The REIT Special - An Inflation Hedge

You know that I have been consistently touting the iShares Cohen & Steers REIT ETF (ICF) as a potential hedge against inflation.

In this REIT Special Edition, I will break down the WHY. But not, we aren’t going to just talk about the ICF ETF. We will dig into what specific real estate sectors you might want to consider when looking at REITs to invest in.

But first and foremost, what is a REIT, and why are they such strong bets right now?

Let’s just say, if you want to invest in real estate but do not necessarily have the capital, you will want to read on. If you don’t have the patience for illiquid assets like buildings, you will want to read on. And suppose you want the easiest, most convenient way to diversify your portfolio and add real estate exposure. You will want to read on.

A REIT, or real estate investment trust, is a company that owns, operates, or finances income-producing real estate assets. Think of REITs as mutual funds for real estate. REITs pool the capital of numerous investors.

For the most part, REITs trade on public exchanges like stocks, which makes them highly liquid, unlike physical real estate assets. But the thing I love most about REITs? They also almost mirror the consistent income streams you can get from real estate assets. REITs pay some of the best and most consistent dividends on the market. All while you as an investor don’t have to get your hands dirty and buy, manage, or finance the property.

REITs invest in almost every real estate sector. However, in this edition, we will focus specifically on multifamily, hospitality, industrial, and healthcare. Why? Multifamily and hospitality could see substantial recoveries after 2020. Industrial and healthcare had strong 2020s and could continue to succeed in 2021 and long after.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Multifamily

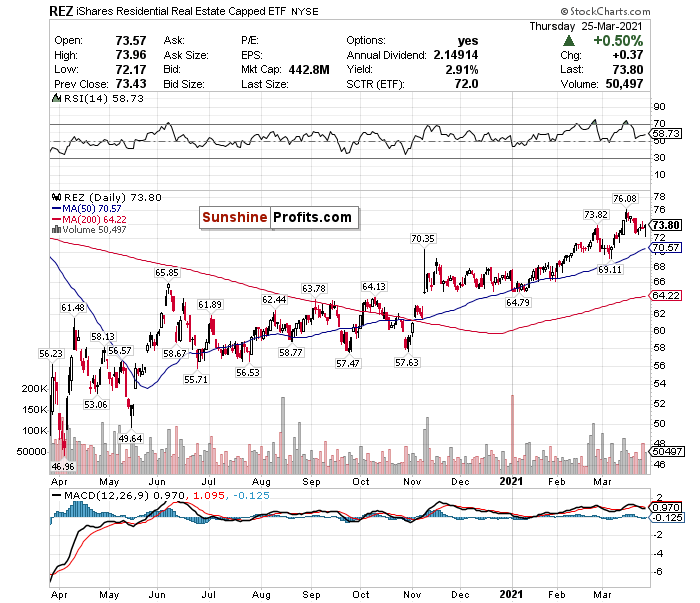

Figure 1- iShares Residential Real Estate ETF (REZ)

Multifamily or residential REITs own and operate apartment buildings and/or manufactured housing.

The most important factors to focus on when researching multifamily REITs are affordability, population growth, and job growth. For example, large cities such as New York and LA have higher living costs and more renters. But their job growth and population growth are severely lagging right now. You want large urban centers that show strong in-migration trends and job growth.

