The Tax Revolution: How ETFs Are Reshaping Investment Strategies

Image Source: Pixabay

The investment landscape has undergone a dramatic transformation over the past two decades. Exchange-traded funds (ETFs) have evolved from a niche investment vehicle to a dominant force, with assets under management skyrocketing from roughly $80 billion in 2005 to an impressive $10 trillion in 2025. This represents a surge from just 2.5% of all mutual fund assets to 36% today.

While many investors initially gravitated toward ETFs for their intraday trading capabilities, lower expense ratios, and commission-free trading options, a deeper story has emerged: tax efficiency has become the primary driver of this massive migration, particularly for long-term taxable investors.

The Science Behind the Shift

In their April 2025 paper, “The Role of Taxes in the Rise of ETFs” Rabih Moussawi, Ke Shen, and Raisa Velthuis examined the sophisticated mechanisms that make ETFs so tax efficient. Their comprehensive analysis of data from 1993-2023 exposes the stark differences between ETFs and traditional mutual funds when it comes to tax burden.

How ETFs Achieve Superior Tax Efficiency: The In-Kind Redemption Advantage

Unlike mutual funds, which must sell securities to meet redemptions (triggering taxable events), Moussawi, Shen, and Velthuis began by explaining that ETFs achieve their tax efficiency through the in-kind redemption process with approved participants (which avoids the realization of capital gains and the consequences for taxable investors) and the use of heartbeat trades, by offloading low-basis stocks without triggering a taxable event, pursuant to the exemption provided by Section 852(b)(6) of the U.S. Internal Revenue Code. Because in-kind redemptions are much costlier for mutual fund investors and are only possible for redemption transactions above $250,000, mutual funds have historically made little use of the in-kind redemption exemption. Since 2012, just 1.9% of active mutual funds employed at least one redemption in-kind per year.

Heartbeat Trades: In these trades, an authorized participant initiates an inflow into the ETF by creating new ETF shares, and, within a few days, reverses the process by executing an in-kind redemption of similar magnitude, allowing the ETF to offload appreciated securities via the in-kind redemption basket and avoiding any capital gains distributions that would have occurred if these securities were sold directly by the ETF. The adoption of SEC’s Rule 6c-11 in 2019 (also known as the ETF Rule) simplified the “custom basket exemption”, allowing ETFs to deploy heartbeat trades more efficiently by permitting the redemption basket to consist only of the appreciated securities leaving the fund. The ETF Rule also paved way for another phenomenon: conversions of mutual funds into ETFs, in order to provide ETF tax benefits to existing taxable fund investors.

Moussawi, Shen, and Velthuis found that since 2012, 26.2% of ETFs utilized heartbeat trades, with an average of 1.9 heartbeats per ETF. This pattern of around two heartbeat trades per fund each year aligns with the frequencies of rebalancing and reconstitution observed in major indexes. They also found that ETFs are more likely to deploy heartbeat trades when ordinary investors’ outflows during the year are not sufficiently large to flush away the bulk of the realized capital gains through regular in-kind redemptions. Also, heartbeat trades are more likely to be employed by ETFs with higher portfolio turnover ratios and with a larger number of portfolio holdings.

The Numbers Tell a Compelling Story

The research reveals striking disparities in tax efficiency as while a majority of U.S. equity mutual funds distributed capital gains, only 4.95% of ETFs had non-zero capital gains distributions during the entire sample period.

