TLT Just Flashed A Print Everyone Missed

Gold miners rallied. Silver popped. The market squeezed higher all week.

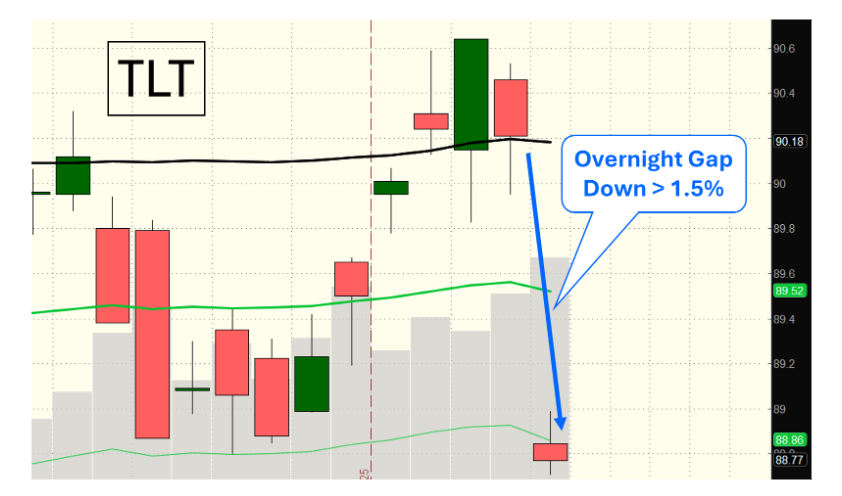

Then Monday morning happened. TLT dropped hard at open. Long bonds got hammered over the weekend. Everyone saw the selloff this morning.

Nobody saw what came next.

The $20 Million Bet on Rates

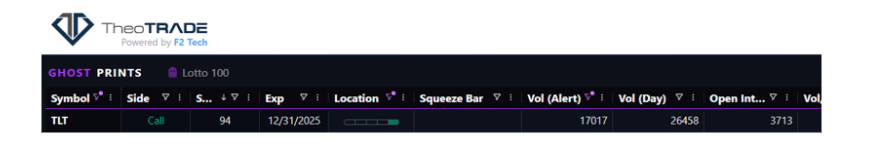

While TLT was bleeding at the open, someone deployed massive capital into out-of-the-money calls.

These were not just any calls. 21,000 contracts at the 94 strike–well out of the money. Two prints. Filled at the ask.

This wasn't hedging. This wasn't portfolio rebalancing. This was directional conviction that rates will come down, and TLT will regain its previous highs—and then some!

The Ghost Prints Surveillance Console caught both prints before most traders even noticed TLT had moved.

While this was happening, the VIX hit support and reversed higher for a short period. That is the signal that means last week's rally is likely finished–for now. Likewise, Gold and silver showed short-term topping patterns. If you rode those moves higher, this is the wrong time to press your luck.

All in all, it means there isn’t an easy trend waiting to be exploited. That’s why the TLT trade stood out so strongly.

You don't need to match institutional size to profit from their positioning. TLT just gave you a clear setup without taking the risk of buying 94-strike calls.

A simple vertical spread captures the same thesis with defined risk. Buy an at-the-money call, sell one strike out. You're playing mean reversion in bonds, not reaching for home runs.

This is why I love being able to break these trades down for you during the Ghost Hour. So you can see the trade behind the prices.

The trade to consider

The institutional money went aggressive because they're positioned for a rate reversal. You can trade the same setup with a fraction of the capital and with dramatically better risk management.

Here's the structure. You're buying the 88 call and selling the 90 call for a net debit of $1.01 per spread. Maximum risk is $101 per spread. Maximum profit is $99 per spread. That's a nearly 1:1 risk-reward ratio.

TLT closed around $87.50. You need it to reach $89.01 to hit 70% of maximum profit. That's less than a 2% move in TLT over the next seven weeks.

Bonds have been volatile. A simple mean reversion back toward recent highs puts this spread solidly in profit territory. You're not betting on a massive rate collapse. You're playing normal bond market fluctuation after an aggressive selloff.

Why This Trade Matters This Week

The market just handed you two signals simultaneously. VIX support says the rally stalls. Massive TLT call buying says bonds are about to bounce.

Most traders will miss both. They'll keep chasing gold miners as they roll over. They'll ignore bonds because this morning’s selloff felt decisive.

With unemployment and Consumer Sentiment data on tap for this week, it is important to have strategic trades that can take advantage of the whipsaw price action we are likely to see. I’ll walk through the exact TLT spread structure along with other trades during my live presentation tonight at 7:00 pm EST. You'll see how to read rate-related option flow, structure trades that work for smaller accounts, and identify when smart money is positioning against consensus.

The short-term rally is over. The question is whether you're positioned for the trades likely to spring this week.

More By This Author:

Yen Carry Trade Unwinding

The Dippers Just Made A Fatal Mistake

How To Fade The Biotech Squeeze