The Insiders Aren't Buying

Image Source: Unsplash

I hope your Sunday is going well. First, let's look at a few quick charts that set the tone this week.

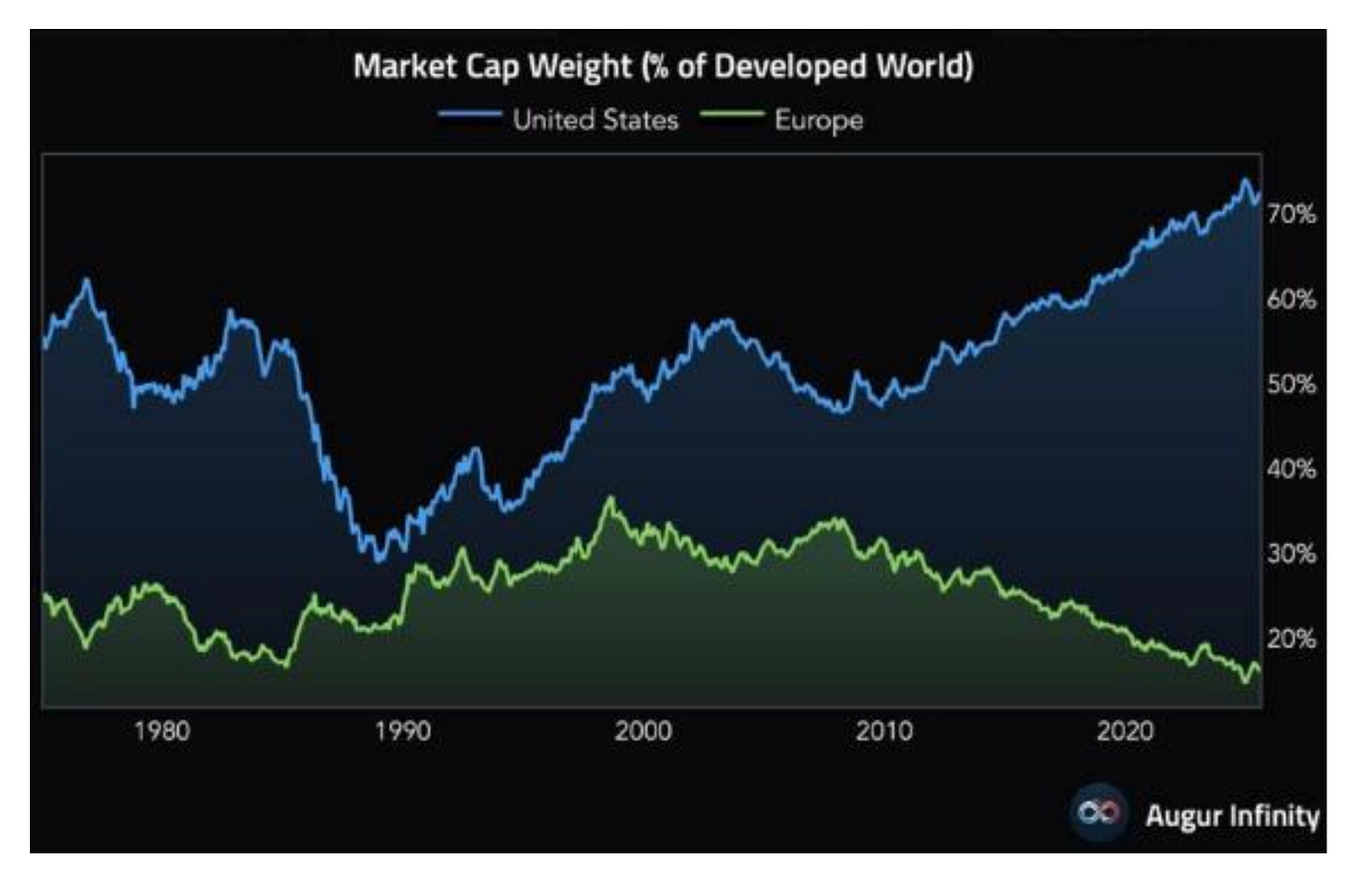

We'll start with the impact of liquidity expansion. As I’ve said before, global investors are chasing returns here. It’s gotten so out of hand now that the US equity market represents 72.5% of the entire developed world’s equity value, according to Augur Infinity.

Image Source: Augur Infinity

What about Europe? A measly ~16%. There was a period earlier this year where people said that the trade situation and tariffs would drive money out of the U.S. That doesn't seem to be the case, but it made for great headlines.

The incentives are here because of the way the global financial system works post-2008, all fueled by a list of decisions made to combat global deflation in the 1990s. This isn’t American exceptionalism, it’s proof that America itself is the bubble -- not AI or any single sector.

Remember, 1993 is the year that changed everything on policy, personnel, and passive investing. It’s right there on the chart. The price action is the story. You have to do the archaeology( which we did with the 1993 Series last year).