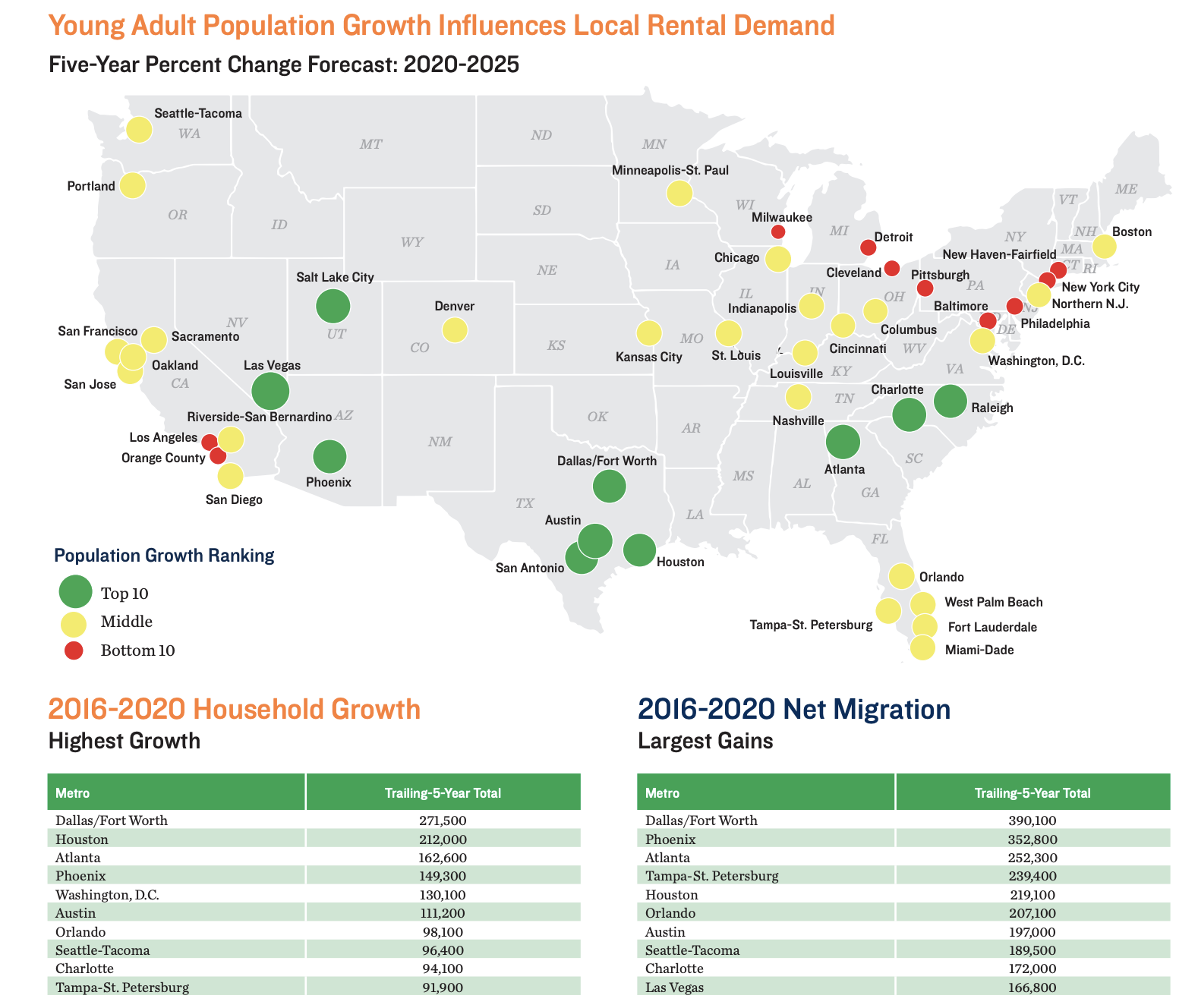

Figure 2: Marcus & Millichap Forecast

Consider the multifamily market in the Sunbelt and Mountain region. Even before COVID, there was a migration boom and significant employment growth, especially in the Sunbelt region. Plus, this region didn’t lock down as strictly as big cities like New York and LA and saw fewer job losses during the pandemic.

The Mountain region is also seeing a rapidly growing population, a strong quality-of-life, and affordable living costs. Do you know the ONLY state that saw year-over-year job growth for total nonfarm payrolls in January 2021 while also leading in year-to-date growth? Idaho.

While multifamily growth will be likely be fragmented based on region, there are two ways you can play this:

- Research individual REITs with the most exposure to growing regions.

- Add broad-based exposure to multifamily assets through ETFs like the iShares Residential Real Estate ETF (REZ). While this ETF does not focus EXCLUSIVELY on residential REITs, as it has exposure to healthcare and self-storage, too, this is an easy and convenient way to give yourself multifamily exposure.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more