The Markets Hold Their Breath Awaiting The Fed’s Decision

With investors unsure of how Big Tech’s earnings will perform this week and how hawkish or dovish Fed Chairman Jerome Powell will be during his press conference on Jul. 27, the financial markets were in a state of cautious paralysis on Jul. 25. However, with the narrative slowly shifting and investors prone to hearing what they want to hear, their preference for jubilation could help uplift the GDXJ ETF in the days ahead.

For example, with the consensus often more influenced by price than fundamentals, here are some of the headlines that hit the wire on Jul. 25:

Source: Bloomberg

Moreover:

Source: Bloomberg

Patiently Waiting

Thus, because "volume speaks volumes," the price action – combined with the S&P 500's ability to hold up despite weak economic data – has investors assuming that peak bearishness is in the past.

To that point, Mike Wilson, Chief U.S. Equity Strategist at Morgan Stanley, predicted that the S&P 500 would bottom at ~3,400 amid a soft landing and at ~3,000 during a recession. However, with signs of uncertainty creeping in, he told clients on Jul. 25 that the S&P 500's recent strength does beg the question: “Is there something going on here we are missing that could make this a more sustainable low and even the end of the bear market?"

He added:

"iF the market is starting to think the Fed is about to pause rate hikes after next week’s move, this would provide the best fundamental rationale for why equity markets have rallied so sharply over the past few weeks and why it might signal a more durable low.”

Therefore:

“With equity markets seemingly shrugging off bad news on the economy and earnings, we explore the idea that it may be trying to get ahead of the eventual pause by the Fed that is always a bullish signal.”

Now, to be fair to Wilson, he also stated that he doesn’t buy the narrative. He wrote:

“The problem with this thinking beyond a near term rally is that it’s unlikely the Fed is going to pause early enough to kick save the cycle (…). The Fed is looking more like the ECB this cycle in that they are likely to still be tightening when recession arrives this time making the window to trade the pause much shorter than usual with less upside as well."

Thus, while his overall conclusion aligns with our medium-term thinking, the doubt showcased by prior skeptics is material. I’ve noted on numerous occasions how bearish positioning has become extremely stretched recently.

As such, with everyone panicking about rampant inflation and an impending recession, their freak-outs were contrarian bullish. In a nutshell: no one is left to sell when all the bears have sold, no matter how weak the incoming fundamental data is. Then, when the shorts cover and systematic funds (CTAs) enter the mix, counterintuitive rallies like the ones we’re experiencing unfold.

However, while the GDXJ ETF hasn’t benefited much from the S&P 500’s relative strength, decent earnings prints from Big Tech (Microsoft and Alphabet report after the bell on Jul. 26) could supercharge investors’ optimism. Moreover, with heavyweights like Visa, Coca-Cola, and McDonald’s reporting in the morning, investors may find something they like.

Furthermore, if Fed Chairman Jerome Powell strikes a dovish tone on Jul. 27, the outcome would be bearish for the USD Index and bullish for the S&P 500 and the GDXJ ETF. To that point, with the futures market expecting Powell to pivot, the front-running is in full swing.

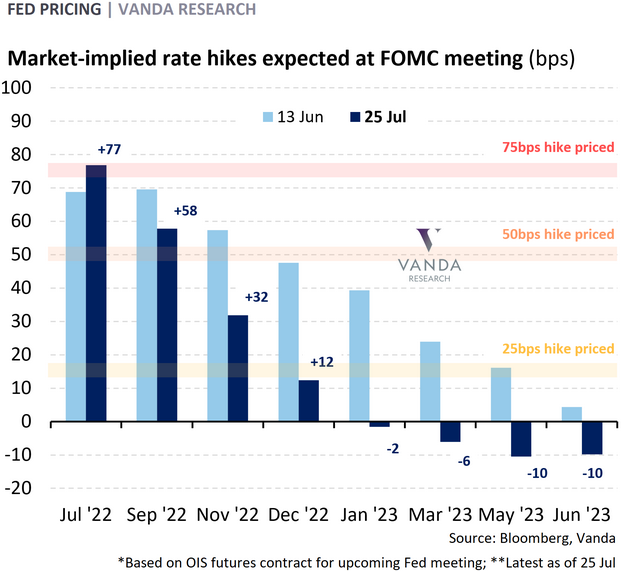

Please see below:

To explain, the light and dark blue bars above track the market-implied rate hikes on Jun. 13 and Jul. 25. If you analyze the height of the light blue bars, you can see that investors had priced in rate hikes through March 2023 (the final bar that reaches 25 bps).

However, the dark blue bars highlight how those expectations have materially decelerated. For example, market participants now expect the Fed to be done hiking by December 2022 and to begin cutting rates in 2023 (the negative dark blue bars).

Moreover, while a 75 basis point rate hike is considered a done deal on Jul. 27, the probability of a 50 basis point rate hike in September has dropped below 50%.