While European politicians argue about regulations and green initiatives, American companies are eating the world because the Federal Reserve printed more money than everyone else combined, and now liquidity expansion is ongoing thanks to Treasury policies.

The money printer didn’t just inflate US assets; it made them the only game in town.

Foreign investors are piling into US stocks because everywhere else looks like a sideshow. When one country controls nearly three-quarters of global equity value, you're not looking at a market anymore. You're looking at a bubble with an American flag on it.

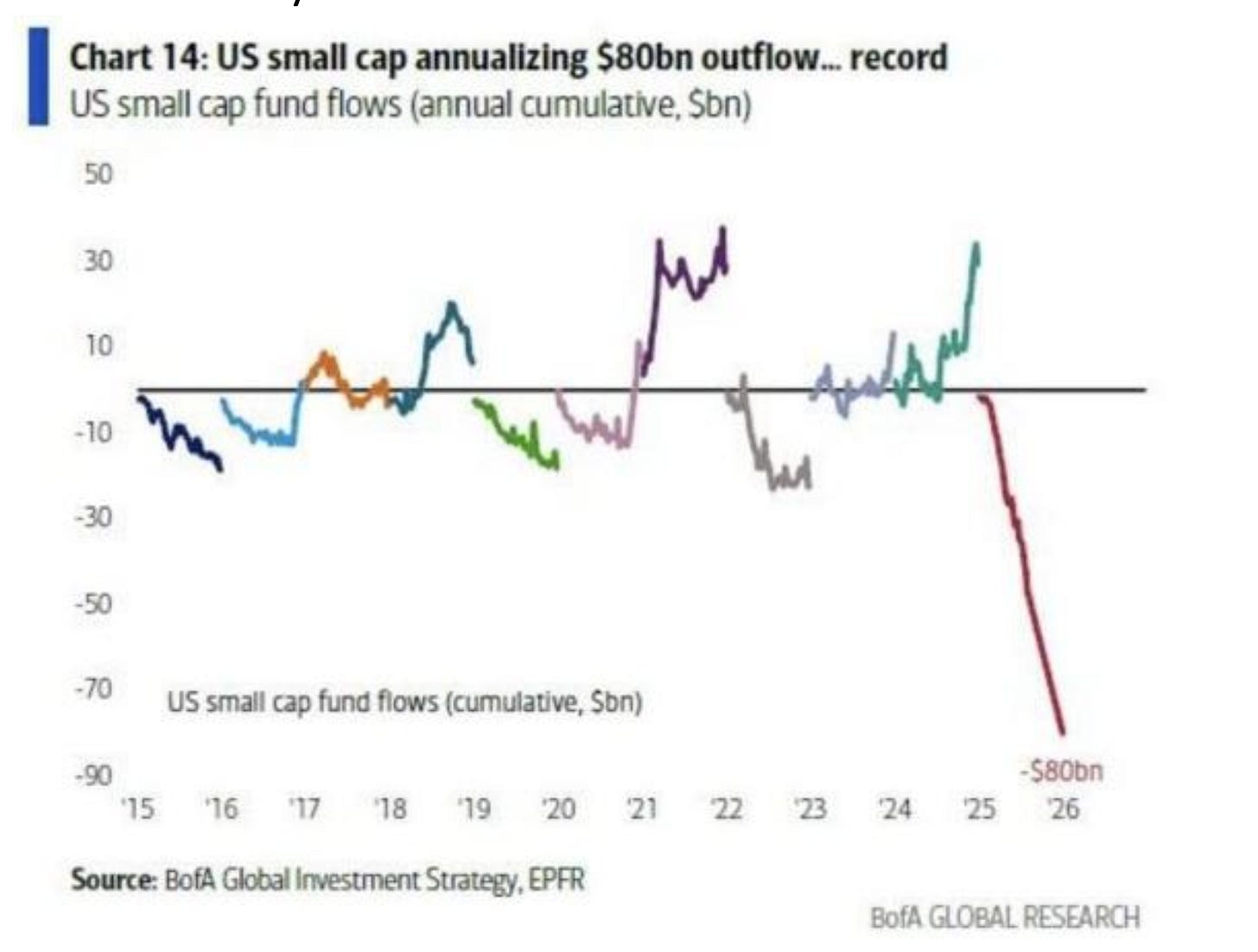

Elsewhere, let's turn our attention to where the money isn't going. It is decisively not flowing into the Russell 2000. Small-cap stocks here are annualizing an $80 billion exodus this year. That’s the biggest exit of all time.

I've been following this issue all week. The Russell's momentum has turned negative and seems to be signaling further pressure on the horizon.

Image Source: Bank of America Global Research

Why? Because in a world of infinite money printing and mega-cap dominance, who needs small companies? When you can buy Nvidia or Microsoft and ride the AI wave, why mess around with some regional bank in Ohio? Why buy any of the 30+ energy producers on the Russell trading for less than their book value?

