Time To Move Your JEPQ Money?

Image Source: Pixabay

It’s a surprise to me to realize that it has been more than five years since JP Morgan set off the wave of option strategy ETFs with the May 2020 launch of the JPMorgan Equity Premium Income ETF (JEPI).

JEPI’s sister fund, the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), launched in May 2022. The two JPMorgan premium income ETFs have amassed more than $70 billion in assets. JEPQ, especially, has rewarded investors with a significant income and total returns, and I would say the ETF is the standard for Nasdaq 100 covered call ETFs.

Rival financial giant Goldman Sachs noticed the success of the JPMorgan covered call ETFs and launched the Goldman Sachs Nasdaq-100 Premium Income ETF (GPIQ) in October 2023. GPIQ currently has assets of $1.5 billion.

There are other Nasdaq 100 covered call ETFs out there. However, since these two, JEPQ and GPIQ, come from very well-known name-brand sponsors, they quickly get the attention of investors. Let’s compare how the two have performed since the launch of GPIQ.

First up are the distribution yields:

- JEPQ: 9.47% (listed as 30-day SEC yield)

- GPIQ: 9.91% (quoted as 12-month trailing distribution rate)

Next up, let’s compare total returns since the October 24, 2023, start date for GPIQ:

- JEPQ: 54.23%

- GPIQ: 62.43%

Those are very attractive two-year returns.

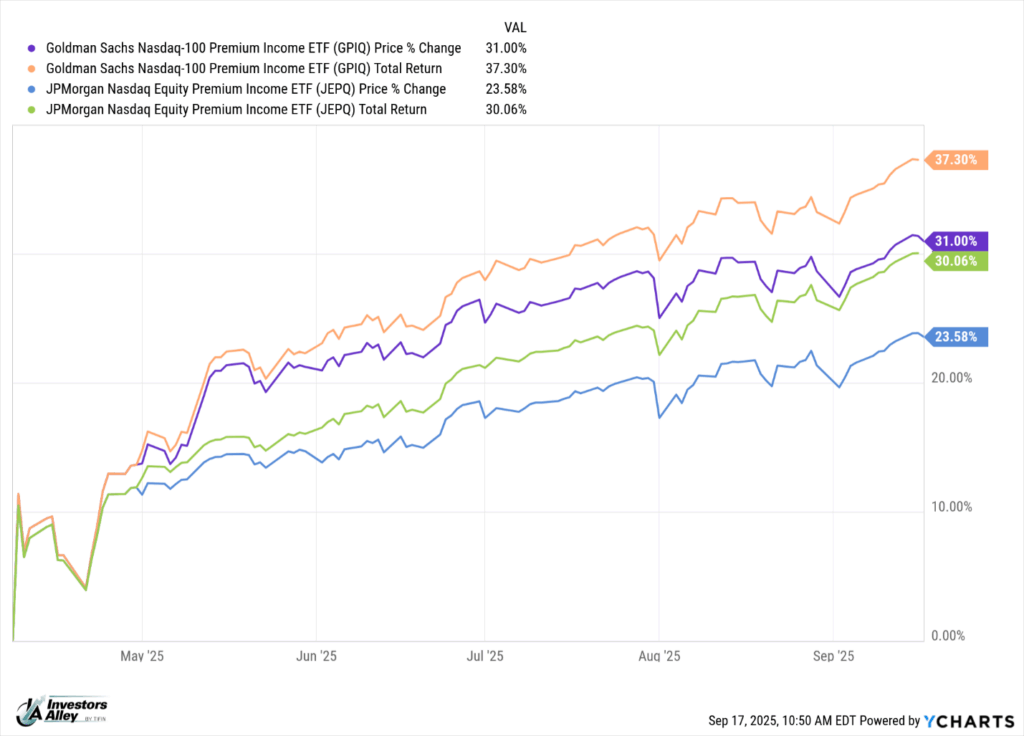

With the early 2025 bear market for stocks, I like to look at how funds have performed since the April 8 bottom for the February-April bear market.

(Click on image to enlarge)

With this time frame, GPIQ also wins. If you are invested in JEPQ, it looks like a move to GPIQ would pay off.

More By This Author:

Two Popular REITs That Will Go Up 25% Next Year

Profit From A Fund In A Hurry To Chase Its Peers

Is Honesty The Best Policy When It Comes To Dividends?