This Selection Of ETFs Has Outperformed The Nasdaq By 212% YTD

Introduction

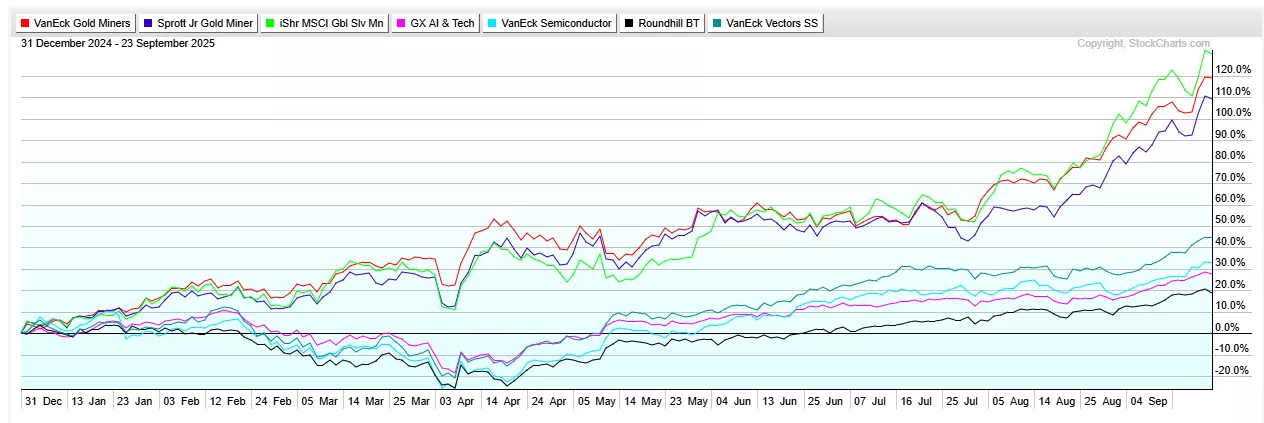

Below is how the constituents in my personal portfolio of ETFs have performed MTD, in descending order, and YTD, compared to that of the Nasdaq (QQQ) along with a description of each constituent plus a chart of the performance of the constituents in comparison to each other, and collectively, in chart form.

Returns By MTD & YTD

- Sprott Junior Gold Miners (SGDJ): UP 16.7% MTD; UP 102.3% YTD excluding dividends

- Focus: tracks an equity index of small-cap (avg. mkt. cap. of $2B) gold mining firms that are weighted by price momentum for gold explorers and by revenue growth for gold developers.

- Assets Under Management (AUM): $234M

- Expense Ratio: 5%

- Dividend Yield: 3.1%

- # Holdings: 34

- iShares MSCI Global Silver & Metal Miners (SLVP): UP 16.1% MTD; UP 118.5% YTD excluding dividends

- Focus: a market-cap-weighted index of global companies (avg. mkt. cap. of $60B) that earn the majority of their revenues from silver mining

- Assets Under Management (AUM): $492M

- Expense Ratio: 0.39%

- Dividend Yield: 0.5%

- # Holdings: 41

- VanEck Gold Miners (GDX): UP 14.5% MTD; UP 113.4% YTD excluding dividends

- Focus: a market-cap-weighted index of global gold-mining firms (avg. mkt. cap. of $58B)

- Assets Under Management (AUM): $19.9B

- Expense Ratio: 0.51%

- Dividend Yield: 0.54%

- # Holdings: 65

- VanEck Social Sentiment (BUZZ): UP 11.0% MTD; UP 41.3% YTD excluding dividends

- Focus: holds 75 U.S.-listed firms with the most positive investor sentiment online

- Assets Under Management (AUM): $109M

- Expense Ratio: 0.76%

- Dividend Yield: 0.35%

- # Holdings: 75

- Global X AI & Technology (AIQ): UP 9.1% MTD; UP 27.2% YTD excluding dividends

- Focus: tracks a market-cap-weighted index of developed-market equities involved in artificial intelligence & big data.

- Assets Under Management (AUM): $5.3B

- Expense Ratio: 0.68%

- Dividend Yield: 0.12%

- # Holdings: 92

- Roundhill Magnificent Seven (MAGS): UP 8.9% MTD; UP 19.6% YTD excluding dividends

- Focus: an actively managed fund offering exposure to the largest and most liquid leading technology stocks

- Assets Under Management (AUM): $3.34T

- Expense Ratio: 0.29%

- Dividend Yield: NIL

- # Holdings: 7

- VanEck Semiconductor (SMH): UP 8.8% MTD; UP 30.4% YTD excluding dividends

- Focus: based on a market-cap-weighted index of 25 of the largest US-listed semiconductors companies.

- Assets Under Management (AUM): $32.1B

- Expense Ratio: 0.35%

- Dividend Yield: 0.34%

- # Holdings: 26

Summary:

My Personal Select ETF Portfolio is UP 10.6% MTD and UP 56.8%, YTD.

Performance Comparison Of Portfolio Constituents YTD

Portfolio Performance Chart -YTD

The above portfolio chart has been generated using the tools provided by PortfoliosLab.com and easy step-by-step instructions are available here to help you create a chart of your own portfolio or that of a client. It's easy, fast and free.

Conclusion

My Personal Select ETF Portfolio is UP 56.8%, YTD, compared to the Nasdaq (QQQ) which has only gone UP 18.2% during the same period. That represents an increase of 212.1%.

Addendum

- If you (or your financial advisor) are interested in creating a chart of the performance of a portfolio you finally can. Just visit follow the simple step-by-step instructions in my post entitled "How To Create A Chart Of the Performance Of A Portfolio". It's fast, it's easy and it's free!

- Please note that I have NO direct or indirect financial interest in PortfoliosLab. I am just a very impressed subscriber who finally found a way to provide charts of the performance of my various model portfolios in my frequent articles as posted on TalkMarkets.

More By This Author:

Our AI Semiconductor Model Portfolios Collectively Shows 29% Gain YTD

Semiconductor EDA Software Company Synopsis Fell 29% Last Week - Here's Why

Pure-Play Quantum Computing Stocks Jumped +25% Last Week - Here's Why

My personal portfolio is personal to me and only me. It takes into account my age, my financial situation, my risk appetite, my investment experience, my citizenship, my depth of research ...

more