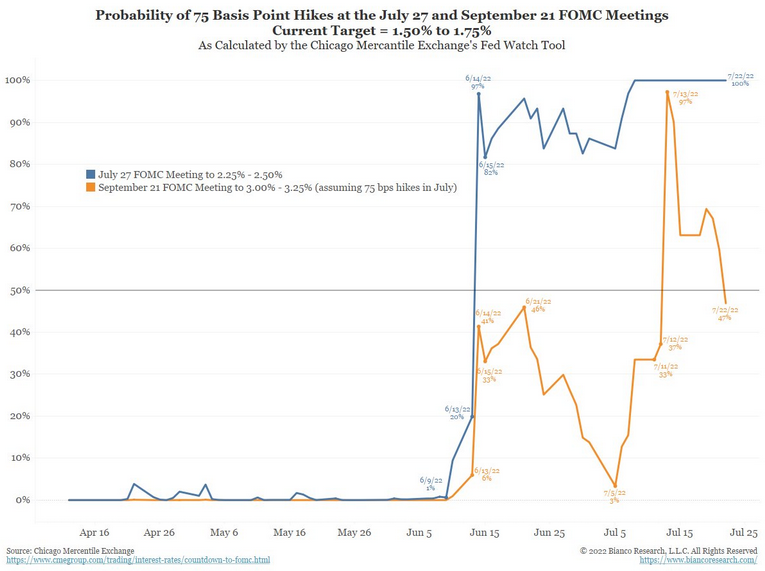

Please see below:

To explain, the blue line above tracks the market-implied probability of a 75 basis point rate hike this week (100%), while the orange line above tracks the market-implied probability of a 50 basis point rate hike in September (~47%). Moreover, the orange line has plunged in recent days.

Therefore, if these expectations materialize, then the USD Index is materially overvalued and the GDXJ ETF is materially undervalued. Right or wrong, the important point is that narratives move markets in the short term, and right now, the narrative is bullish for the GDXJ ETF.

Not So Fast

While investors’ misguided optimism is short-term bullish for the GDXJ ETF, the medium-term realities should have the opposite effect. For example, a 75 basis point rate hike on Jul. 27 would put the U.S. federal funds rate at 2.50%.

Moreover, if we add 25 basis points in September (since the market-implied probability of 50 basis points is less than 50%) and November, and then assume a pause in December (like the futures market expects), the U.S. federal funds rate would peak at 3%.

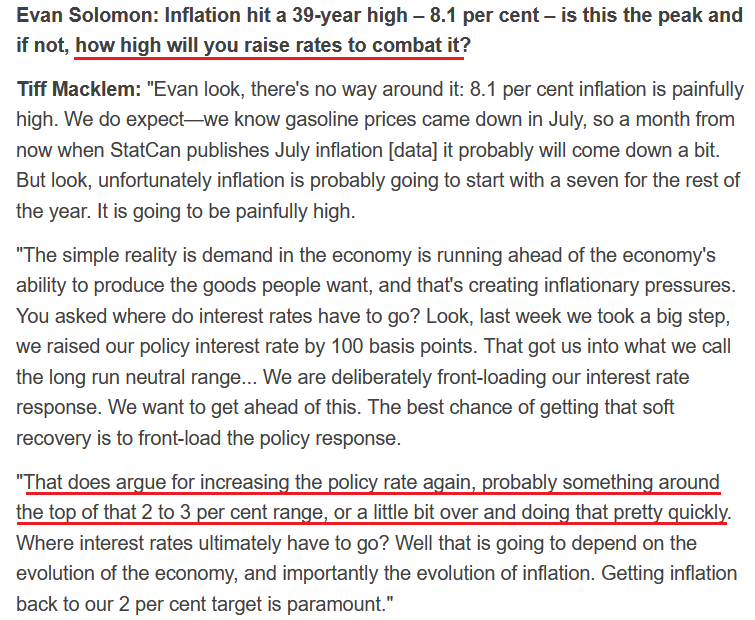

Likewise, it’s no surprise that investors have adopted these expectations. With Bank of Canada (BoC) Governor Tiff Macklem (Canada’s Jerome Powell) singing a similar tune, the new narrative is that a ~3% overnight lending rate will capsize inflation.

Please see below:

Source: CTV News

Thus, while these developments should help uplift the GDXJ ETF in the short term, the Fed, the BoC, and investors are in a fantasy land. To explain, I wrote on Jul. 25:

I noted on Jul. 22 that earnings calls from Blackstone, Hasbro, and Tractor Supply highlight how inflation is entrenched in the U.S. economy. In addition, with more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

Furthermore, I warned on May 26 that all three are betting on an outcome that hasn’t materialized in 70+ years. I wrote:

With annualized inflation of [9%+], calming price pressures with such little action is completely unrealistic. In fact, it’s never happened.

