The First 50 Point Hike Is Now Priced In

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

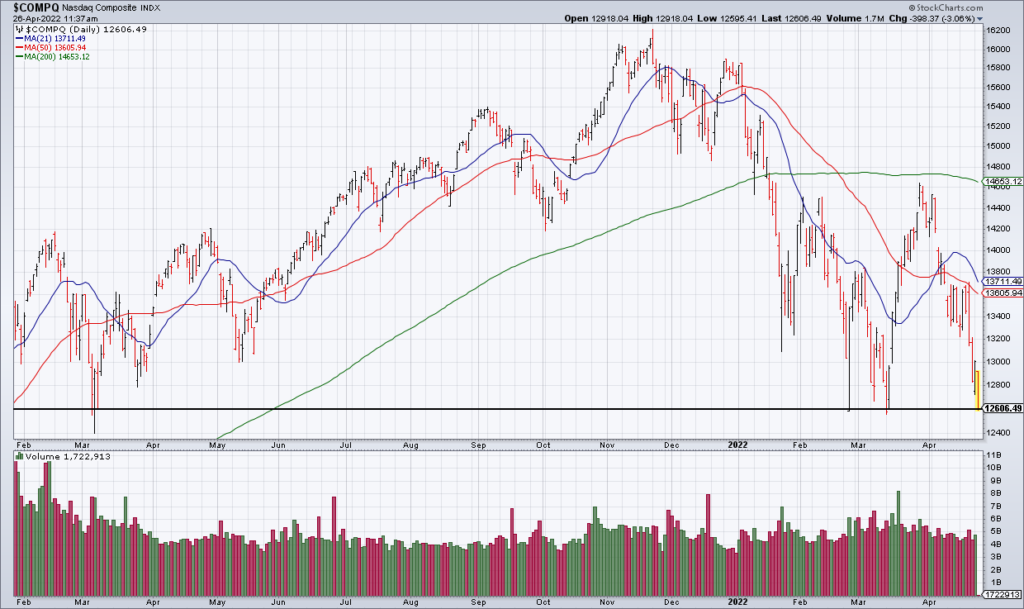

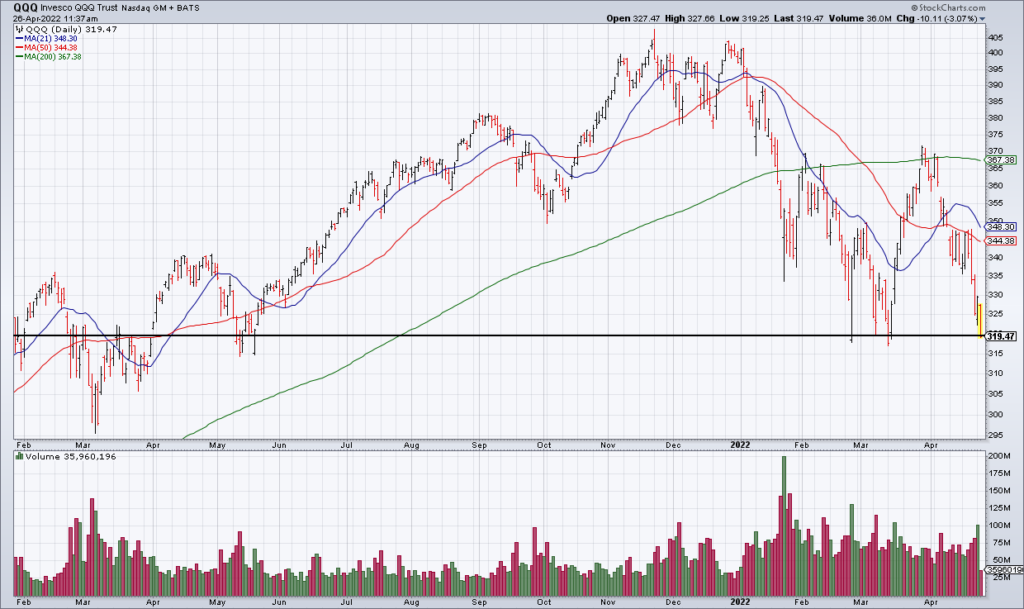

With the Nasdaq and QQQ testing YTD lows Tuesday morning at 12,600 and $320 respectively I think the first 50 basis point Fed rate hike has now been priced in. This applies to the precious metals miners and commodity stocks as well which I’ve represented above with a chart of GDX. Based on this premise, I added to my precious metals miners positions yesterday morning and covered my tech and growth shorts this morning.

#earnings for the week https://t.co/lObOE0dgsr $FB $AAPL $MSFT $AMZN $PYPL $GOOGL $KO $UPS $ATVI $TWTR $XOM $BA $F $GE $SPOT $PEP $ROKU $MMM $CVX $QCOM $VLO $RTX $CL $INTC $JBLU $V $WM $CAT $NOK $LUV $GM $DHI $HOOD $ENPH $CVE $MA $ABBV $OTIS $PHG $CMG $MCD $MRK $DORM $X $ADM pic.twitter.com/Q2N0mmLZyB

— Earnings Whispers (@eWhispers) April 23, 2022

With the rest of The Big 6 (AAPL GOOG/GOOGL MSFT AMZN FB) reporting earnings in the next three days and the Fed almost certain to raise 50 basis points next Wednesday, I would expect the market to be in a holding pattern until the next Fed decision on June 15.

I will be very interested to see if they do in fact hike another 50 in June. If so, I would expect the market to make new lows which will put Powell to the test. Then we’ll find out if he really is Volcker 2.0.