The Short-Term Downtrend Continues After Friday

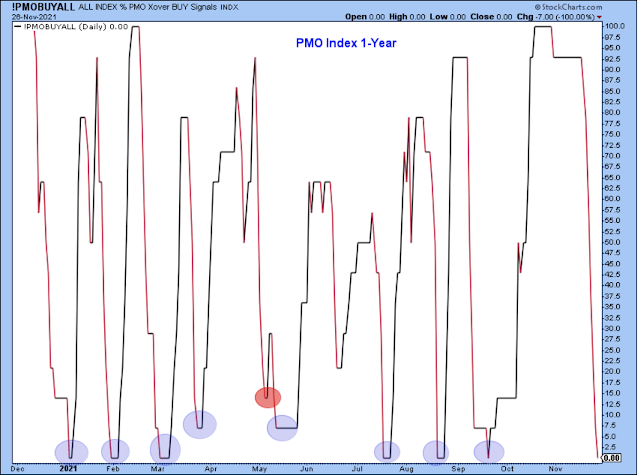

The short-term downtrend continues. On Tuesday and Wednesday it looked like the market was trying to find its low for this cycle, but then Friday occurred and we all know what happened. Now, the PMO index rests at the very bottom of its range, which is when it is generally too late to sell.

For me, the time to sell is when the major indexes are pushing higher but the underlying breadth and momentum indicators are starting to falter. That is the window to take partial profits, raise some cash, and prepare for the inevitable short-term downturn that sends the PMO from the top of its range to the bottom. Having cash gives me more confidence to hold, and, as a result, I will only need to trim the positions that fall sharply on volume.

Now that the PMO is at its low, I'll look for the market signals that hint that the selling is done and it is time to deploy cash again into the market.

After such a bad day on Friday, you can imagine that almost every indicator that I follow is looking terrible, so I will only show a couple.

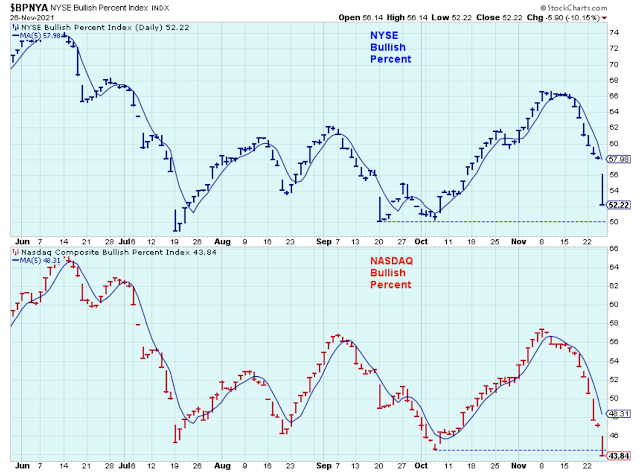

The bullish percents continue to point decisively lower, and the Nasdaq bullish percent is at the lowest level since the Spring 2020 COVID-19 crash. That isn't a good sign for the Nasdaq going forward, but in the short-term, it is a signal that the Nasdaq is likely to bottom out soon. The NYSE bullish percent is still above previous lows, but it is getting close, so it could be near a bottom as well.

The chart of the junk bond ETF looks bad and had broken down well before Friday. Based on this chart I feel like asking whether Friday's bad day was really about COVID-19, or was it just an excuse to sell? I like to trade in the same direction as junk bond prices, and this weak junk bond chart is telling me to be worried about stock prices, and that perhaps the next stock rally won't be as healthy as they have been most of this year.

The chart below shows three of the growth stock ETF canaries, and all three showed strength on Friday. Growth stocks perform better with lower Treasury yields, and Friday's session pushed Treasury yields lower, which helped these ETF prices. Also, if growth stocks are showing some price strength, you might have a hint from the market that a bottom may in for stocks sometime soon and that growth stocks will be the place to put money in the short-term.

Who knows what Monday will be like. People will have all weekend to think and I honestly have no idea if two days will build or diminish the desire to sell stocks. In fact, if we get a lot of selling on Monday, that could perhaps be the washout needed to set up for the next rally.

I mentioned earlier that yields pulled back on Friday, and this chart shows that the 10-year and 30-year yields are now below their 10-week averages. If this continues, I'll have to consider whether the price trend has changed for bond prices.

The CRB broke down below its long-term trend on Friday. This index could easily snap back above the trend next week, but it is well worth keeping an eye on this chart. If commodity prices move down or sideways, the Fed will have room to go easy on short-term rates.

The last chart is one of my favorites. This chart reminds me that whenever stock prices look like they will never go higher again, they do, at least in the short-term. With the PMO at this level, and while the news is bad and pessimism is high, it is time to be thinking about making money in the next short-term uptrend.

I closed my 3x bear positions last Tuesday and I now have a fair amount of cash. I will sell any stocks that show a serious breakdown in price, but otherwise, I'll hold my positions and look for opportunities to add.

Outlook Summary

- The short-term trend is down for stock prices as of Nov. 17.

- The economy is in expansion as of Sept. 19, 2020.

- The medium-term trend is down for treasury bond prices as of Sept. 23 (prices down, yields up).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more