Thursday Continues The New Uptrend

The uptrend that started late last week was a bit shaky earlier this week, but it followed through nicely on Thursday. However, the PMO has almost reached the top of its range which means that the best period for buying stocks has passed, at least in the short-term.

The past six trading days are a reminder that if you are trading the short-term market trends, the window of opportunity can be very brief. Now it is time to sit back a bit, trim the disappointing positions, and add to the winners.

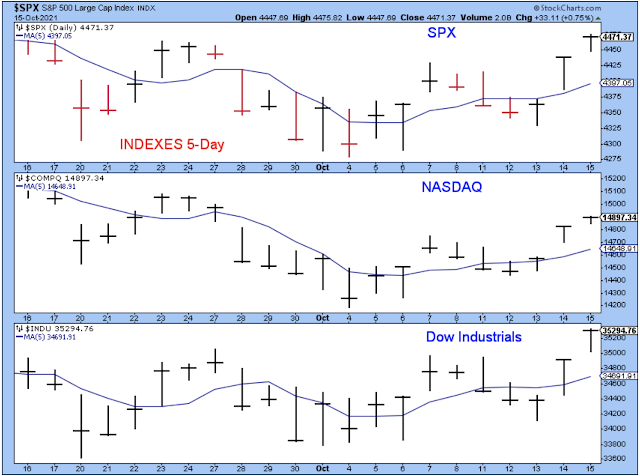

The chart below does a good job showing how the market has spent the last few weeks hammering a bottom from which it was able to build the recent uptrend. In fact, the SPX looks like it built an inverted head-and-shoulders pattern as it traced around its five-day average in mini-cycles.

I really like the looks of this chart. This is what I want to see early in a short-term uptrend. The 10-day call/put is confirming the uptrend very nicely, which is bullish.

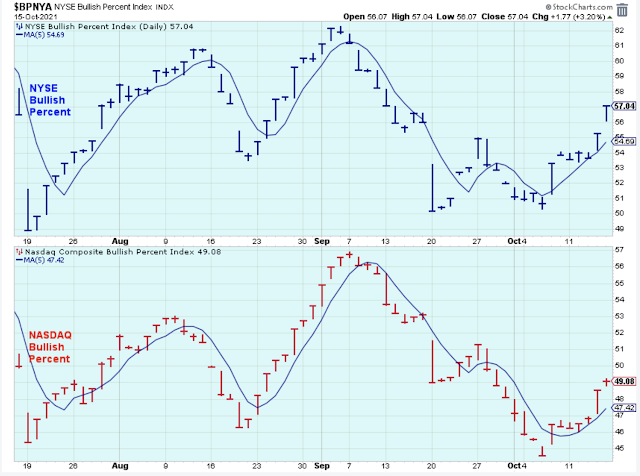

The bullish percents really got the short-term cycle right when both indexes popped above their five-days and stayed above despite a few wobbly days in the market. Interesting to note that the NYSE BP held its lows in this chart while the Nasdaq BP continued lower, which appears to be a bullish move.

I like the price action shown by the SPX: bottoming action in early October, then a bounce followed by a pullback, and then a lift off past the moving averages. Also, the summation index nicely confirmed the market action.

Not every chart is showing the perfect market, however. The small-caps were quite disappointing on Friday as they appeared to break out, then failed, and closed below Thursday's close. That's negative price action, and junk bonds had a similar failure.

So, we need to remain cautious. For instance, when I saw this failure late in the session I decided to go into the weekend off margin and with a bit of available cash.

Here is what the 15-minute chart of the small-caps looked like Wednesday through Friday. After the close on Thursday, Investor's Business Daily declared a "market confirmed uptrend," but Friday's action in the small-caps is not at all what you want to see the day after.

I'm keeping in mind that it's just one day in the market so I won't worry too much, and, to be fair, we've all seen plenty of rallies that left the small-caps behind.

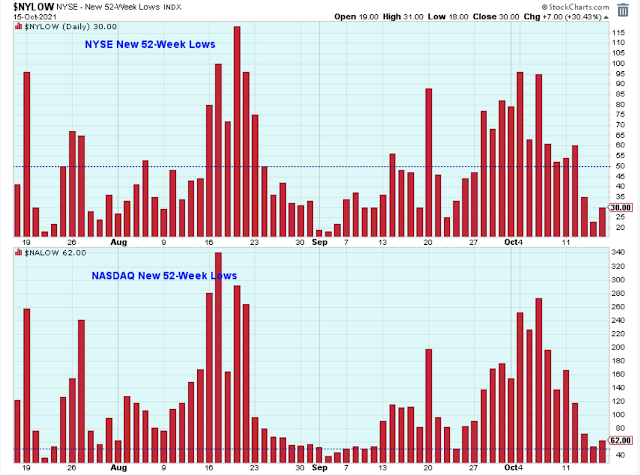

NYSE new 52-week lows behaved very well starting on Wednesday, but the Nasdaq still isn't quite behaving. There are just a few too many Nasdaq new 52-week lows, and this makes me glad that I went off margin and still have a bit of cash.

No doubt that the weakness in the small-caps are showing up in this chart, and that the elevated Nasdaq new lows are confirming the weakness in the SML index shown above.

Commodities are on a tear. How bullish is this chart? And there still appears to be room above based on the upper-channel line. This has Fed-watchers very nervous because it will force their hand to raise rates before they achieve their desired employment goals.

Here is another disappointment. The steel stocks broke this downtrend, but it is not at all convincing.

There are a lot more charts that I would like to review, but I'm out of time. So, I will end with this chart that is one of my favorites. It is a reminder to myself that the market almost always moves in these short-term cycles, and that there are generally nine really good buying opportunities every year.

The trick is to take advantage of them by trimming near the peaks and buying near the lows. Sometimes it seems too easy, and other times it can be really challenging. But it never gets boring.

Outlook Summary

- The short-term trend is up for stock prices as of Oct. 8 (bad call on Sept. 23).

- The economy is in expansion as of Sept. 19, 2020.

- The medium-term trend is down for treasury bond prices as of Sept. 23 (prices down, yields up).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more