The Landscape Of Biotech ETFs

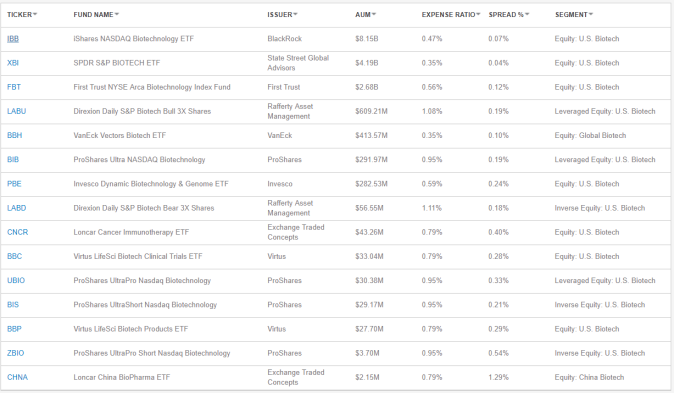

According to ETF.com, there are 15 biotech ETFs trading in the U.S. market with total asset over $16 Billion.

iShares NASDAQ Biotechnology ETF (IBB) is the largest one in terms of AuM, accumulating $ 7.57 Billion as of Jan 07, 2019. The inception date of IBB is Jan 2001, it tracks NASDAQ-listed biotech companies with pharmaceutical companies also being included. There are over 180 holdings as of recent. The key eligible criteria is for companies to be classified according to the Industry Classification Benchmark (ICB) as either biotechnology or pharmaceutical.

Invesco Dynamic Biotechnology & Genome ETF (PBE) is the best performer among the 15 with an annual return of ~13% since its issuing date on 06/23/2005. However, the AuM of PBE is mere $282 Million. The underlying lying index is developed based on FactSet Revere Hierarchy classification system. The superior performance can be accounted for by the unique classification system as well as the equal-weighting schema.

What’s worth mentioning is the Virtus LifeSci Biotech Clinical Trials ETF (BBC), which is based on the LifeSci Biotechnology Clinical Trials Index. The index developer is LifeSci Index Partners, they distinguish Clinical Trials companies and Products companies into two distinct categories. According to their methodology listed on its website, various data sources are used for filter companies.

Similarly, Loncar Cancer Immunotherapy ETF (CNCR) which tracks the Loncar Cancer Immunotherapy Index, has about 30 companies of various sizes that have approved immunotherapy cancer drugs on the US or European markets or that are engaged in human clinical trials of such drugs. This index is mostly constructed based on one person’s expertise, the total number of holdings is about 23, according to the info on its website:

“Immunotherapy, or harnessing the body’s own immune system, is changing the way many cancers are treated. While traditional medicines like chemotherapies often give cancer a broad punch, the benefit of using immunotherapy is derived from the immune system’s dynamic nature and the way it can more precisely be tailored to fight a patient’s disease.Interferon alpha (IFN-α), a cytokine, was the first cancer immunotherapy approved in 1986. Antibody therapies that facilitate the destruction of cancer cells by the immune system have been widely used since 1997, and the first cell-based immunotherapy, a cancer vaccine to treat prostate cancer, was approved in 2010.Today, many new classes of therapies, including checkpoint inhibitors, next generation vaccines, oncolytic viruses, and chimeric antigen receptor (CAR) technologies, are being developed. It is the progress of these new therapies that the LCINDX aims to track.

The index was designed to capture contributions from companies both large and small that are leading in this effort. First, five top large pharmaceutical companies who are working on immunotherapy are chosen. They are selected both for their strategic focus on immunotherapy, and their leadership role in a specific type of immunotherapy. Next, the top 20 growth biotechnology companies in immunotherapy by market capitalization are added.This leaves the portfolio with a target composition of 25 companies.It is an equal-weighted index and is rebalanced semi-annually.We believe this mix provides the best way of measuring the field’s growth.

Company inclusion criteria: All companies included in the LCINDX index must have a high strategic focus on immunotherapy.In determining whether a company has a high strategic focus on immunotherapy, a company’s business must reflect one or more of the following factors:

- The company has a drug(s) approved by either the FDA or EMA that harnesses the immune system to fight cancer.

- The company has a drug(s) in the human stage of testing that harnesses the immune system to fight cancer.

- The company has announced intentions to begin human stage testing of a drug(s) that harnesses the immune system to fight cancer

- The company has announced an immunotherapy collaboration or partnership with a major pharmaceutical company.

Company exclusion criteria:The Index Provider excludes from the underlying index companies with any of the following characteristics:

- The company’s market capitalization is less than $100 million and/or it does not qualify to be in the top 20 biotechnology companies by market capitalization who are leading in this effort.

- The company’s equity liquidity threshold does not surpass 50,000 shares or $500,000 in average daily trading volume.

- The company is currently under investigation by the SEC or any other government or regulatory entity.

Notwithstanding the foregoing, the Index Provider reserves the right to exclude a company that, while it might meet the foregoing criteria, does not have, either as a company or through its management or scientific research staffs, an established history or credible presence in the field of cancer-focused immunotherpy research and development.

The provider of the LCINDX index is Loncar Investments, LLC., which was founded by independent biotech investor and analyst Brad Loncar. Mr. Loncar regularly provides his unique insight and analysis on this market segment to the investment community via a variety of publishing platforms. Through Loncar Investments LLC, Mr. Loncar incorporated his extensive research into biotech companies and technologies to develop this index. He previously worked in the financial services industry at Franklin Templeton Investments, and was appointed to serve in a Senior Adviser role at the U.S. Department of the Treasury.

Each day the index’s prices and returns are calculated independently by Indxx, LLC. Quotes can be found under the symbol “LCINDX” on the Bloomberg Professional service, www.LoncarIndex.com, and other financial data providers.The inception date for the index was March 18, 2015.

Cancer immunotherapy is a transformational field of research, and we think it is important to have an index that specifically tracks its progress.We have the highest admiration for the researchers who are working to develop new therapies using this approach, and also for courageous patients who participate in trials that make progress possible.It is our hope that highlighting immunotherapy in this way will drive more awareness and investment in their direction.”

Now the challenge is to create such quality biotech index with a rule-based system, so the picking and re-balancing are handy and quick.