The Logical-Invest Newsletter For July 2021: Inflation And Policy

Outlook

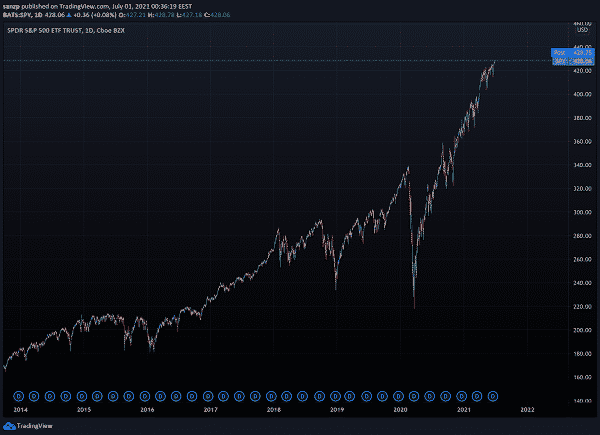

June was a positive month for equities, seeing moderate gains in the S&P 500 (+2.2%) and emerging markets (+1.6%) while the Nasdaq rose by +6.3%. Suffice to say, we are at all-time highs as U.S. indexes rides on waves of positive post-COVID-19 recovery and increasing inflation expectations. We have seen an almost linear progression in stock prices since March of 2020.

It is important to keep policy in mind. In 2020, the US Federal Reserve announced a major shift towards inflation management. Under this new policy, called Flexible Average Inflation Targeting, or FAIT, the Fed now targets a 2% inflation on average over time as opposed to fighting inflation as it appears. This allows for inflation to overshoot the 2% target before policy is adjusted.

This, of course, could lead to runaway inflation that the Fed may not be able to control. Currently, the accepted view is that deflationary forces are large enough to counterbalance inflation pressures. The bottom line is that if the Fed wants slightly higher inflation, we should expect it.

The S&P 500 Daily chart (above)

For June, the data says otherwise. Long-term treasury ETF (TLT) saw a significant increase (+4.4%), meaning yields fell while gold, an inflation friendly hedge, had a correction at -7.2%.

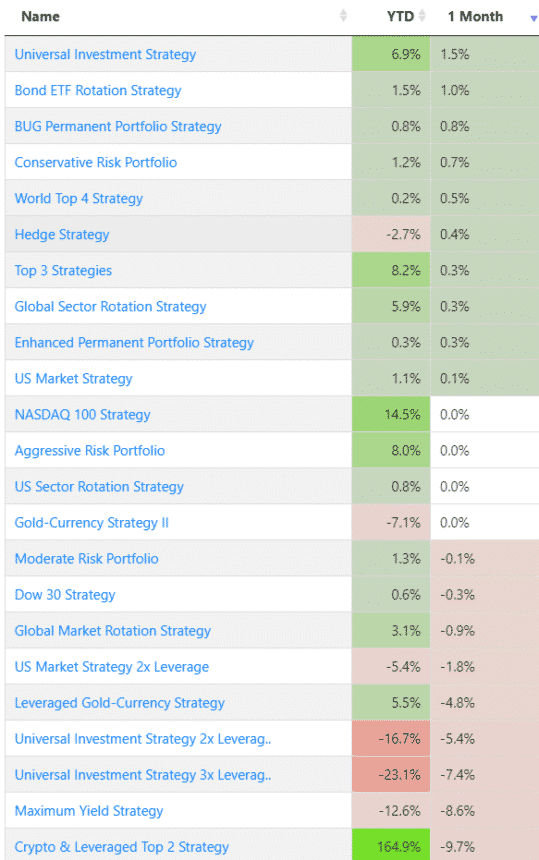

Strategy Performance

June was a mediocre month for our strategies, with the leveraged strategies being the ones that suffered due to exposure to gold.

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more