Capital Gains Distributions

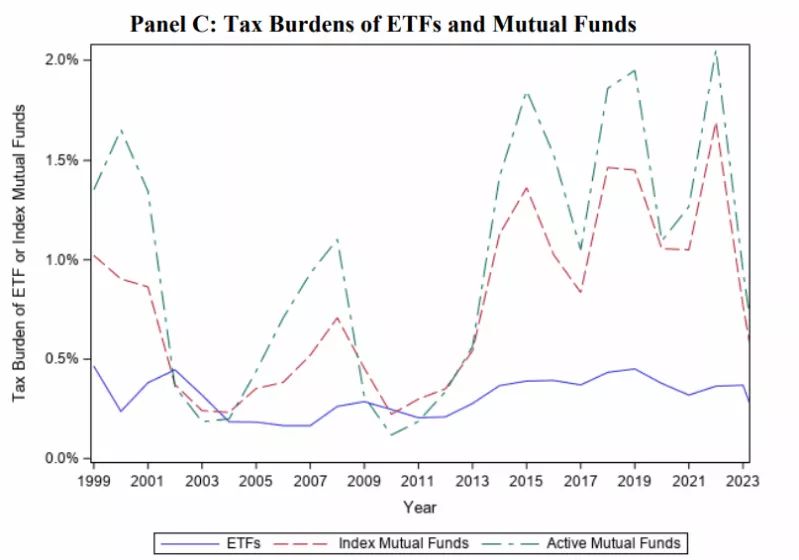

While ETFs and mutual funds realized similar capital gains (4.11% for ETFs, 4.18% for index mutual funds, and 5.97% for active mutual funds, on average), ETFs distributed almost no capital gains at all (0.12%), compared to a 3.72% (2.11%) capital gains distribution yield by active (index) mutual funds, on average.

Overall Tax Burden (Annual Average)

- ETFs: 0.41% (primarily from dividend distributions)

- Index Mutual Funds: 0.83%

- Active Mutual Funds: 1.07%

The “Tax Alpha” Effect

In high-turnover investment styles like small-cap growth strategies, ETFs deliver even more impressive tax advantages, with tax “alpha” approaching 1.5% annually—a substantial boost to after-tax returns.

The Institutional Recognition

Perhaps most telling is how sophisticated institutional investors have responded. Investment advisers serving high-net-worth clients—the most tax-sensitive investor segment—have allocated nearly 47% of their assets to ETFs as of 2023. Despite representing less than 10% of overall institutional assets, these tax-focused advisers now control over 27% of total ETF market capitalization.

The Negative Spiral of Mutual Fund Outflows

The research identifies a troubling cycle for mutual funds: outflows force fund managers to sell securities to meet redemptions, generating capital gains that must be distributed to remaining shareholders. This creates a “first-mover advantage” where tax-sensitive investors might benefit from exiting before distribution dates, typically in December, further accelerating outflows. This would be the case if the fund is expected to distribute short-term capital gains and the investor has held the shares for more than a year.

ETFs break this cycle entirely through their in-kind redemption structure, eliminating negative tax externalities for remaining investors.

Strategic Implementation: The Heartbeat Data

Since 2012, over 26% of ETFs have employed heartbeat trades, averaging 1.9 transactions per fund annually. This frequency aligns perfectly with major index rebalancing and reconstitution schedules, demonstrating the strategic nature of these tax-optimization techniques.

ETFs are most likely to deploy heartbeat trades when:

- Regular investor outflows aren’t sufficient to eliminate realized gains

- Portfolio turnover ratios are higher

- The fund holds a larger number of securities

Beyond Current Benefits: The Compounding Advantage

ETFs offer tax-sensitive investors something even more valuable than current-year tax savings: indefinite tax deferral. This allows for tax-free compounding of both short-term and long-term capital gains, potentially creating substantial accumulated wealth over time.

Moreover, the step-up in basis rule means investors can completely avoid capital gains taxes on ETF shares passed to heirs—a powerful estate planning advantage that mutual funds cannot match.

Looking Ahead: A New Investment Paradigm

The research suggests we’re witnessing more than a temporary trend. The superior tax efficiency of ETFs is likely to:

- Accelerate migration from active mutual funds to ETFs.

- Drive more mutual fund conversions to ETF structures.

- Create a new equilibrium where ETFs dominate taxable investment accounts

The Bottom Line for Investors

For taxable investors, the choice between ETFs and mutual funds has become increasingly clear. While mutual funds may still serve important roles in tax-advantaged accounts like 401(k)s and IRAs, the tax efficiency advantages of ETFs make them the superior choice for taxable portfolios.

The research demonstrates that ETFs don’t just offer modest tax savings—they provide a structural advantage that compounds over time, potentially adding 1% or more annually to after-tax returns, a significant and sustainable competitive advantage.

More By This Author:

Where Factors Speak Loudest: Why Size Matters In Factor InvestingESG Metrics: Just Information Or Value-Added Investment Intelligence?

The False Dichotomy: Why The Active Vs. Passive Fund Debate Misses The Point