Three Dividend And Income CEFs Paying Over 7%

In this world of low bond yields, investors are searching far and wide for options to increase their dividend and interest income. Here are three options paying more than 7%:

- Nuveen Preferred & Income Opportunities Fund (JPC)

- First Trust Intermediate Duration Preferred & Income Fund (FPF)

- Cohen & Steers Limited Duration Preferred & Income Fund (LDP)

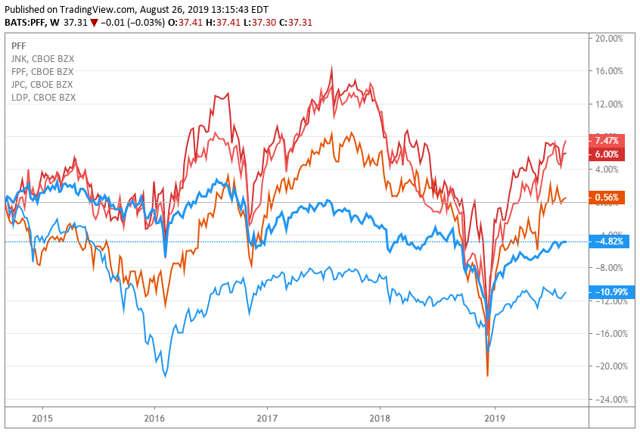

For this analysis, we will benchmark these closed end funds against the iShares Preferred and Income Securities ETF (PFF) and SPDR Bloomberg Barclays High Yield Bond ETF (JNK).

The following 5-year chart shows the ups and downs of these funds at any given moment. The blue lines are SPDR Bloomberg Barclays High Yield Bond ETF (JNK) and iShares Preferred stock fund (PFF). In the 5-year chart, JNK is the worst performer, followed by PFF. The red lines represent the three funds in this analysis.

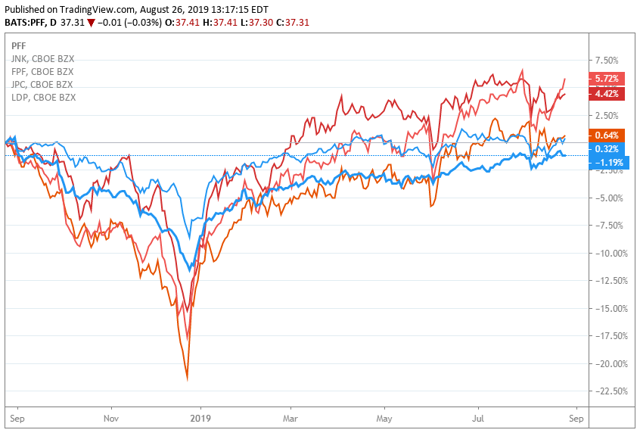

Moving to a 1-year chart, you may notice that the two ETFs (blue lines), JNK and PFF outperformed during a downtrend in the cycle. This indicates that they are less volatile than the three CEFs in this analysis.

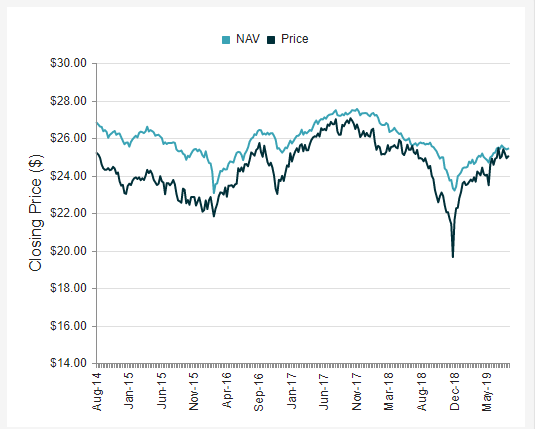

The volatility of the closed end funds is most likely due to their leverage and inefficiencies of the market. These funds can trade at a discount to net asset value. In fact, all three trade at a discount today.

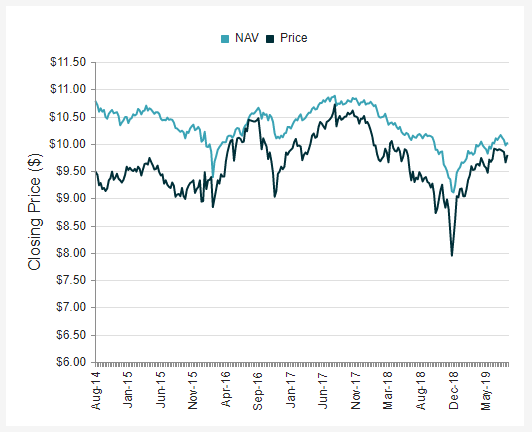

Nuveen Preferred & Income Opportunities Fund (JPC) is a billion dollar closed end fund and yields 7.48%. In the past year, the CEF has traded as low as $7.95 per share and this is when it had a steep discount to net asset value, trading 12.92% below. - CEFconnect.com

The current discount to NAV is 2.3% and if you are interested in finding NAV at the end of the day, you can look at the ticker XJPCX.

This CEF is heavily skewed towards corporate bonds at nearly 96%. Top holdings include many large banks and companies.

This CEF pays about $0.06 per share in dividends monthly. Like the others on this list, do not expect any increases in the payout. In fact, the distribution may decrease slightly over time.Over 5 years, the dividend has decreased about -0.20% (which is a small amount).

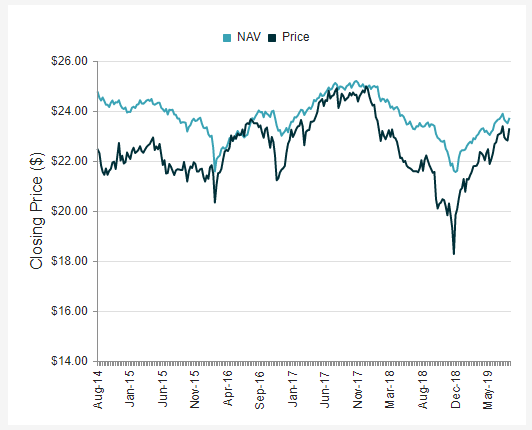

First Trust Intermediate Duration Preferred & Income Fund (FPF)

This First Trust CEF (FPF) has a NAV of $23.69 and the share price is currently 1.77% below that price. Some lucky investors were able to purchase shares at a discount to NAV of 15.4% in the past year.

The dividend is paid monthly on this fund, at about 14 cents per share.

The credit quality of the investments in this fund is predominantly BB and BBB (lower medium grades) and only 41% is invested in the United States.

Cohen & Steers Limited Duration Preferred & Income Fund (LDP)

The Cohen & Steers CEF (LDP) has a NAV of $25.43 and the share price is currently 1.61% below that price. In the past year, the fund has traded at a discount to NAV by as much as 15.74%.

This $1 billion fund does use some leverage, just like the others, but it is limited to about 30%. Holdings are skewed to bonds over preferred stock and towards the banking and insurance sectors.Half of the holdings come from outside the United States.

The monthly dividend on these shares is almost 16 cents per share.

Conclusion: Since these funds are affected by market pricing, you can get a nice deal and discount to net asset value if you are waiting for a dip in the price. Look for an entry point that is at least 5% to 10% below the current market value. Over the past 5 years, this would have led to several buying opportunities.

what was the catalyst for the dips

I'd like to know this as well.