The Market Has Rallied Nicely

The short-term uptrend continues. Since the Aug. 19 low, the market has rallied very nicely, as shown by the white bars of the PMO in the chart below. And with the PMO at a high level, it shows that participation in the rally has been good compared to the weak participation since the Spring.

Still, it would be nice to see the PMO reach all the way up to its maximum, which would mean that all sectors of the market are being lifted by the rally. That would be a real bullish market signal.

Now what? Just stick to the basic trade plan. With the PMO index near the top of its range we know that the best period for buying stocks in the short-term cycle is over, even if the rally continues. For me, it means that instead of looking only at stocks to buy, I'm beginning to also have my eyes on what stocks are looking extended or are not rallying as expected.

At this stage of the short-term trend, the strategy that works well for me is to add small amounts to my winners when they exceed buy points, and to trim up to a half of the positions in the laggards and extended positions.

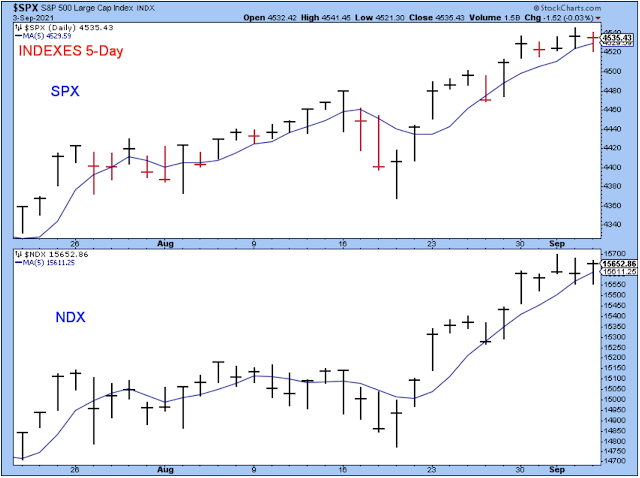

The SPX and the NDX remain above the 5-day averages, which is an indication that there is strength remaining in the short-term trend. When we start seeing closes under the 5-day, it doesn't necessarily mean that the short-term uptrend is ending, but it does mean that some of the market tailwind is easing up and that people are starting to take some of their profits. On any subsequent rallies back above the 5-day I start to sell into strength by trimming positions.

The 10-day Call/Put is in a solid uptrend. This chart is sure looking good. It is showing strength and it also looks like it has room to run higher; bullish.

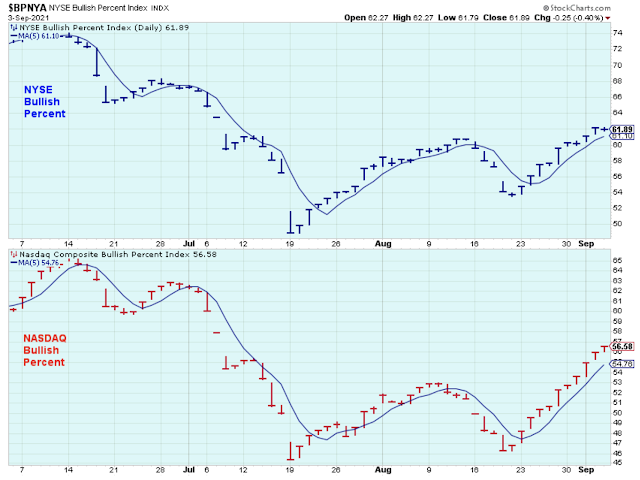

The bullish percents continue to climb higher, although the Nasdaq bullish percent is subtly stronger than the NYSE. The Nasdaq has been consistently closing at the top of the daily range, whereas the NYSE has had a few wobbly days. I like that both bullish percents have exceeded their August peaks.

It is hard to find a bearish chart in my chart lists, but not all of them are clearly bullish. This chart below is a bit disappointing because it shows that neither of the Dow indexes has rallied very well. Both indexes had sharp rallies in early August so maybe they are still consolidating gains. The transports were quite weak on Friday, which is probably because of the disappointing job number.

The small-caps rallied past their 50-day which is bullish, but now they need to show upside follow-through or at least that they can maintain prices in the top half of this sideways pattern. On Friday, Aug. 27, this index showed a strong rally above the 50-day, and the break above the downtrend line was sharp.

Here is a look at another small- and mid-cap ETF. This one contains 50 of the very best growth stocks, and it has been off to the races.

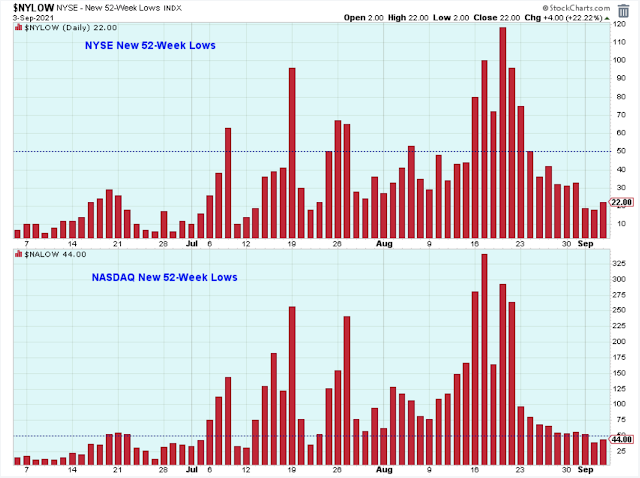

The number of new 52-week lows has settled way down. Watch this chart everyday to make sure that the general market remains healthy.

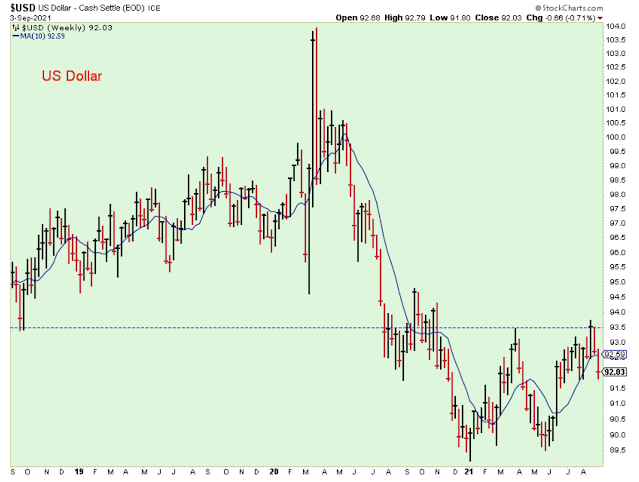

A couple weeks ago it looked like the US dollar was headed back to a medium-term uptrend after what looked like a well-defined double bottom, but that was short-lived and it is now back within its sideways range.

Rates continue to trend lower, but a test of the trend is near.

Contrarian sentiment is favoring higher stock prices.

Bottom line: My accounts are close to fully invested. The only reason there is some cash is because I like to lighten up on exposure just before a long weekend. At the moment, market breadth signals higher prices, but with a little more short-term risk than a week ago considering that the PMO is near the top of its range.

Outlook Summary

- The short-term trend is up for stock prices as of Aug. 20.

- The economy is in expansion as of Sept. 19, 2020.

- The medium-term trend is up for treasury bond prices as of June 11 (prices higher, rates lower).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more