The money is flowing where Federal Reserve liquidity goes: big tech, big pharma, big everything. Small-caps represent the real economy, but in our financialized casino, the real economy is so 2019. And when all the leverage unwinds at once and cracks all those Magnificent Seven stocks, that regional bank in Ohio gets hit hard, too.

This isn’t a real stock market, it’s a leverage machine that hurts real investing.

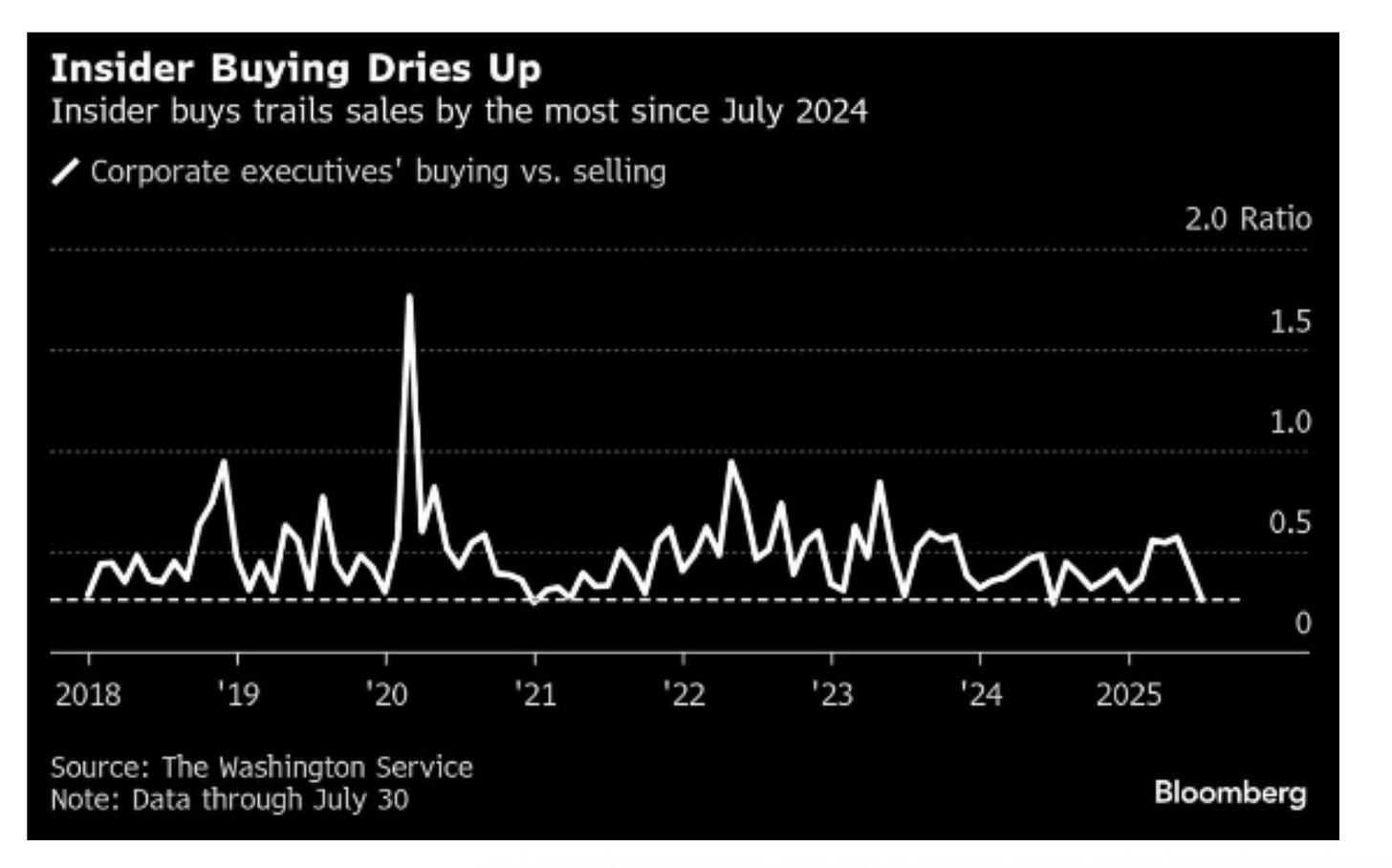

Meanwhile, you likely know that I’m always watching the actions of corporate insiders. They’re not buying their stock.

Image Source: Bloomberg

Only 151 S&P 500 companies had insiders buying their stock last month. That is the lowest rate since 2018.

The insiders know these markets are costly. Corporate executives are dumping stock like it's radioactive waste. When insiders won't even touch their stocks at current prices, that's your canary in the coal mine.

We have to keep a very close eye on our S&P 500 momentum indicator and the FNGD right now. All eyes are on CPI this week and the Jackson Hole Symposium (Fed) on Aug. 21.

More By This Author:

Rough SeasCentral Banks Just Showed Their Hand

Where I've Hidden My Gold

Florida Republic Capital Editor’s Note: In a previous version, I said that the Russell 2000 had lost $80 billion in outflows. I misspoke. It is “annualizing” an $80 billion ...

more