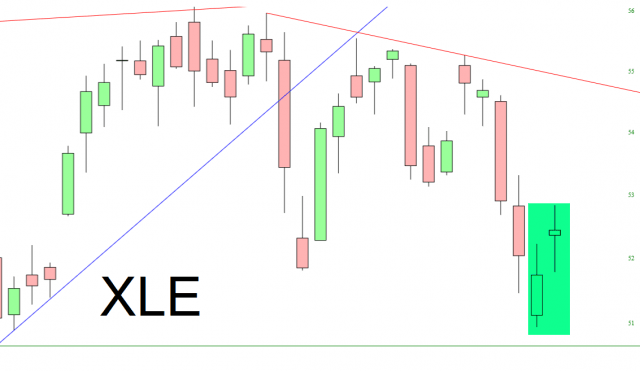

Then in Let It Slip, I stated that energy XLE seemed oversold, which is why I closed my energy-related bearish plays. Again, looks like the right choice. Cash is boring, but it’s safe.

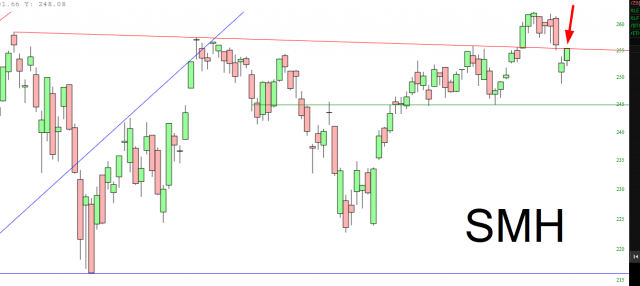

Lastly, there was Semi Price Gap in which I pointed out how semiconductors SMH might soon shape up into an interesting opportunity, given the break under the red trendline and the price gap. Yep, looks good!

So since today is far less frenetic (and dull) I wanted to at least trumpet those three posts, since my idea to de-fang my bearishness for at least a few days was a good one.

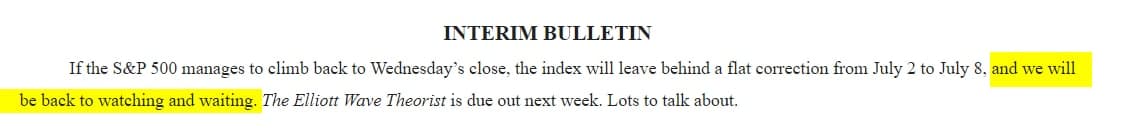

Comically, the boys in Gainesville sent out a breathless Special Bulletin yesterday stating that the weakness we were witnessing might just herald an unprecedented July stock market crash. Then, moments ago, I get this gem:

Disclaimer: This is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. Before selling or buying any stock or other investment you should consult ...

more