The Logical-Invest Newsletter For April 2022

Image Source: Unsplash

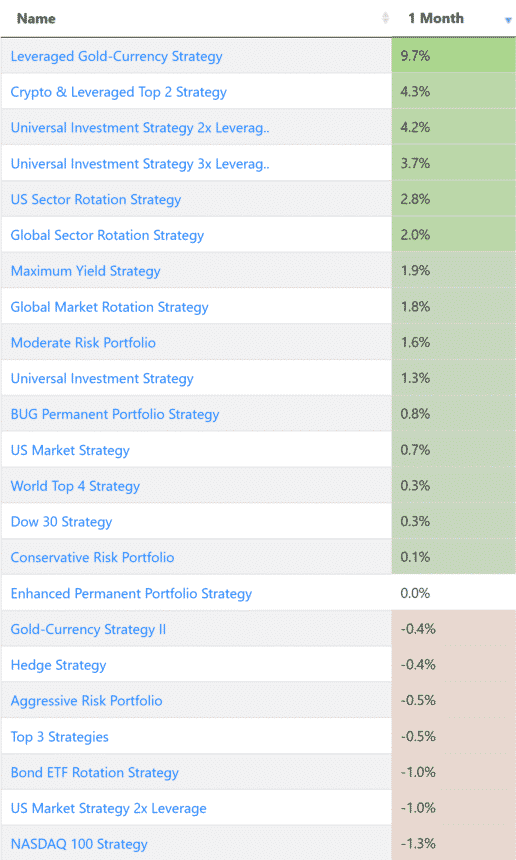

Strategy Performance – Moderate Gains on Equity Rebound

Most of our strategies were positive as the market rebounded from last month’s selloff.

Logical Invest Strategy Development Process – A Look Inside

Our philosophy in portfolio construction is controlling risk via diversification and hedging. Here is our typical construction process for a strategy such as the Nasdaq 100 strategy:

Part I – Building the equity part:

- We create a pure momentum sub-strategy called Nasdaq 100 Leaders Strategy. This strategy picks the strongest performers from the Nasdaq group.

- We create a lower volatility sub-strategy, the Nasdaq 100 Low volatility. This strategy picks more stable performers and is somewhat more conservative.

- We create a ‘parent’ strategy that allocates between the two depending on the market environment. This is the Nasdaq 100 Balanced unhedged Strategy. In essence, it gauges the market environment every month and then picks between the aggressive Leaders strategy or the low-vol strategy.

Part 2 – Building the hedge part:

- We now create the hedge, which itself is a strategy called the Hedge strategy. It consists of two sub-strategies; a gold based sub-strategy and a Treasury based sub-strategy.

- The gold-currency-strategy-ii manages allocation to gold or a short-term market fund (GSY). It can be 100% in gold or 100% in GSY (which is similar to cash), or anywhere in between.

- The Treasury Hedge manages allocation to Treasuries and can pick between long-term Treasuries (TLT), inflation protected Treasuries (TIP), and a short-term market fund.

- The Hedge Strategy allocates between the two sub-strategies depending on market conditions.

Finally, these two parts, the equity and the hedge, are combined into the final strategy: the Nasdaq 100 strategy. In essence, the sub-strategies that make up the Nasdaq 100 are:

- Nasdaq 100 Balanced unhedged Strategy.

- Nasdaq 100 Leaders Strategy.

- Nasdaq 100 Low volatility Strategy.

- Hedge.

- Gold-Currency strategy.

- Treasury Hedge.

Accessing All Strategies

Although we like to protect capital, our ‘LI-made’ strategies shine when there is trouble in the markets. Historically, markets are often in bullish mode, so our (non-leveraged) strategies may under-perform in the medium-term while holding the S&P 500. Or, in our example, the Nasdaq 100 index.

We are considering giving users direct access to all sub-strategies. This would allow to pick, choose, and combine them as you see fit. For example, you could choose to follow the standard Nasdaq 100 strategy or choose to be bold and just pick the Nasdaq 100 Leaders (non-hedged) version.

Europeans and U.S. Based ETFs

Due to reasons discussed in previous texts, E.U. citizens do not have access to U.S. based ETFs. Nowadays, there are more liquid, E.U./UCITS based ETFs that you can use.

But if you are keen on investing in the U.S ETF market, a solution is to trade CFDs via Interactive Brokers. We have found the spreads to be similar to trading the actual ETFs, usually $0.01 for liquid ETFs.

Keep in mind that CFDs can be abused as they give access to leverage. Do not use leverage, use CFDs as a substitute to the corresponding ETF - and use the same notional positions as you would with a standard stock/ETF account. Leverage is what causes the majority of retail investors to lose when utilizing CFD products.

Disclaimer: We have no affiliation with Interactive Brokers and do not recommend any broker over another. We have posted a temporary page with a list of all current sub-strategies: more