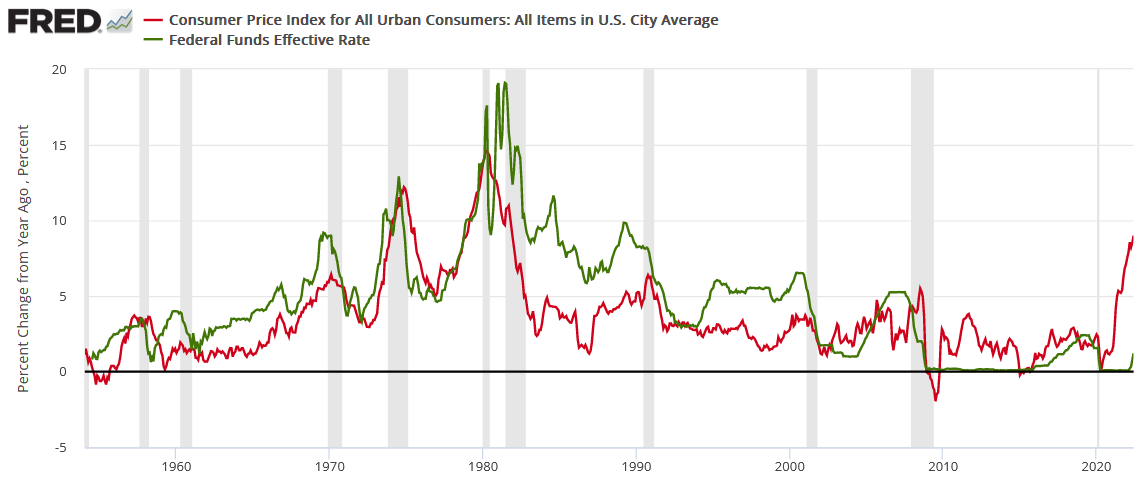

If you analyze the chart below, you can see that the U.S. federal funds rate (the green line) always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

In addition, notice how every inflation spike leads to a higher U.S. federal funds rate and then a recession (the vertical gray bars)? As such, do you really think this time is different?

More Earnings Calls

While I've noted in recent days how several earnings calls have been riddled with mentions of inflation and price increases, the chorus continues to sing. For example, Domino's Pizza released its second-quarter earnings on Jul. 21. For context, it's the largest pizza chain in the U.S.

Moreover, while Q1's pricing underperformance was notable, CFO Sandeep Reddy said during the Q2 earnings call:

“We have successfully pulled many pricing levers, including our standard menu pricing. Our national offers, our local offers, and our delivery fees. This has helped us cover some of the cost increases we are incurring in both the food basket and labor market while also ensuring we continue to deliver terrific value to our consumers.”

As a result, it’s another sign that executives aren’t waiting around for the inflationary pressures to subside.

Please see below:

Source: Domino’s Pizza/Seeking Alpha

Likewise, BJ’s Restaurants released its second-quarter earnings on Jul. 21. Moreover, while the company is smaller than Domino’s Pizza, the results are still material. During the Q2 earnings call, CEO Greg Levin said: “Inflationary pressure on our operating costs accelerated in the second quarter and is now running ahead of our earlier forecast (…). This food cost inflation equated to approximately 10% higher than in the second quarter of 2021 and 2% higher than what we experienced in the first quarter of this year.”

As a result:

Source: BJ’s Restaurants/The Motley Fool

Also noteworthy, Levin said:

“In the second quarter, we began to more closely track the underlying patterns of our guests, so we can identify any shifts in our guest behavior early. We measure not only overall sales and traffic trends, but deeper layers such as how often certain categories of guests visit and what is being ordered from our menu, and we review and analyze this data regularly.”

“The good news is that, to date, through July, we have not yet found any measurable changes in our guest behavior. In fact, traffic patterns are following a typical seasonal trend, and our guests are continuing to enjoy the usual amount of appetizers, drinks, and desserts in our restaurants. And we haven't seen any uptick in the usage of our value offerings, including our Happy Hour and Daily Brewhouse special menus.”

Thus, while BJ’s Restaurants continues to raise prices, consumers are not pushing back. Moreover, with many companies experiencing spirited demand despite higher prices, investors materially underestimate the resiliency of inflation. Therefore, they also underestimate how far the Fed will have to go to rectify the problem.

The Bottom Line

With the bulls regaining their confidence, their willingness to overlook inflation and their position for a soft landing is bullish for the GDXJ ETF. Moreover, with the USD Index, the U.S. 10-Year real yield, and high yield credit spreads all coming down, more than a few investors believe we’re closer to March 2009 than March 2008. As a result, a tactical buying opportunity remains in place.

In conclusion, the PMs declined on Jul. 25, as the waiting game continued. However, with investors increasingly excited about the market outlook, it will only take a small bout of fundamental optimism to spark a material rally. Therefore, while we expect one to occur, we also view it as an opportunity to re-enter our shorts at higher prices.

More By This Author:

If Gold Continues Its Uptrend, Junior Miners Will BenefitEurozone Recession Fears Didn’t Stop Gold Miners From Spiking

Despite a Stumble, the GDXJ’s Short-Term Outlook Remains Bullish

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more