The Levered Oilpocalypse: Two 3x Levered Oil Exchange-Traded Products To Liquidate

In the aftermath of the February 2018 Volmageddon, aka VIXtermination event, where VIX exploded from 17.3 to 37.3 in one day as several levered inverse VIX ETNs were caught in a gamma feedback loop that forced them to buy more VIX the higher VIX rose, eventually pushing the fear index above 50 and resulting in 80%+ losses among the inverse VIX ETNs, the most notable outcome was that the retail darling VIX ETN, the XIV, suddenly triggered its "termination event" clause after it suffered heretofore unthinkable losses of over 80% in one day.

Two years later the exact same "termination" fate has befallen at least two levered oil exchange-traded products.

As Bloomberg reports today, the spectacular crash in oil prices "claimed its first victims among exchange-traded products: Two highly leveraged instruments in Europe will shutter as a result of the maelstrom.".

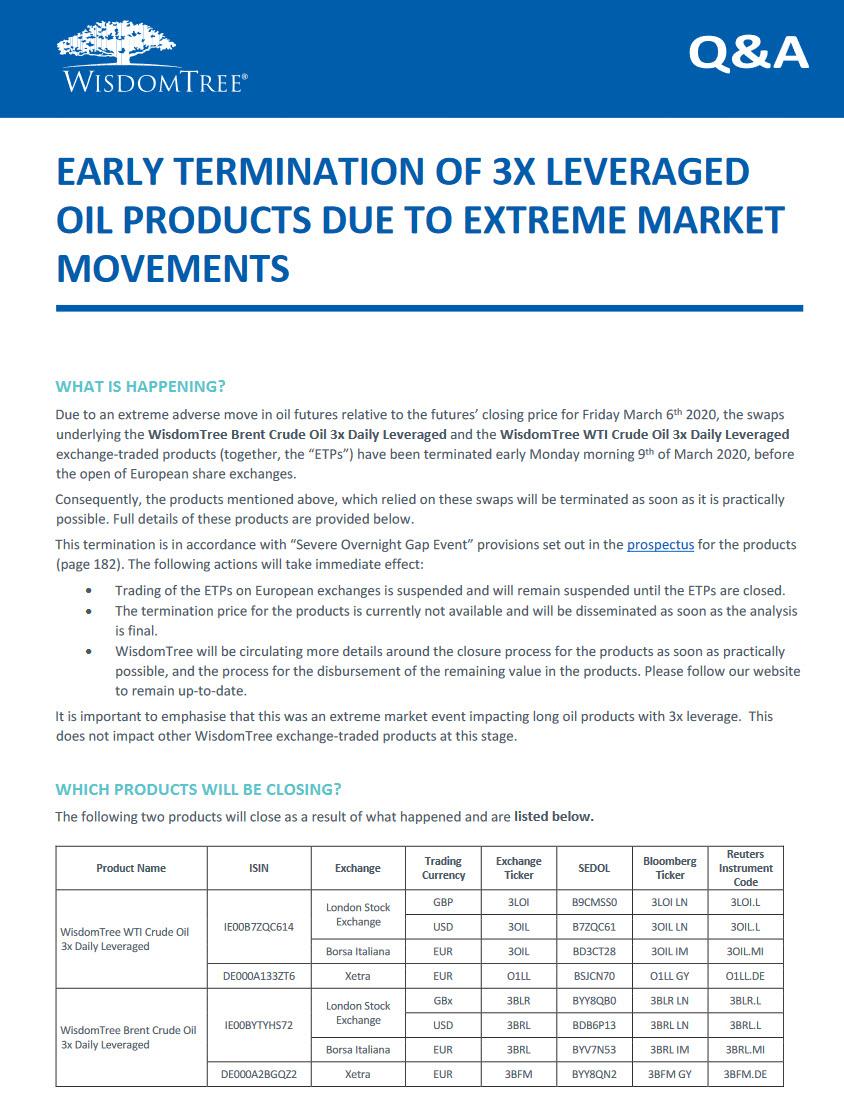

The WisdomTree Brent Crude Oil 3x Daily Leveraged and the WisdomTree WTI Crude Oil 3x Daily Leveraged products will both be terminated “due to an extreme adverse move in oil futures,” according to a notice on the issuer’s website.

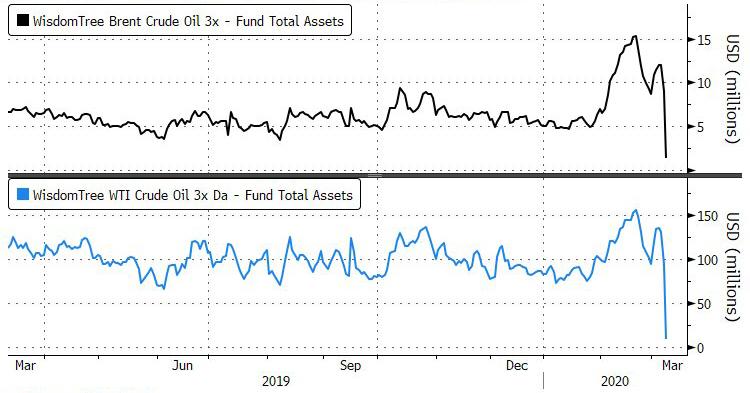

Just like the XIV and its levered peers, the oil-linked products, which hold a combined $10.3 million in assets, relied on swaps to deliver three times the daily move in crude prices. Those swaps have been closed thanks to the recent price collapse, and the funds themselves will be terminated “as soon as it is practically possible,” the notice states.

The statement in question is below:

(Click on image to enlarge)

Oil plunged the most in almost three decades this week as Saudi Arabia and Russia vowed to pump more in a battle for market share just as the coronavirus spurs the first decline in demand since 2009. Futures slumped by about 25% in New York and London on Monday, while 3x levered ETPs such as the ones above were effectively wiped out.

(Click on image to enlarge)

Unlike the Wisdomtree ETPs, several U.S.-listed products narrowly escaped liquidation the same day, with UWT or the VelocityShares 3x Long Crude Oil ETN plunging as low as 73% on Monday, just shy of its termination trigger of 75%.

SAVED BY THE BELL: $UWT just barely avoided triggering a termination event. It's INAV ended day at -73.8%, just shy of the -75% req for termination. A couple more minutes and it was prob curtains, but was stopped (saved) by the 2:30pm Nymex futures close. pic.twitter.com/URU0WoG8QD

— Eric Balchunas (@EricBalchunas) March 9, 2020

"The sudden crash in oil has put UWT in the danger zone of getting XIV-ed today,” said Bloomberg ETF analyst Eric Balchunas. "A termination of the note would really just add insult to injury given how severely painful this trade is right now -- and has been all year."

Among the other 3x levered oil ETN which narrowly missed liquidation, were GUSH, GASL, and OILU:

Looks like 3x Energy/Oil ETPs will avoid getting XIV-ed today, but damn it's bad: $UWT: -54% Today, -87% YTD$GUSH: -70% Today, -96% YTD$GASL: -62% Today, -98% YTD$OILU: -52% Today, -87% YTD

— Eric Balchunas (@EricBalchunas) March 9, 2020

UPDATE: $UWT took in $75m in flows yest and is up 17% in pre-market after being an inch from death, it could literally hear the bullet whizzing past its head.. https://t.co/PgCHZH81Zv

— Eric Balchunas (@EricBalchunas) March 10, 2020

Missed the liquidation.

Isn’t that in pertaining to Europe.

Not here.

I believe gush does not have liquidation clause in their prospectus.

Oh good, so all those traders will jump ship and come here ;)

Not OILU!