The Virus Infecting MLPs

Closed end fund investors are passionate about the product. Because they generally own a portfolio of publicly traded securities, their NAV per share is easily calculated. The fixed share count means their share price can deviate from the NAV, and this attracts investors keen to buy something for less than it’s worth.

MLP closed end funds have been around for years. They’re a low-octane version of levered ETFs. If you’re good at market-timing, a skill claimed by far more than actually possess it, you can navigate the ups and downs. Leverage magnifies your exposure, and strategies with fixed leverage have to rebalance in the direction the market has moved (i.e. buy high and sell low).

We have warned investors about this before (see Lose Money Fast with Levered ETFs).

In 2015 we pointed out how the Cushing MLP Total Return Fund (SRV) had persistently destroyed value, because of leverage (see An Apocalyptic Fund Story).

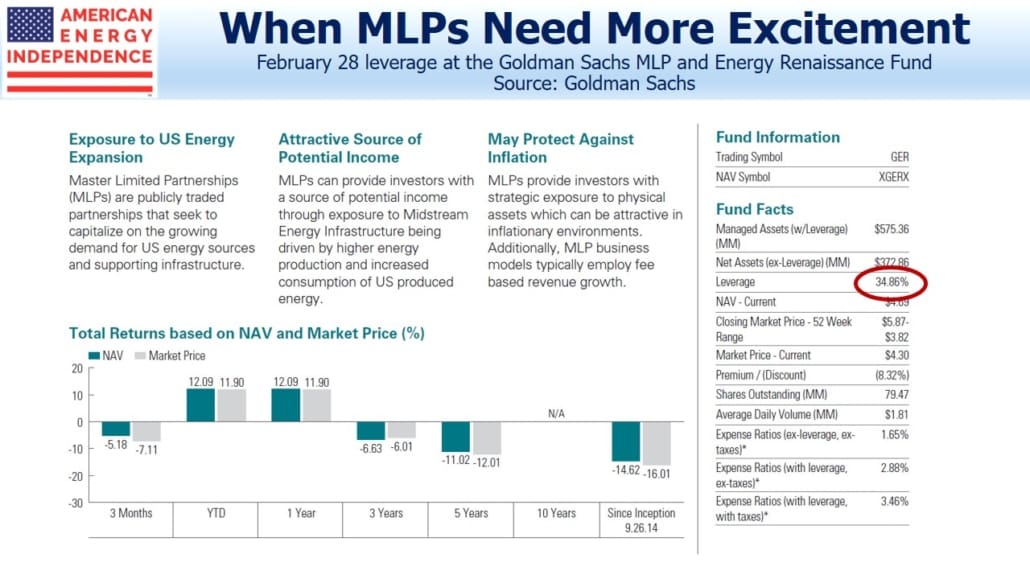

(Click on image to enlarge)

MLP closed end funds use leverage. Because they are more than 25% invested in MLPs, they are non-RIC compliant and therefore their profits are subject to corporate income tax. The interest expense on their borrowings can be deducted against taxable income, thereby reducing or even offsetting the tax obligation that few holders realize exists.

But adding leverage to a single sector fund is a dumb idea. Investment-grade midstream energy infrastructure companies generally operate at around 4.0X Debt: EBITDA. Non-investment grade are a little higher. The manager of a sector-specific leveraged fund is essentially rejecting this leverage as too conservative, even though such a fund has little diversification in a sharp fall in the market.

This is an expression of arrogance, that the managers of these funds have some insight superior to the collective opinion of CFOs and rating agencies. They don’t. They are just willing to gamble other people’s money that they do.

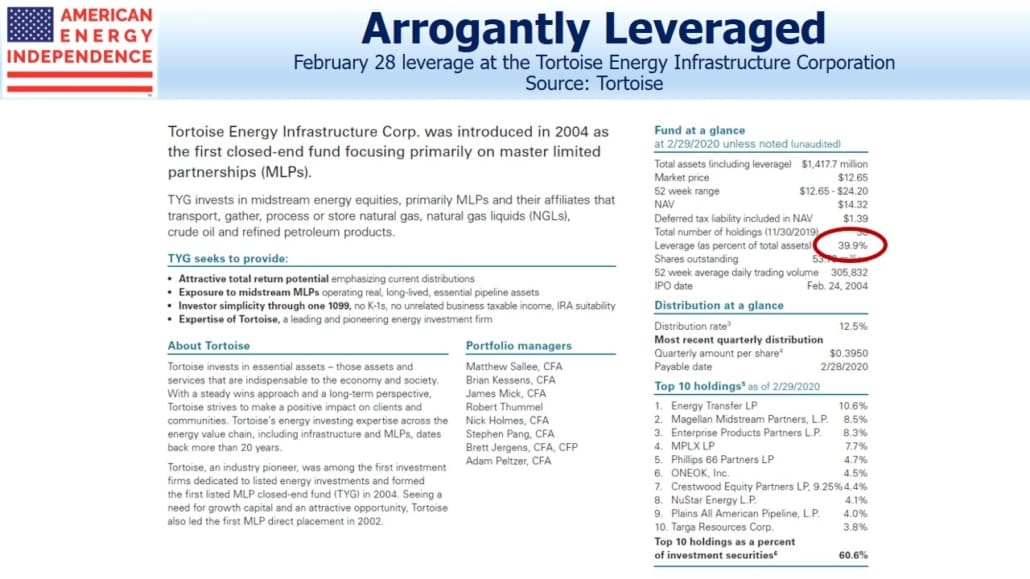

(Click on image to enlarge)

An investor pointed out to me leverage at some of these funds, from fact sheets recently published at the end of February. Goldman was running a fund with 35% leverage. Tortoise had one with 40%. YTD these funds were down 85% and 95% respectively as of 2pm today.

Given the collapse in March, these funds have all been forced, sellers. As long-only investors, we are down a lot. But the delivery of MLP CEFs has exacerbated the drop for everyone. Leveraged MLP closed end funds are a financial virus that is infecting the rest of the sector, by driving prices even lower. They harm all investors, but most especially the poor souls who sadly bought them. Fortunately, most of these funds are nearly dead, with little capital remaining to protect.

The information provided is for informational purposes only and investors should determine for themselves whether a particular service or product is suitable for their investment needs. Graphs and ...

more